Top news

The Securities and Exchange Board of India, in its recent circular, has amended guidelines for stock brokers to allow the use of a common mobile number or email for multiple clients under specific written requests, provided the clients belong to the same family or authorized representatives for non-individual entities, effective immediately.

Enviro Infra Engineers got listed at a premium of 50 percent over the issue price of ₹220.

Axis AMC, DSP AMC, and, Invesco AMC, have launched the NFO for Axis Crisil Ibx Aaa Bond Nbfc Hfc Jun 2027 Index , DSP Business Cycle Growth and Invesco India Multi Asset Allocation Growth

Index Returns

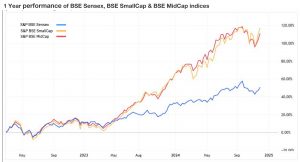

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 2.3% | 17.9% | 12.7% | 22.7 | 3.7 |

| NIFTY NEXT 50 | 3.3% | 44.6% | 19.8% | 23.3 | 3.9 |

| S&P BSE SENSEX | 2.4% | 17.3% | 17.9% | 23.3 | 4.1 |

| S&P BSE SmallCap | 3.4% | 38.6% | 35.2% | 34.3 | 4.0 |

| S&P BSE MidCap | 3.5% | 35.8% | 26.9% | 40.9 | 4.8 |

| NASDAQ 100 | 3.3% | 34.4% | 12.7% | 48.6 | 4.2 |

| S&P 500 | 1.0% | 32.3% | 10.4% | 31.2 | 5.4 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Nifty Capital Markets Index | 8.6% | NA | NA |

| 5.8% | NA | NA | |

| Whiteoak Capital Digital Bharat Growth | 5.3% | NA | NA |

| HDFC Nifty Realty Index Growth | 5.3% | NA | NA |

| Tata Nifty Realty Index Growth | 5.3% | NA | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal ELSS Tax Saver | 4.5% | 55.6% | 29.40% |

| Bank Of India ELSS Tax Saver | 4.0% | 34.4% | 22.7% |

| Invesco India ELSS Tax Saver | 3.8% | 35.4% | 18.1% |

| ITI ELSS Tax Saver | 3.5% | 35.6% | 23.5% |

| Baroda BNP Paribas ELSS Tax Saver | 3.4% | 35.3% | 19.5% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| BSE | 18.0% | 120.8% | 100.3% |

| 15.0% | 39.3% | 93.5% | |

| PB Fintech | 14.0% | 160.6% | NA |

| NTPC Green Energy | 12.7% | NA | NA |

| Max Healthcare Institute | 12.2% | 60.5% | NA |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| -1.8% | 19.7% | NA | |

| Edelweiss US Value Equity Off Shore Growth | -1.1% | 28.8% | 13.30% |

| Kotak International Reit FoF Growth | -0.9% | 9.2% | 0.2% |

| ICICI Prudential FMCG Growth | -0.4% | 7.3% | 15.8% |

| Quant Healthcare Growth | -0.3% | 39.4% | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Total Gas | -9.1% | -16.7% | 36.9% |

| Oil India | -5.9% | 119.6% | 34.9% |

| Adani Power | -4.4% | -0.4% | 54.5% |

| Colgate-Palmolive (India) | -3.8% | 24.7% | 14.8% |

| HDFC Life Insurance Co | -3.2% | -5.4% | 2.0% |

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 2.3% | 29.4% | 18.3% |

| UTI Nifty 50 Index | 3.3% | 19.6% | 13.9% |

| Motilal Oswal Midcap | 4.6% | 64.3% | 37.4% |

| Quant Small Cap | 2.3% | 37.00% | 30.00% |

| Nippon India Small Cap | 2.9% | 35.8% | 30.4% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Sundaram Large & Mid Cap | 3.0% | 30.2% | 18.6% |

| Quant Bfsi | 4.0% | 26.5% | NA |

| Mahindra Manulife Multi Cap | 3.1% | 31.7% | 21.9% |

| Edelweiss Balanced Advantage | 1.9% | 20.2% | 13.5% |

| Nippon India Power & Infra | 3.8% | 42.5% | 33.6% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Nifty 50 Index Growth Direct Plan | 2.3% | 19.6% | NA |

| Axis Small Cap Growth Direct Plan | 3.1% | 30.6% | 23.1% |

| UTI Nifty Next 50 Index Growth Direct | 3.3% | 45.4% | 20.1% |

| Motilal Oswal Midcap Growth Direct Plan | 3.6% | 64.3% | 37.4% |

| Parag Parikh Flexi Cap Growth Direct Plan | 1.9% | 29.4% | 18.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Suzlon Energy | 5.7% | 70.0% | 100.8% |

| 3.0% | 107.5% | NA | |

| Tata Motors | 4.8% | 15.2% | 37.5% |

| Reliance Power | 8.7% | 91.8% | 64.1% |

| Tata Steel | 3.4% | 12.7% | 30.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| MicroStrategy Inc | 2.0% | 559.0% | 91.8% |

| NVIDIA Corporation | 3.0% | 199.8% | 93.0% |

| 2x Bitcoin Strategy ETF | 5.50% | 153.9% | NA |

| Tesla, Inc | 12.8% | 59.6% | 76.9% |

| S&P 500 Growth Vanguard | 3.4% | 43.9% | 17.1% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!