The share of gross household financial assets doubled from 3% to 6% between 2014 and 2018, as per data from Association of Mutual Fund of India (AMFI). AMFI-CRISIL factbook gives a picture of the changes in the mutual fund’s industry since 2014 –

Share of equity funds in total assets under management went up from 24% to 45%

The AUM of equity funds grew at a CAGR of 38.6% This includes both inflows and returns.

The AUM of Hybrid funds grew at 54% CAGR, liquid funds at 27% and debt funds at 8%

Individual investors upped their share of AUM from 48% to 58% in this period

The average ticket size for individual investors increased from Rs 1.02 lakh to Rs 1.69 lakh

The annual SIP flow from individual investors increased from Rs 44,000 crore in FY 2016-17 to nearly Rs 93,000 crore in 2018-19.

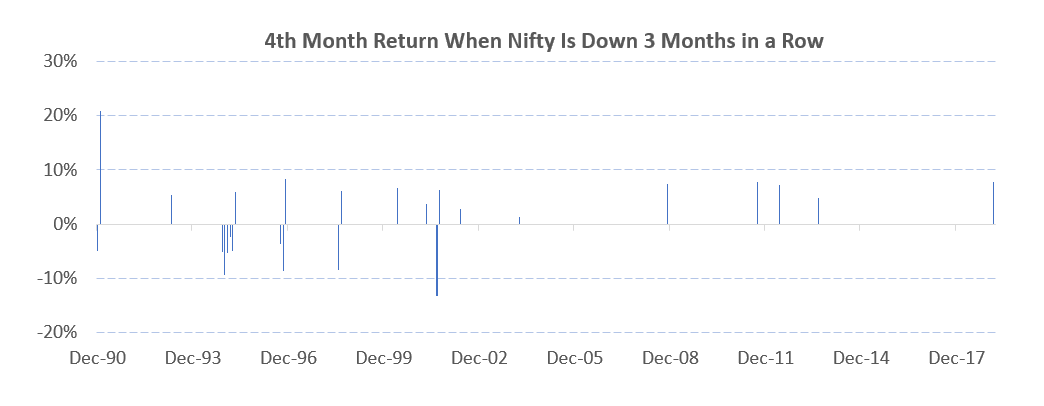

Aug-19 was the 26th time since 1990 that Nifty had 3 negative monthly returns in a row. We are seeing some forwards that claim that 3 consecutive down months have usually meant a positive return the next month. We wanted to check for ourselves and ran the same backtest all the way to 1990.

If we look at the past 25 instances that Nifty had 3 negative monthly returns, we do find a small postive return of 1.5% in the next month. Unfortunately, it is not statistically significant.

This follows reason as well. While everyone agrees that reversion to mean happens in the market, there is no reason for it to happen at precisely 3 down months. Our advice is to be very wary of such analysis of market timing and almost never ever to follow it.

On Friday, Finance Minister Nirmala Sitharaman announced plans to merge 10 public sector banks into 4. This move will bring down the number of PSU banks to 12 from 21. According to the plan:

Indian Bank will be merged with Allahabad Bank (anchor bank – Indian Bank)

PNB, OBC and United Bank to be merged (PNB will be the anchor bank)

Union Bank of India, Andhra Bank and Corporation Bank to be merged (anchor bank – Union Bank of India)

Canara Bank and Syndicate Bank to be merged (anchor bank – Canara Bank)

The Central Statistics Office released GDP data for the April-June quarter on Friday. India’s GDP grew by 5% in the first quarter of this Financial Year. In comparison, the GDP growth rate was 5.8% during the same period in 2018.

|

|

|

|

|

Movers & Shakers

1/ UTI Mutual Fund has announced the change in fund manager for a few schemes including UTI Mid Cap Fund and UTI Long Term Equity Fund.

2/ Axis Mutual Fund has announced that U R Bhat has ceased to be an Independent Director on the Board of Axis AMC and Venkataramanan Anantharaman has been appointed in his stead. The fund house also announced the appointment of Ravi Narayanan as a Director on the board of the AMC.

3/ Indiabulls Mutual Fund has announced that Rekha Warriar, Independent Director, has resigned from the Board of Indiabulls Asset Management Company Limited with effect from 27 August 2019.

4/ Edelweiss Mutual Fund has announced that K V Hegde has ceased to be an Independent Director of Edelweiss Trusteeship Company Limited, with effect from 24 August 2019.

Quote of the week:

There are no great limits to growth because there are no limits of human intelligence, imagination, and wonder.

: Ronald Reagan

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!