Decision making is hard. When making a decision we put too much emphasis on the first piece of information we are offered. This cognitive bias is called anchoring. For example, did you sit down and analyze your income, expenses, assets and liabilities to decide how much to invest in a Systematic Investment Plan (SIP) or did you just choose a number suggested by a well-wisher? We recommend investing monthly surplus income based on your asset allocation model i.e every month invest the cash surplus you have over and above your annual expenses.

Scenario 1: Ram calls to wish his grandpa on his 91st birthday. After the call he logs onto kuvera.in where our intelligent algorithm suggests that he invest 65% of his portfolio in equities. Ram thinks 65% is low and over-rides it to 75%.

Scenario2: Ram is out playing cricket and he gets out on 10. He is a good batsman and is unhappy with his low score. After the game he logs onto kuvera.in where our intelligent algorithm suggests that he invest 65% of his portfolio in equities. Ram thinks 65% is high and over-rides it to 45%.

If the above scenarios sound bizarre, then you are not the only one. Everyone thinks the same when they first come across “Anchoring”. In the first scenario Ram’s brain is anchored on 91 (his grandpa’s age). From that context 65% allocation looks small (65 << 91) and he adjusts his equity investment up to 75%. In the second scenario his brain is anchored to his score of 10. From that context 65% allocation looks really big (65 >> 10) and he adjusts his equity investment down to 45%.

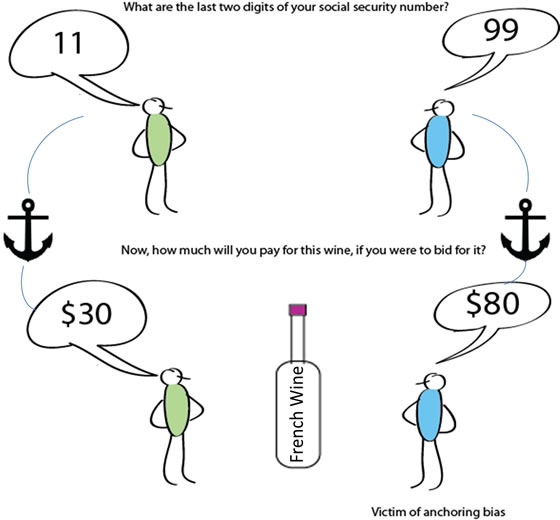

The above is not just a hypothetical example; researches have run countless experiments showing the effect of anchoring.

“In a study by Tversky and Kahneman, participants observed a roulette wheel that was predetermined to stop on either 10 or 65. Participants were then asked to guess the percentage of the United Nations that were African nations. Participants whose wheel stopped on 10 guessed lower values (25% on average) than participants whose wheel stopped at 65 (45% on average). The pattern has held in other experiments for a wide variety of different subjects of estimation.”

Anchoring is prevalent everywhere. When bargaining we anchor on the original price i.e we will offer Rs150 for something being sold for Rs300, and Rs300 for something being sold for Rs600, though in reality we don’t know the true cost of either item. 50% of the asking price just seems like a good deal.

Similarly, if a friend or a family member is doing a Rs5,000/month SIP, we are likely to pick a number not different from that for ourselves, even though our life stage and cash availability could be very different. A SIP in itself is an anchor that could cause under-investment over the long run. People rarely up-size their SIP as they grow wealthy. Just because they started with a Rs5,000/month SIP they continue on it even though their salaries are significantly higher now.

Finally, research has shown that experts are as likely to anchor as non-experts. Investment advisers who know you personally might anchor your portfolio on their relationship with you or other clients they have. A data driven approach in analyzing and allocating your portfolio could avoid most anchoring pitfalls and prevent you from losing out on long term investment gains.

It’s all good in theory, but what does it mean in practice:

- Unfortunately it is hard to avoid the anchoring bias. Knowing that it exists and correcting for it is the first step in the right direction.

- Make data driven decisions rather than gut driven decisions.

- Do not anchor your expectations on what you hear on financial media. A target price for a stock or an index is just one analysts expectation of the future price – do not anchor on it to make your own investment decisions.

Visit www.kuvera.in to invest in “Direct Plans” of Mutual Funds and save BIG on commissions!!!

If you like this post, share the love below..