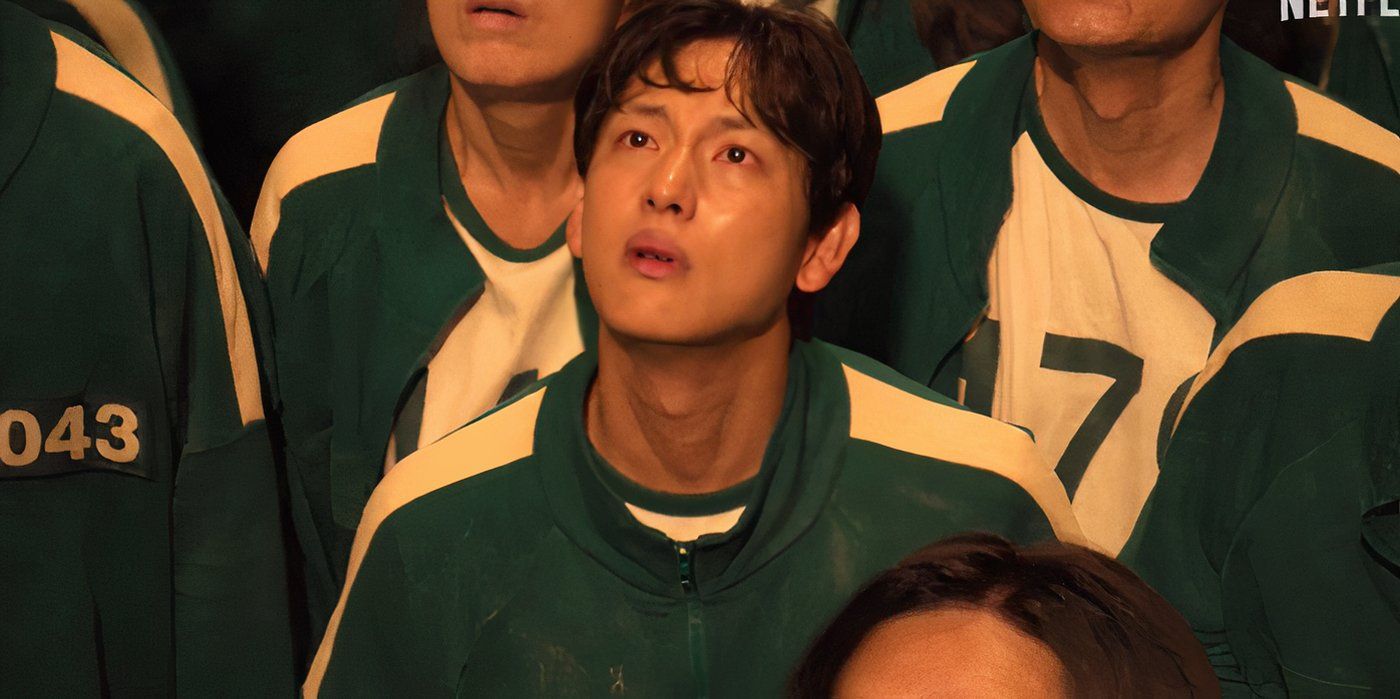

Squid Game is a South Korean thriller series where 456 contestants, struggling with debt and desperation, compete in deadly versions of childhood games for a massive cash prize.

As the games progress, alliances are formed, betrayals occur, and the stakes become increasingly life-threatening, exposing human greed, morality, and survival instincts. The series is a sharp critique of socioeconomic inequalities and the lengths people will go for survival and success.

Let us look at the valuable life lessons that can be applied to investing in mutual funds. The key themes of the show align with different investment principles in the following manner:

1. Understanding the Rules, be Careful and Diligent

Like players needed to know game rules, as investors you must know the investment objective, risks associated with the investment, and terms before investing.

In Squid Game, the players were often required to analyse their tasks carefully, such as in the “Honeycomb” task, where precision was critical for survival. Those who rushed or ignored instructions, lost the game.

As an investment lesson from the game, avoid investing in a fund because it’s popular; instead, analyse its objectives, track record, and management style, and most importantly, understand its fundamental attributes detailed in the scheme related documents.

2. Avoid Cognitive Biases

In the “Marbles” game, players made emotional decisions, overestimating their chances based on biases like overconfidence or herd mentality.

