These changes were earlier scheduled to be implemented from 1st Jan 21, the same has been extended to 1st Feb 21 by SEBI.

What’s changing?

In short: From 1st Feb 21, Net Asset Value (NAV) date applicable to all mutual fund purchases will be the date on which funds are received by the fund house (or AMC).

Earlier fund houses could provisionally allot units at the NAV of the order placed date while the funds would come in later through the payment systems. Provisional Allotment was done only for non-liquid non-overnight fund orders below Rs 200,000. This provisional allotment is now discontinued.

This change is pursuant to a circular published by SEBI amending the existing NAV applicability norms. Irrespective of the order size, NAV applicable to all mutual fund purchases will be dependent on the time of realization of funds.

How does this impact me?

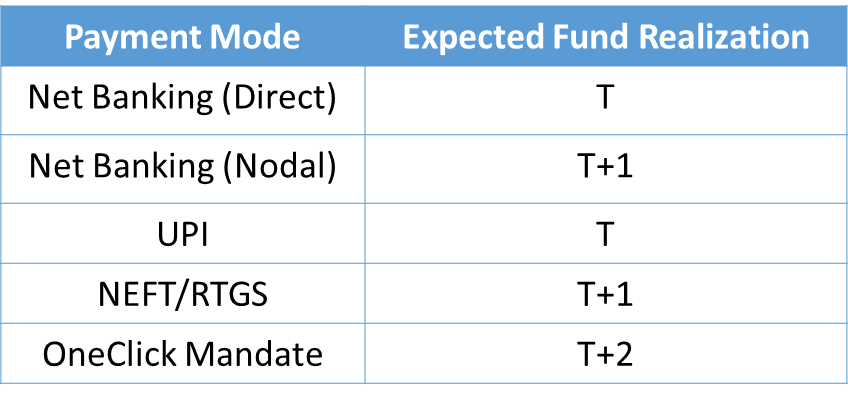

You may not get same day NAV if you use payment modes other than Net Banking(Direct) or UPI. The time taken for the realization of funds depends on the payment mode (more about this below).

But, why are my funds not reaching the AMC instantly?

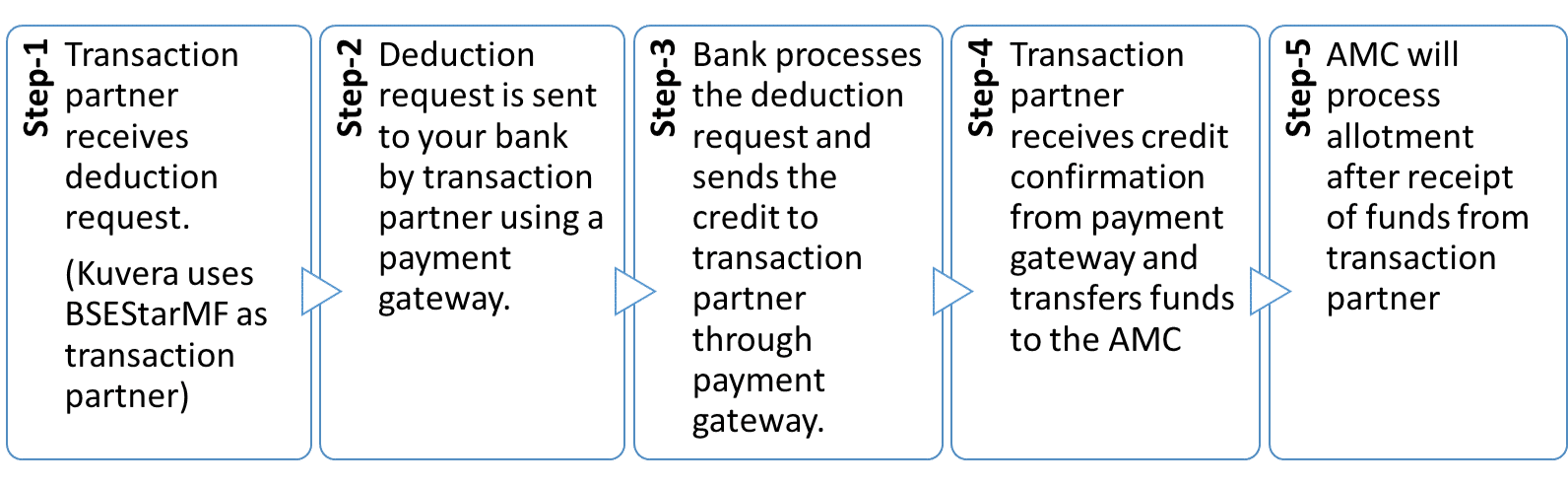

Let’s first see how funds flow when you place a purchase order in mutual funds. Here, we have explained typical funds flow with net banking as the payment mode.

