Top news

SEBI in a circular has changed the implementation date for fund realisation-based NAV to February 1. It was earlier scheduled to be implemented from January 1. Refer to our detailed note.

After being oversubscribed by 15 times, Antony Waste Handling IPO debuted with a premium of 36% over the issue price of Rs 315.

ICICI Prudential Mutual Fund and Mirae Asset Mutual Fund have announced a change in fund managerial responsibilities of their schemes.

ICICI Prudential Mutual Fund has launched the NFO for ICICI Prudential Business Cycle Fund. The fund will invest with focus on riding business cycles through allocation between sectors and stocks at different stages of business cycles. The NFO closes on 12 January.

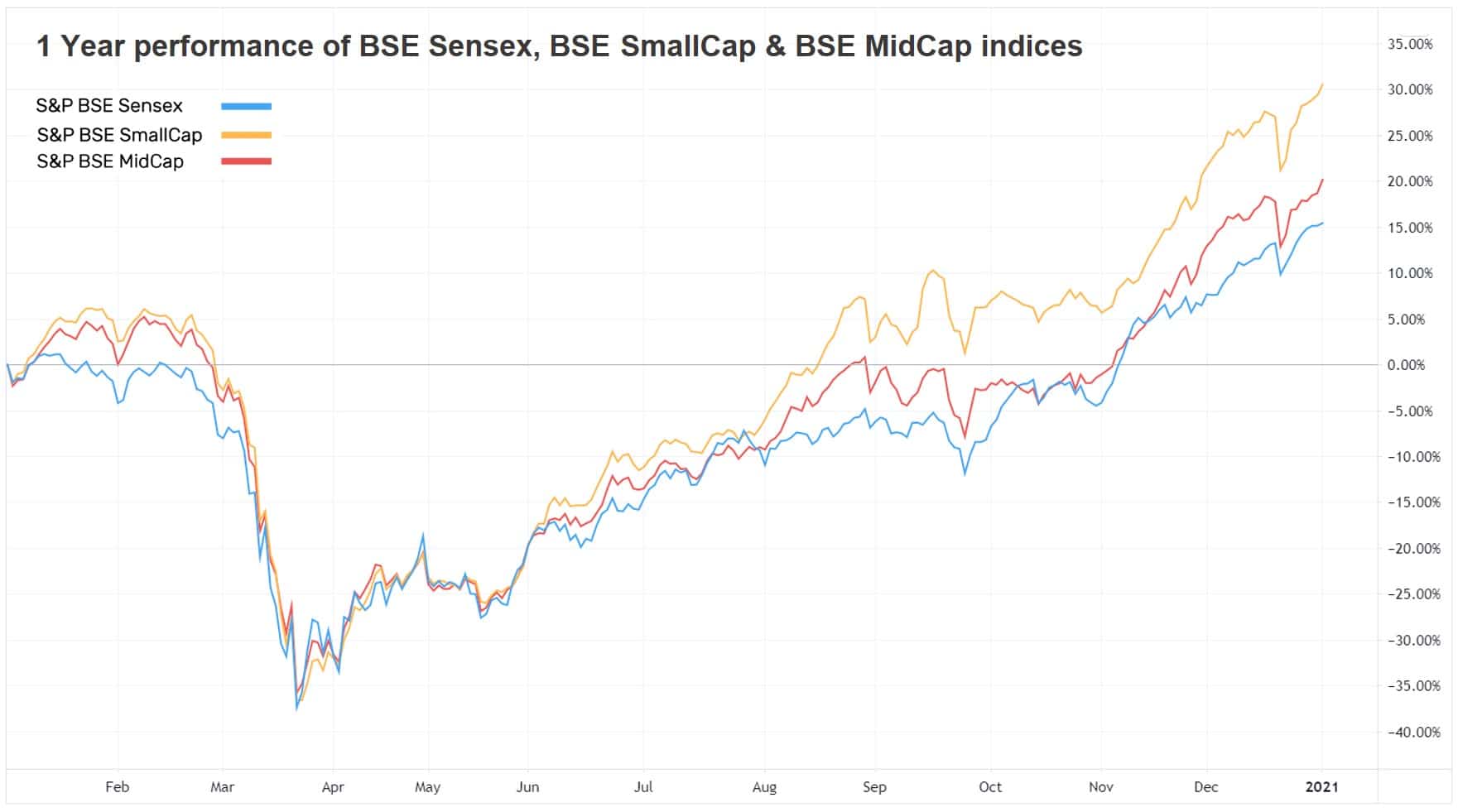

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 2.0% | 15.0% | 10.3% | 38.6 | 4.0 |

