Beating the stock market Index returns is incredibly hard.

The experts on financial TV and financial press would make you believe it is easy to pick market-beating stocks. So would a lot of financial planners. But they always stop short of showing you the evidence or show short term returns or just handwave the whole returns comparison. Time and again research has shown that beating the stock market Index returns is incredibly hard. Further selecting which investors will be able to beat the index market returns is equally hard. Thus the age-old advice, invest in index funds and keep your investment costs low.

Let’s look at the data.

India Evidence

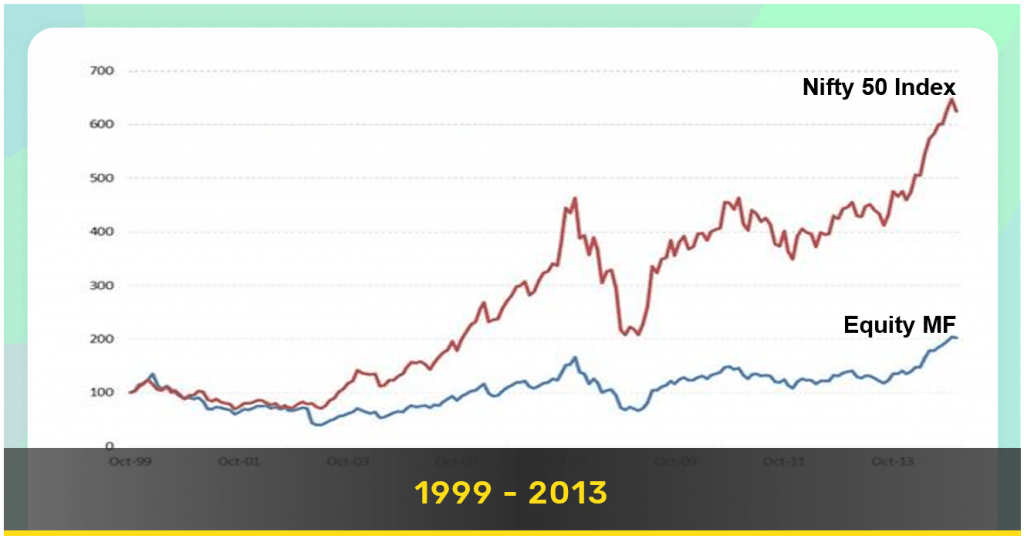

There is a lot of noise in the Indian data and in the financial blogosphere where this is hotly debated. Most of the data presented in the financial blogosphere is not conclusive and almost all of it suffers from selection and survivorship bias. AMFI collects monthly data on the stock and flow of money invested into different mutual funds category (eg. Equity, bond, lifestyle etc). Since it is flow data we are using it is free of selection and survivorship bias. We use this data to create a history of equity mutual fund returns (as an industry) and compare it to NIFTY returns. The difference is massive, of the order of 60bps a month. In the chart below we track Rs100 invested in NIFTY and the average equity mutual fund.

But our data ends in 2013. Enter SPIVA Index Vs Active report.

SPIVA, which stands for S&P Index Vs Active studies the outperformance of active managers vs benchmark Indices all over the world. They have been writing a report on India as well and starting this year (2019) it includes a 10-year comparison of Index Vs Active funds in the Indian Mutual Fund landscape. The results are not good for the active guys:

So in one of the longest bull market (2009 – 2019), the active guys have underperformed in each category. Beware the next promise from the advisors that active funds have better downside protection, i.e in times of market downturns they fall less. Again across multiple market cycles globally, this has also been proven to be patently false.

SPIVA goes deeper into the issue at hand and looks at survivorship and also style consistency. An interesting story emerges if you look at the 10-year data.

- Only 67% of Large Cap and Mid/Small Cap funds survive for 10 years. What happened to the remaining 33%. They are usually merged with better performing funds to hide their inferior performance. What this also means is that if you run any analysis starting with funds available today you will get very biased returns as it will not capture the 33% funds available at the start of 2009 which had bad outcomes. This is the single biggest fault in most of the fund analysis that is littered on the web. They start with the survivors and look at their past returns.

- There is little style consistency. Large-cap funds had a style consistency of only 14.63%. They were taking a lot of mid-cap and small-cap risk. Still, 64% of large-cap funds failed to beat the benchmark index. Given the stricter guidelines imposed by SEBI, it will be harder for funds to take a risk outside their defined scope. This will make it even harder for them to beat benchmark returns.

Enough said!

International Evidence:

There is a lot of international evidence that active managers underperform market index returns. The higher fees charged by active managers usually is the biggest drag on their performance. An exhaustive study by Vanguard finds

“To take one example, 72% of U.S. large-cap value equity funds under performed their benchmarks over the ten years ended December 31, 2014. The case for indexing has been strong over shorter horizons, too, although shorter sample periods have tended to produce slightly more erratic results. The case for indexing over longer horizons such as 15 years has also tended to be strong.”

Similar returns have been shown in academia for all investment horizons.

The last two years have been good for managed mutual funds. This reflects in the increased marketing money and rhetoric by the managed portfolio managers and investment managers that push these products for higher fees than an index mutual fund.

A prudent investor would do well to look at the long term performance evidence in India and abroad and ask “is this time any different?”

It’s all good in theory, but what does it mean in practice:

- Beating the market is incredibly hard. So is selecting a money manager who can beat the market. For every Warren Buffet, there are thousands of money managers who underperform the market index.

- If investing is not your day job and you don’t want to take a lot of risks, you are better off investing in index mutual funds.

Visit www.kuvera.in to invest in “Direct Plans” of Mutual Funds and save BIG on commissions!!!

First published – Apr 23 2016

Updated – Jun 10 2019