About the author: Chirag Bogra, 29 Years, is a Sr. Big Data Architect at American Express and an Investment Blogger at www.mutualfundswiki.com. At MutualFundsWiki, he aims to empower investors with good strategies for long term wealth creation.

I always Buy from Pessimists & Sell to Optimists.

– Warren Buffet

You know who runs Equity Markets? We HUMANS!! And there has to be a specific pattern of human behavior, which makes us take reactive measures when markets go through bull & bear phases. Yes, the patterns are Greed & Fear – The emotions that drive equity markets

Volatility is the nature of market. So is it only for the selected few? Not exactly, everyone can generate healthy returns. Here are the few ways which could help the investors survive the market.

Long Term Investment Horizon

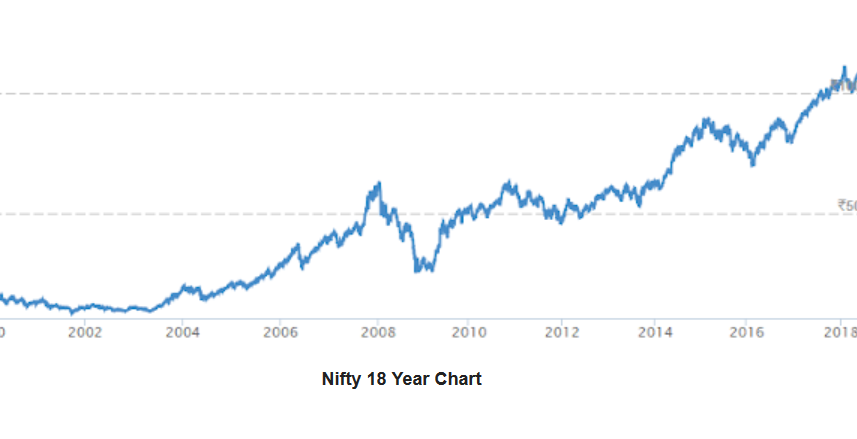

But when markets started getting volatile, many of the new investors bailed out. Check AMFI mutual fund inflows MoM figures – AMFI Monthly, which clearly suggests a downtrend when markets move downward.Investors failed to realize equity does generate value, but only when it is held for long term. Equity no doubt is a risky investment option, the only way to mitigate the risk is to ensure you’re giving enough time to your investments. Let’s look at the 18 year chart for NIFTY.

Invest When Market is Down

If you get this right, half of your job is done. We understand you want to invest into quality businesses, but the most important aspect is the investment price. You wouldn’t want to invest at a price which is 5-10 years ahead of the growth prospects, Right?

What better time to invest into quality when the market is down, this is when you get quality at a much cheaper price. Once there is a turnaround in the market, you will earn maximum returns.

Portfolio Diversification

Equity Mutual Funds

Not all have in depth knowledge & expertise to manage the portfolio. You need to understand there are market specialist fund managers, who can manage it for you through Mutual Funds.

SIP

You also need to understand that over-hype is for a reason. SIP brings about a discipline in your investing & also provide benefits like cost averaging, flexibility etc.No one can catch top or the bottom of a particular stock, not even Warren Buffett. Therefore, it is always advisable to accumulate stocks at a specified time interval or based on market conditions. Similar is the case with mutual funds – these are long term wealth creation instruments and you need to invest through SIP’s & define a long term investment horizon which could be 5,10,20 or 30 years away, based on your goal.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!