Two things to note here –

1/ Transaction processing involves multiple steps.

2/ We use BSEStarMF as our transaction partner. Hence, we never receive your funds in our own accounts. Funds go from your account to BSE and thereon to the AMC. This helps us in streamlining funds flow and eliminating any possible delays at our end.

While the deduction might start reflecting in your bank account right after completing payment, it takes time for the AMC to receive funds. The time taken for the realization of funds depends on the payment mode you choose.

When should I expect fund realization in case of lumpsum orders?

Here, T is the day on which the order was placed within the cut-off timings. For Liquid and Overnight fund orders, the cut-off time is 12:30 PM. For all other funds, the cut-off time is 2:30 PM. Orders placed after the cut-off time are considered as orders of the next business day.

What is Direct and Nodal in Net Banking?

Direct in Net Banking refers to transfers where you and the beneficiary, in this case BSEStarMF, have accounts within the same bank. At present, BSE supports direct Net Banking with 6 Banks –

- HDFC Bank

- Axis Bank

- ICICI Bank

- SBI Bank

- Kotak Mahindra Bank

- Yes Bank

All other banks other than those above are referred to as Nodal Banks.

Funds transfer are faster for direct net banking transfers and can take upto 2 business days for Nodal banks depending on the bank you use.

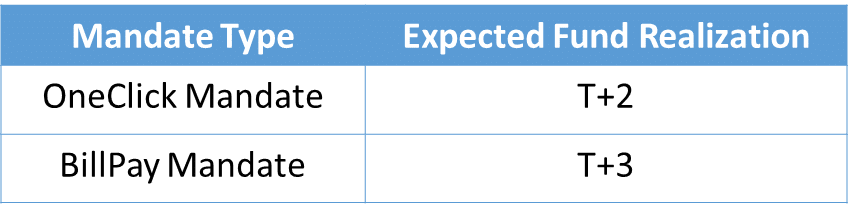

When should I expect fund realization in case of SIP orders?

Here, T is the scheduled SIP order day.

You can find your mandate type in the bank section in your Kuvera account.

Will there be any impact on Switch and STP orders?

Yes, think of switch and STP orders as a combination of redemption & purchase orders. Units are redeemed from the fund you are switching out from and units are purchased in the fund you are switching in to. NAV of the order day will continue to apply to switch out orders. Switch in orders will get processed only after the switch out leg settles.

So, if you are switching into a fund – “B” from equity fund – “A” with a redemption cycle of 3 business days. NAV of order day will apply to the switch out order from the fund – “A”. NAV of T+3 business days will apply to the switch in order in the fund – “B”.

Redemption/switch-out cycle depends upon the category of fund you are switching out from –

| Scheme Type | Business Days |

| Liquid Funds |

T+1

|

| Debt Funds |

T+2

|

| Equity Funds |

T+2

|

| International Funds |

T+5 or more

|

Will there be any impact on my redemption and SWP orders?

No, there will be no impact on your redemption and SWP orders. They will continue to get processed with the NAV order date.

Can I do anything to minimize the difference between the order date and the NAV date for my SIP orders?

Yes, If you have any existing SIPs linked to BillPay mandates, then register a OneClick mandate and shift SIPs to the same.

We have historically noticed OneClick mandate based SIP deductions to be more predictable than BillPay mandates. With OneClick mandate, more often than not, the credit confirmation becomes available within 1-2 business days of SIP date. With BillPay mandate, the credit confirmation date can be anywhere upto 5 business days from SIP date.

If you don’t already have one, you can set-up a OneClick mandate on the bank page on Kuvera. Once you have a registered OneClick mandate, you can reach out to us here and we will help you shift all your SIPs to the OneClick mandate.

Can I do anything to minimize the difference between the order date and the NAV date for lumpsum orders?

You can follow these thumb rules-

- Use Net Banking for placing lumpsum orders.