| NIFTY NEXT 50 | 2.2% | 15.7% | 2.0% | 41.8 | 4.4 |

| S&P BSE SENSEX | 1.9% | 15.8% | 12.3% | 33.5 | 3.3 |

| S&P BSE SmallCap | 3.3% | 32.3% | -1.8% | NA | 2.5 |

| S&P BSE MidCap | 2.8% | 21.0% | 0.6% | 67.1 | 2.7 |

| NASDAQ 100 | 1.4% | 47.2% | 26.3% | 39.7 | 8.6 |

| S&P 500 | 1.4% | 16.1% | 12.0% | 29.9 | 4.2 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Sundaram Small Cap | 4.3% | 28.2% | -4.5% |

| PGIM India Midcap Opp... | 3.8% | 52.8% | 11.3% |

| ABSL Infrastructure | 3.8% | 13.6% | -4.5% |

| Tata Resources & Energy | 3.8% | 33.4% | 8.8% |

| 3.6% | 20.2% | -1.0% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| IDFC Tax Advantage | 3.0% | 21.3% | 4.8% |

| ITI Long Term Equity | 2.9% | 15.2% | NA |

| Motilal Oswal Long Term Equity | 2.7% | 10.8% | 5.7% |

| JM Tax Gain | 2.6% | 19.6% | 10.3% |

| 2.5% | 10.6% | 2.1% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Motherson Sumi Systems | 9.1% | 10.8% | 5.3% |

| Tata Steel | 9.0% | 217.9% | NA |

| Tata Motors | 8.6% | 0.1% | -14.2% |

| Vedanta | 7.3% | 4.6% | 20.5% |

| 6.6% | 5.0% | 16.2% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Global Stable Equity | -0.7% | 4.1% | 8.8% |

| DSP World Gold | -0.6% | 32.1% | 17.2% |

| -0.6% | 11.5% | 4.1% | |

| DSP US Flexible Equity | -0.4% | 23.4% | 16.4% |

| -0.4% | 0.5% | 2.0% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Biocon | -3.8% | 59.4% | 40.0% |

| Indus Towers | -2.8% | -9.7% | -7.1% |

| Tata Consumer Products | -2.6% | 83.5% | 33.3% |

| Nestle India | -1.8% | 23.6% | 27.1% |

| -1.3% | 17.3% | 20.1% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 1.6% | 33.5% | 15.6% |

| Motilal Oswal Nasdaq 100 FOF | 1.2% | 51.9% | NA |

| UTI Nifty Index | 2.0% | 15.7% | 11.4% |

| ABSL Digital India | 2.0% | 60.8% | 27.9% |

| 1.9% | 21.4% | 16.6% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Nippon India Arbitrage | 0.1% | 4.9% | 6.4% |

| HDFC Small Cap | 2.8% | 21.0% | 1.2% |

| IPRU Bluechip | 2.0% | 14.3% | 8.4% |

| L&T Arbitrage Opportunities | 0.1% | 5.2% | 6.1% |

| 2.5% | 16.8% | -1.7% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | -0.4% | 74.4% | 32.8% |

| Tata Digital India | 2.7% | 57.0% | 30.3% |

| Parag Parikh LTE | 1.6% | 33.5% | 15.6% |

| Axis Bluechip | 1.9% | 21.4% | 16.6% |

| 2.8% | 71.9% | 29.2% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 2.1% | 29.7% | 32.0% |

| Adani Green Energy | 0.6% | 562.0% | NA |

| Infosys | 0.2% | 71.4% | 19.7% |

| Tata Consultancy Services | -1.3% | 31.5% | 20.8% |

| 4.4% | 12.2% | 21.7% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla, Inc. | 6.6% | 720.1% | 71.2% |

| Apple, Inc. | 0.5% | 76.6% | 38.2% |

| NIO Inc. | 6.5% | 1213.7% | NA |

| Amazon.com Inc. | 2.7% | 71.6% | 36.9% |

| -0.1% | 38.4% | 32.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!