Top news

SEBI in a circular introduces a new framework for execution-only platforms in the mutual fund industry to protect investors. Category 1 EOPs would have to be registered with AMFI and Category 2 EOPs have to be registered as stock brokers with SEBI.

The WPI inflation in India hits a seven-and-a-half-year low, recording a fall of 3.48% in May 2023.

Shares of IKIO Lighting got listed at a premium of 38% over issue price of Rs 285.

360 One MF, Samco MF and Motilal Oswal MF have launched the NFOs for 360 One Flexicap Growth Fund, Samco Active Momentum Growth Fund and Motilal Oswal Nifty Microcap 250 Index Fund .The NFOs close on June 12, and June 14 respectively.

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.4% | 22.6% | 89.9% | 21.6 | 4.3 |

| NIFTY NEXT 50 | 2.7% | 20.9% | 76.3% | 28.3 | 4.7 |

| S&P BSE SENSEX | 1.2% | 23.1% | 88.6% | 23.2 | 3.3 |

| S&P BSE SmallCap | 1.1% | 16.1% | 189.2% | 25.6 | 2.6 |

| S&P BSE MidCap | 3.0% | 24.9% | 126.6% | 23.8 | 2.9 |

| NASDAQ 100 | 3.3% | 26.8% | 15.5% | 23.7 | 4.6 |

| S&P 500 | 2.6% | 20.0% | 12.9% | 24.9 | 4.2 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| 5.3% | NA | NA | |

| Motilal Oswal Nasdaq 100 FoF | 4.5% | 42.0% | 17.6% |

| Edelweiss Greater China Equity Off Shore | 4.3% | -1.3% | 2.3% |

| Navi Nasdaq 100 FoF | 4.1% | 38.0% | NA |

| PGIM India Emerging Markets Equity | 4.0% | -1.8% | -5.2% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| SBI Long Term Equity | 3.5% | 33.9% | 29.8% |

| Axis Long Term Equity | 3.2% | 24.5% | 20.1% |

| Motilal Oswal Long Term Equity | 3.1% | 38.0% | 28.2% |

| Sundaram Tax Saving | 2.8% | 24.9% | 27.7% |

| JM Tax Gain | 2.7% | 32.6% | 30.1% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| One97 Communications | 16.1% | 44.7% | NA |

| Avenue Supermarts | 15.4% | 11.7% | 20.7% |

| IDFC First Bank | 13.3% | 147.4% | 13.0% |

| Hindustan Aeronautics | 9.0% | 106.5% | 32.0% |

| Trent | 7.8% | 56.9% | 39.6% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -1.4% | 11.6% | 0.3% |

| IPRU Strategic Metal & Energy Equity FoF | -0.9% | 2.6% | NA |

| Edelweiss Asean Equity Off Shore | -0.3% | 11.3% | 9.4% |

| Motilal Oswal Nifty Bank Index | -0.1% | 31.3% | 29.9% |

| Navi Nifty Bank Index | -0.1% | 35.4% | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Power | -4.7% | -2.2% | 70.9% |

| SRF | -4.6% | 4.6% | 44.7% |

| Wipro | -4.6% | -13.4% | 14.7% |

| Hero MotoCorp | -4.5% | 8.7% | -2.2% |

| Bajaj Auto | -3.3% | 25.5% | 12.3% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.8% | 28.1% | 29.8% |

| Tata Small Cap | 1.6% | 42.0% | 45.5% |

| Quant Small Cap | 2.0% | 44.4% | 62.6% |

| UTI Nifty 50 Index | 1.4% | 23.6% | 25.0% |

| Nippon India Small Cap | 1.8% | 42.9% | 49.7% |

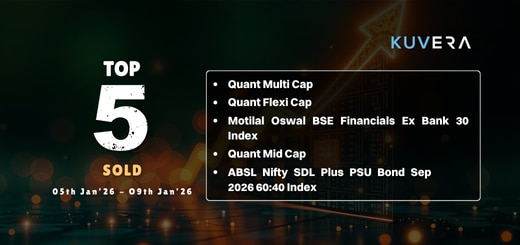

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Bluechip | 2.0% | 19.0% | 19.0% |

| Axis Focused 25 | 3.4% | 17.5% | 18.7% |

| Navi Nifty 50 Index Fund | 1.4% | 23.6% | NA |

| Franklin India Feeder Franklin US Opp... | 3.8% | 26.0% | 8.5% |

| Bandhan Arbitrage | 0.1% | 6.4% | 4.9% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal Midcap | 1.6% | 45.3% | 41.7% |

| Axis Small Cap | 2.6% | 32.1% | 40.4% |

| Tata Digital India | 1.9% | 12.9% | 35.2% |

| ABSL Flexi Cap | 2.1% | 24.5% | 25.5% |

| IPRU Bluechip | 1.5% | 25.1% | 26.7% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| ITC | 2.3% | 72.0% | 13.0% |

| Tata Motors | 1.8% | 37.6% | 13.4% |

| Varun Beverages | 3.8% | 108.7% | 48.6% |

| Tata Steel | 2.8% | 19.1% | 17.0% |

| HAL | 9.0% | 106.8% | 32.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Provention Bio | 2.2% | 578.8% | NA |

| NVIDIA Corporation | 10.1% | 168.8% | 45.4% |

| Netflix | 2.8% | 149.2% | 2.0% |

| Apple | 2.2% | 43.1% | 32.6% |

| Microsoft Corporation | 6.5% | 41.2% | 29.3% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!

SARAVANA KUMAR

June 19, 2023 AT 19:15

Can you split most bought MF in to equity, and debt section?