The investment lesson from the same is to beware of Herd Mentality. Don’t invest in a mutual fund simply because everyone else does. Popularity doesn’t always translate to profitability.

Generally, during market rallies, investors may flock to equity funds, ignoring their risk profile. Hence, it is essential to choose funds that align with your financial goals.

3. Don’t Be Impulsive

Many Squid Game participants acted impulsively under pressure, leading to dire consequences. An investment lesson is that you should stay calm during volatile market conditions. When markets fall, avoid the urge to exit hastily. Similarly, don’t jump into an investment just because it’s trending.

4. Understand Your Risk Appetite

Another observation indicated that some players in Squid Game underestimated the risks involved, leading to their downfall. The learning from the same is to assess risks and rewards. You must understand your risk tolerance before investing. Mutual funds range from low-risk debt funds to high-risk equity funds. For example, if you are a risk-averse investor then you should consider investing in balanced or hybrid funds instead of small-cap equity funds. It is always advisable to seek expert guidance while making investment decisions if the investment stream is unknown.

5. Stay Invested and Think Long-Term

The overarching lesson in Squid Game is endurance; those who stayed focused and consistent had the best chance of survival. And also, the popular saying is ‘Patience Pays Off’. Hence, mutual funds often require a long-term horizon to yield optimal returns. Therefore, Systematic Investment Plans (SIPs) encourage disciplined investing and help deal with market volatility over time.

6. Diversify

In the Squid Game, alliances and adaptability were crucial. Players who relied on just one strategy often failed. Like Cho Sang Woo told his team, “Don’t put all eggs in one basket.” Similarly, you must diversify your investments across asset classes, fund types, and sectors. For example, you may invest in a mix of equity, debt, and hybrid funds to balance risk and returns.

7. Be Wary of High Promises

The show highlights how desperation can lead people to take extreme, unwise risks, such as trusting the wrong individuals.

As an investment lesson from the show, you should avoid unrealistic promises. This means you should steer clear of funds that promise extraordinary returns, and always remember that high returns may come with high risks. Know that, a fund advertising “guaranteed high returns” might be a red flag because mutual funds are always subject to market risks.

8. Leverage Expertise

Some players in Squid Game leveraged the skills and knowledge of others to succeed, for example, the glassmaker in the “Glass Bridge” game. This guides you to seek professional advice, i.e., consulting a financial advisor to choose funds that align with your goals and risk profile. For instance, a financial advisor can guide you on whether to invest in large-cap, mid-cap, or sectoral funds based on your investment objective(s).

9. Beware Digital Vulnerability

The show, in its second season, highlighted themes pertaining to cryptocurrencies and digital finance. It showcased the perils of putting blind faith in speculative ventures, directing people to understand digital financial risks, as many people fall prey to crippling debts linked to erratic digital assets such as cryptocurrencies. The depiction of numerous players struggling with crippling debts brought on by speculative investments serves as a warning for investors about digital vulnerabilities and the significance of making well-informed decisions when using the internet.

10. Know Your Advisor

There are instances where contestants show their faith in others to deal with certain situations. For instance, Sae-byeok asks for help from Gi-hun after sustaining a fatal injury, showcasing the importance of discernment and mutual reliance in overcoming challenges. On the other side, Ali’s death in a marble game by his own partner teaches us why you need to trust credible sources for your decisions. Similarly, while seeking investment advice, it is of utmost importance to know who your advisor is. Hence, always reach out to SEBI or licensed entities for your varied investment decisions and goals. For example, for choosing a suitable mutual fund scheme for your investment goal, approach a licensed mutual fund distributor.

Wrapping Up

To wrap up, Squid Game offers valuable insights beyond its thrilling narrative, with lessons that resonate deeply with mutual fund investing. Investors can make informed decisions and navigate market volatility, by understanding the rules, avoiding cognitive biases, and staying disciplined.

Assessing risk appetite, diversifying investments, and leveraging expert advice align with the show’s themes of survival through strategy and adaptability. The series also emphasises the importance of avoiding high promises, recognising digital vulnerabilities, and trusting credible advisors, reinforcing prudent practices in investment planning. These parallels remind us that success, whether in games or investments, requires preparation, patience, and informed choices.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Rebalancing for Mutual Fund Investors