- If you have an account with one of the 7 banks where BSE accepts Direct Net Banking transfers, then use that bank.

- Avoid using a OneClick mandate for lumpsum orders if any other payment mode is available to you.

- Refrain from waiting till the cut-off time for placing your orders.

How should I interpret the orders details shown on Kuvera while my order is under processing?

You can track your orders on Kuvera in the “Pending” order section. You will see details such as order date, bank name and most importantly expected NAV.

The expected NAV date we show is a conservative estimate after taking into consideration multiple factors such as your bank, payment method, order type etc. The actual NAV applicable to your order will still be dependent on the time at which the AMC receives the credit confirmation. Once we receive the allotment confirmation from the AMC, the actual NAV date will get updated to your order.

Please Note: The expected timelines shared in this note are based upon the generally observed time taken for fund settlement. The actual timeline in some cases might differ from the expected timeline shared here.

Alok

December 31, 2020 AT 09:13

Hi Gaurav

Thanks a lot for this article, it makes a lot of things clear.

One further question that I have is

let’s say my(one click mandate) SIP date is 5th of every month and that heppened to fall on a Saturday.(Although the bank transaction can happen on a Saturday )

How would this transaction take place?

Gaurav Rastogi

January 2, 2021 AT 04:01

If money reaches the AMC by Monday cutoff you will get Monday NAV.

King

December 31, 2020 AT 10:53

Please allow SIP through UPI auto pay. This is needed now.

Santhosh

January 2, 2021 AT 20:24

Hi,

Thanks for the detailed article. I am just thinking about how it would impact Tax Harvesting feature. So, it would be suggested to use netbanking (preferably direct) for the buy orders. Isn’t it?

Gaurav Rastogi

January 18, 2021 AT 12:00

Yes pls use netbanking.

Pankaj

January 6, 2021 AT 13:59

Hi Gaurav,

Nice article. I would have sworn that I posted the below question earlier too, but here goes

If I use NEFT/RTGS as a payment mechanism from a Nodal bank ensuring that funds are received by ICCL before cutoff time, will I get same day NAV?

What is ICCL’s time overhead to transfer NEFT/RTGS funds to the AMC? Thanks for your response.

Gaurav Rastogi

January 18, 2021 AT 05:50

Yes if they receive funds before the cutoff time, you will get same day NAV.

Rahul Jain

January 25, 2021 AT 09:11

Is the cut off time for all funds 2:30 or 3:00

Gaurav Rastogi

February 1, 2021 AT 08:56

From 1/Feb/21, cut-off time for all non liquid fund orders on Kuvera is 2:30 PM. For liquid funds, cut-off is 1:00 PM.

Do note that NAV applicable to all orders will depend on date of funds realization.

Satish

February 3, 2021 AT 08:09

Hi, is the cut off time of 2:30 is for buy(subscription) only? What about cut off time for redemption..?

Gaurav Rastogi

February 10, 2021 AT 03:00

The cut-off time for redemption orders is 3 pm.

Syed

January 29, 2021 AT 15:29

Thank you very much, Gaurav.

ATUL SHRIMAL

January 30, 2021 AT 05:02

Hi Gaurav, Thanks for very informative article. I have a question – the bank account currently linked with Kuvera is not one of the 7 banks – can I still make net banking payment through my other account which is with SBI (one of the 7 banks)? Or do I need to change my linked account at Kuvera? And if so then what’s the process?

Gaurav Rastogi

February 1, 2021 AT 08:56

To use a bank account for transactions, you need to first add it to your bank details on Kuvera, this can be done in the profile section of your Kuvera account.

You will be able to select one of the added banks at the time of placing purchase orders on Kuvera.

Karthik

January 31, 2021 AT 12:24

Hi Gaurav,

Thanks for the article

What are the steps to switch from bill pay mandate to direct netbanking transfer. Please let me know

Gaurav Rastogi

February 1, 2021 AT 02:48

When buying lumpsum please use bank payment option and then choose netbanking. SIPs will continue on bill pay mandate.

Vivek Mallik

February 1, 2021 AT 13:39

If I use One Click or Bill Pay, the amount gets deducted instantly. But the fund reaches the AMC on T+2/T+3 day. So, where is the money lying for these 2/3 days?

And if this is the case, then I feel it is better to have a direct account with AMC. Why should I continue with Kuvera?

