Top news

Foreign Institutional Investors bought Rs 65,317 crore worth of Indian equities during the month of November, 2020. Highest monthly infusion in the last 2 decades.

November turned out to be the best month in decades for multiple global Indices. Dow Jones went up by 12.9%, S&P Energy by 33.7%, S&P Financials by 19%, and S&P industrial went up by 16.8% with record breaking performance during November.

RBI has rejected Muthoot Finance’s proposal to acquire IDBI AMC stating that -

"The activity of sponsoring a mutual fund or owning an asset management company is not in consonance with the activity of an operating NBFC"

NFOs for 5 funds have gone live this week. These funds are - Mirae Asset Banking & Financial Services Fund, ICICI Prudential Quant Fund, Baroda Banking & PSU Bond Fund, HDFC Dividend Yield Fund and Union Hybrid Equity Fund.

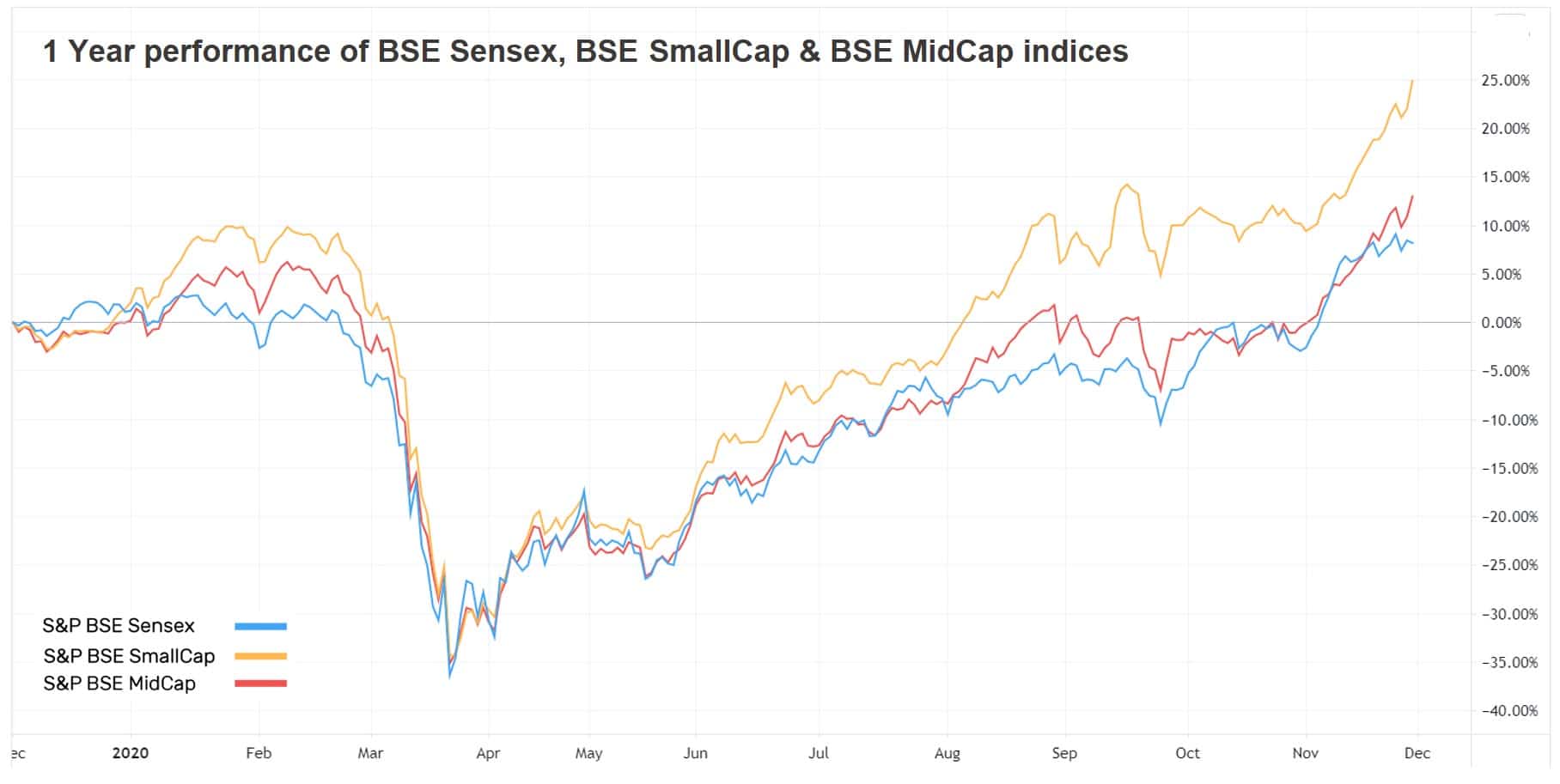

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 0.9% | 7.1% | 7.6% | 35.7 | 3.7 |

