We came across an informative article from Prof Sendhil Mullainathan of University of Chicago about long term investing. It’s a long article but well worth the time spent reading it. You can read it here.

Here are 8 things to watch out for to make investing simple (with excerpts from the article):

Don’t leave a lot of money in cash.

It leads to regret later. “And the rest of my money was in cash, earning virtually nothing; how had I let it sit there for so long?”

Spend time in managing your long term investments.

“A recent survey.. …found that most of us spend twice as much time choosing a car as we do to choose investments that are supposed to support us for years.”

Don’t depend on your Employer-provided pension.

“Pensions have been disappearing, for many reasons. And many of the remaining ones are underfunded and vulnerable.”

Buy Index funds where possible.

“For a long time, the simple investment advice given to consumers has been “buy an index fund.” Index funds are such standardized products…that just about all of them were initially low cost while offering wonderful diversification.”

Control your investment fees like a hawk.

“And these fees are nothing to be scoffed at — paying 1 percent more every single year in fees can compound over a lifetime to noticeably lower returns.”

Ensure that the adviser is being paid by you and not the Mutual Fund company.

“If you’re seeking advice, ask yourself one simple question: “If I’m not paying for this adviser, where are they getting their money?” If you don’t know the answer, you may have a problem.”

Follow a program like ours with good default choices and frequent and timely reminders.

“A recent study… showed that timely reminders and programs with good default choices can help ensure that good advice is followed. People in well-designed experimental programs who are given sound advice and plenty of reminders tend to save more.”

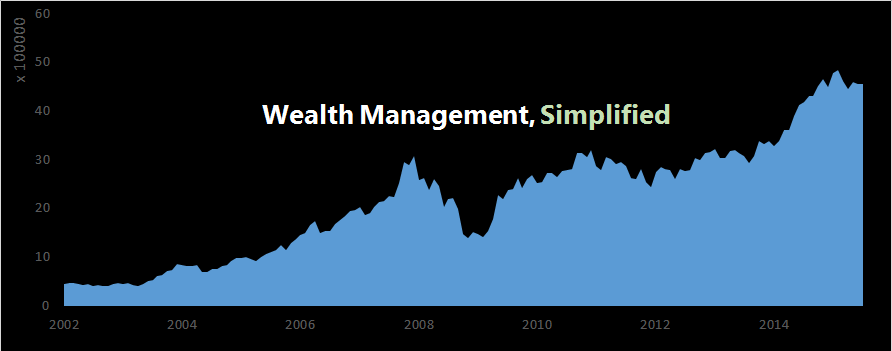

Invest early, invest often, and invest for the long term.

The biggest cost of fear is paralysis. “It is easy to make a mistake in choosing investments. But in an effort to avoid an error, I had been making an even bigger error. As I procrastinated, my money was un-invested and earning zero returns.”

Visit www.kuvera.in to invest in “Direct Plans” of Mutual Funds and save BIG on commissions!!!

If you like this post, share the love below.