Prasanna

February 2, 2021 AT 17:02

Exactly 2-3 days for settlement of payment seriously? It’s 2021 .Can anyone suggest how to have direct account with amc

Gaurav Rastogi

February 10, 2021 AT 03:01

The NAV settlement for direct AMC will be the same.

Raghavendra

February 8, 2021 AT 05:44

Please add UPI mode payment for SIP.

Ku

February 11, 2021 AT 10:05

Hi,

What I understand, SEBI says for same day NAV for equality mf, funds have to reach the relevant clearing corporation by 3 pm. If 3 pm is the cutoff time, then why kuvera insists funds must be cleared by 2:30pm? Walk me through this.

Kuna Pradhan

March 1, 2021 AT 11:49

HI,

How could I change the mandated type I want to switch the One-Click mandate to direct or nodal net banking transaction. Please advise thanks

Gaurav Rastogi

March 9, 2021 AT 03:54

Pls reach out to support@kuvera.in and we will help.

Hemant

April 6, 2021 AT 23:22

Hi Team,

Very Nice article. Can you please let me know if I can use UPI/Net banking for SIP transactions.

SUMAN

June 14, 2021 AT 07:46

Hi, in case of switch from one scheme to another , lets say liquid to equity in the same fund house, why should it take T+3 business days..

Himanshu

September 2, 2021 AT 20:02

Are there any transaction charges if i pay using net banking. Second question can i create one click mandate for 50k instead of 1 lakh.

Gaurav Rastogi

September 3, 2021 AT 02:20

No transaction charges for net banking.

We recommend mandate for Rs 1 lakh as it allows you to pay for Lum-sum order as well.

Pradeep Satpathy

September 10, 2021 AT 12:23

गौरव जी,

सादर अभिवादन !

आपके द्वारा प्रस्तुत निवेश समन्धित लेख वास्तव में रोचक और ज्ञानवर्धक है।आपके साथ खाता खोलने से पहले मुझे बैंक से जुड़े ये सारे सवाल और पैसे म्यूच्यूअल फण्ड में भुगतान तक के बारे में बहुत कुछ पूछना था,पर आपकी यह सटीक और समर्थ लेख ने मेरे सारे शंकाओं का निवारण करदिया।मेरा और एक सुझाव रहेगा,अगर सम्भव है तो स्टॉक में जैसे GTT ऑर्डर लगाया जा रहा है उसी प्रकार म्यूच्यूअल फण्ड में कोई उपाय के बारे में अवश्य सोचें।इससे काफी सारे निवेशकों को फण्ड ख़रीद-बिकवाली से मुनाफा कमाने में फायदा हो सकता है जो म्यूच्यूअल फण्ड में ही वर्षों से निवेश करते आ रहे है।

गणेश चतुर्थी की शुभकामनाएं!

??

Ashbi

September 13, 2021 AT 19:36

What I understand is that for SIP, fund trasfer is scheduled only on the T day. Then why there is a 10 day window for pausing the SIP for future transaction. It looks like for an NAV realisation on the 13th, the fund has to be freezed from 1st of the month (10 + T + 2 days).

Gaurav Rastogi

September 16, 2021 AT 03:09

The fund need to be available only on T and not on T-10. The order from the AMC (via the exchange) is queued up to 10 days sooner.

Vishal

December 1, 2021 AT 10:55

Why does Kuvera insist on 2:30 pm cut-off time when SEBI’s prescribed cut-off time is 3 pm?

Gaurav Rastogi

December 15, 2021 AT 01:47

It is a restriction from the exchange i.e BSE. Other platforms will have even sooner cutoffs.

K.S.Lakshminarayana Rao

December 15, 2021 AT 11:55

Nice & informative. But, for STP transaction from one scheme to another scheme of the same M.F. 6 days period is too long for determining the NAV and may not be favorable to investors.

Abhijit Gupta

January 24, 2022 AT 15:53

Could you pls clarify cut off time a bit more. Let’s say I place buy order on kuvera at 3 PM for equity MF with net banking transfer on Day T. Will it get T+1 day closing price ?

Abhijit Gupta

January 24, 2022 AT 16:01

Is there a chance that I make a lumpsum payment after cut off time through Net Banking for equity MF and I am not credited the shares at the end of next business day, with that day’s closing NAV rate