| NIFTY NEXT 50 | 1.3% | 6.5% | 0.4% | 38.0 | 4.1 |

| S&P BSE SENSEX | 0.6% | 7.6% | 9.4% | 31.5 | 2.9 |

| S&P BSE SmallCap | 4.3% | 25.4% | -2.4% | NA | 2.3 |

| S&P BSE MidCap | 2.9% | 13.3% | -0.2% | 60.7 | 2.5 |

| NASDAQ 100 | 3.0% | 44.9% | 24.1% | 38.2 | 8.3 |

| S&P 500 | 2.3% | 15.3% | 11.8% | 28.5 | 4.0 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Energy | 5.4% | 3.2% | 3.0% |

| ICICI Prudential Smallcap | 5.3% | 19.2% | 1.1% |

| Sundaram Small Cap | 4.8% | 18.2% | -5.3% |

| SBI Magnum Midcap | 4.8% | 22.6% | 2.5% |

| 4.8% | 15.5% | -5.9% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 2.4% | 30.7% | 10.9% |

| Baroda Elss 96 B | 2.4% | 12.7% | 2.0% |

| ITI Long Term Equity | 2.3% | 8.3% | NA |

| Quantum Tax Saving | 2.1% | 7.9% | 2.7% |

| 2.0% | 11.1% | 7.4% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| SAIL | 21.4% | 25.4% | 1.4% |

| L&T Finance | 21.1% | -15.8% | 4.6% |

| Bharti Infratel | 17.6% | -6.1% | -6.2% |

| Shriram Transport Finance | 17.4% | -1.2% | 5.9% |

| 16.9% | 25.4% | 23.4% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -4.0% | 38.7% | 15.1% |

| HDFC Gold | -2.9% | 29.0% | 17.4% |

| Axis Gold | -2.8% | 28.4% | 18.3% |

| Kotak Gold | -2.6% | 28.2% | 18.0% |

| -2.5% | 27.8% | 16.8% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Interglobe Aviation | -10.3% | 7.2% | 7.2% |

| PI Industries | -6.1% | 57.6% | 29.2% |

| AU Small Finance Bank | -5.1% | 5.5% | NA |

| Avenue Supermarts | -4.3% | 28.3% | NA |

| -3.5% | 43.1% | 35.4% |

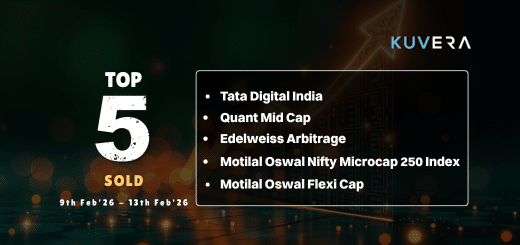

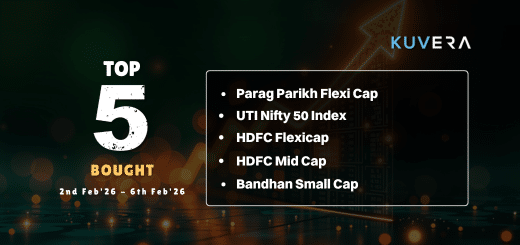

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 1.7% | 28.7% | 14.7% |

| Axis Bluechip | 0.8% | 13.0% | 14.3% |

| UTI Nifty Index | 0.9% | 7.8% | 8.7% |

| DSP Dynamic Asset Allocation | 0.6% | 12.5% | 9.3% |

| 2.4% | 22.9% | 14.4% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| L&T Emerging Businesses | 4.0% | 11.3% | -2.1% |

| HDFC Small Cap | 3.4% | 12.1% | 0.5% |

| Motilal Oswal Multicap 35 | 0.9% | 5.8% | 3.3% |

| 3.4% | 12.3% | -2.6% | |

| 1.0% | 7.0% | 4.9% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | 1.0% | 64.4% | 29.8% |

| Tata Digital India | 1.5% | 42.9% | 26.4% |

| Parag Parikh LTE | 1.7% | 28.7% | 14.7% |

| IPRU Technology | 1.9% | 56.8% | 26.1% |

| 1.8% | 17.8% | 10.0% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -2.2% | 25.0% | 32.5% |

| Adani Green Energy | 3.4% | 873.3% | NA |

| TCS | 1.6% | 30.9% | 19.3% |

| Infosys | 0.4% | 59.3% | 17.0% |

| 4.8% | 13.0% | 22.2% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | -0.4% | 74.1% | 31.7% |

| Tesla | 12.9% | 784.4% | 66.1% |

| Amazon | 2.3% | 75.7% | 36.5% |

| Microsoft | 1.7% | 41.3% | 31.9% |

| 3.5% | 37.5% | 21.4% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!