When markets are close to new highs a lot of investors ask the same question – should we STP or lumpsum now?

I have some money in my bank account, should I invest it as a lumpsum or buy a liquid fund and setup a Systematic Transfer Plan (STP) into an equity fund over a year. A 1 Year STP will move 1/12th of your liquid fund units to the equity fund every month.

Over time two narratives have emerged:

1/ STP – why take the risk of investing at highs? The market will likely mean revert so averaging your buy price over a year is the way to go.

2/ Lumpsum – time in the market is all that matters. Since we cannot predict what the market will do (can go higher or lower), just invest as soon as you have the money.

The advisor community, by and large, has adopted that STP is the way to go.

We ran a backtest to see what historical data suggests.

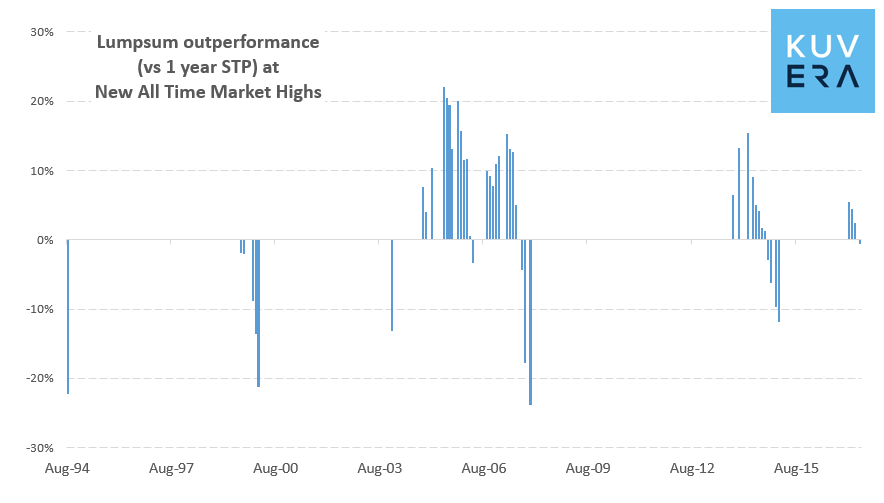

We start with NIFTY index data going back to 1994. Over the past 24 years, the market has made a new all-time high in 48 months. In each of those months we set up two investments:

1/ Invest in a liquid fund and then STP into NIFTY over 1 year

2/ Invest in NIFTY

After 1 year we see which investment did better.

| Times Outperformed | Avg 1 Year Return | |

| STP | 19 | 8.7% |

| Lumpsum | 29 | 12.0% |

| Total Instance | 48 |

Of the 48 instances when we set up the STP vs Lumpsum race, lumpsum investment outperformed 60% of times. More importantly, investing in a lump sum in all 48 instances would have returned on average 12%, while a 1 year STP returned on average 8.7% after one year.

Lumpsum investing has outperformed STP even when market are making new highs. Lumpsum investments are likely to work out better 60% of times and with higher expected returns.

The intuition behind the data

The STP or lumpsum debate eventually is one of market timing. Doing an STP implicitly assumes that you can time a market high – it is the only scenario that justifies doing an STP over a lump sum. If you do not think you can time market highs, then don’t STP.

How is STP a claim of market timing ability? Well, think about it.

STP will work only when the average NAV over the next 12 months is lower than today’s NAV so that you can accumulate more units than you would by buying all of it today. So an STP investor is making a complex claim that NAV will be on average lower over the next 12 months while I am accumulating units and then it will go up after.

Lumpsum, on the other hand, makes no market timing assumptions – it is the simpler option.

The narrative that data is telling us is similar:

Advisors recommend STP at market peak assuming that markets will correct. Future though is unpredictable and markets don’t correct as often as expected. Investor accumulates higher NAV through STP. Thus, investor STP returns are lower than Fund returns!

And what does international evidence says

We ran the same analysis on S&P500 (from 1950) and NASDAQ (from 1971) and the results are the same. Lump-sum outperforms roughly 3 out of 5 times and also on average has 2-3% higher 1-year returns.

So, next time someone asks – to lumpsum or to STP, remember the data says to “lumpsum”.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

This market update was initially published by CNBCTV18 in the Personal Finance section.