Looking for passive funds India? If yes, for passive investment India, you might be thinking of benchmark indices like Nifty 50 or Sensex.

The Nifty 50 is one of the leading stock market indices in India, representing the top 50 companies listed on the National Stock Exchange (NSE). Launched on April 22, 1996, the index serves as a benchmark for measuring the performance of the Indian equity market.

The NSE NIFTY 50 index ecosystem includes a variety of investment vehicles such as index funds (both onshore and offshore mutual funds), ETFs, and futures and options available on the NSE and NSE International Exchange (through GIFT Nifty).

In 2016, the NIFTY 50 was recognized by the World Federation of Exchanges (WFE) and the Futures Industry Association (FIA) as the most actively traded index options contract globally, although it was subsequently surpassed by Nifty Bank.

Looks perfect for passive funds India investment? Check out top Nifty 50 passive funds India here.

The NSE NIFTY 50 index represents 13 sectors of the Indian economy, providing investment managers with a comprehensive portfolio that captures the market’s diversity. As of July 2024, the index allocates a weightage of 32.76% to financial services (including banking), 13.76% to information technology, 12.12% to oil and gas, 8.46% to consumer goods, and 8.22% to automotive.

Formation and Development

Initially, the NSE Nifty 50 included 50 of the largest and most liquid stocks across various sectors, providing a comprehensive snapshot of the Indian economy. The index is calculated using free-float market capitalization which means it reflects the market value of the companies’ shares that are available for trading. This methodology ensures that the index remains relevant and accurately represents market movements.

Over the years, the NSE Nifty 50 has undergone periodic reviews to include companies that meet certain eligibility criteria, reflecting the evolving landscape of the Indian economy. Notable companies in the index include major players from sectors such as information technology, financial services, consumer goods and pharmaceuticals.

Long-Term Growth and Short-Term Volatility

While investing in passive funds India, long-term growth is an important factor.

Let us see how the NSE Nifty50 index fares here?

Despite experiencing significant short-term volatility due to various economic, political and global factors, the Nifty 50 has shown a consistent upward trajectory over the long term. For instance, after the initial launch in 1996, the index faced challenges during events such as the dot-com bubble burst in 2000, the 2008 financial crisis and more recently, the COVID-19 pandemic. Each of these events led to short-term declines in the index.

However, in the aftermath of each crisis, the NSE Nifty 50 rebounded strongly, reflecting the resilience and growth potential of the underlying companies.

Recent Accelerations (2021–2024)

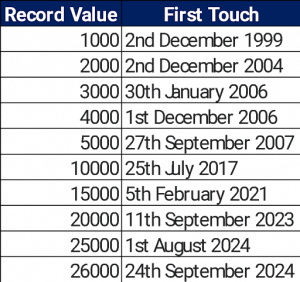

The index reached 15000 on February 5, 2021, and 20000 on September 11, 2023, showing a remarkable acceleration in growth. This surge can be attributed to factors like:

- Post-pandemic recovery and growth.

- Increased foreign investment and bullish sentiment in the Indian economy.

- Technological advancements and digital transformation in various sectors.

The index quickly moved to 25000 on August 1, 2024, and touched 26000 on September 24, 2024. This rapid increase suggests strong market confidence and a favourable economic environment.

High value record of Nifty 50 over the years

The NSE Nifty 50 index grew from 1000 to 26000 in approximately 25 years. The consistent upward trajectory highlights the benefits of investing in index funds as the NIFTY 50 reflects the performance of major companies and the economy’s growth.

Factors Contributing to Long-Term Growth

1. Economic Fundamentals

The Indian economy has been on a growth path, driven by factors like increasing consumer demand, infrastructure development and a growing middle class. These fundamentals provide a solid foundation for the companies listed in the Nifty 50.

2. Diversification of Sectors

The Nifty 50 encompasses various sectors, reducing the impact of volatility in any single industry. This diversification helps stabilize the index during economic fluctuations.

3. Global Integration

As India becomes increasingly integrated into the global economy, foreign investments and trade can support the growth of the Nifty 50, helping it recover from downturns.

4. Investor Confidence

Over time, both domestic and foreign investors have gained confidence in the Indian market. This trust encourages long-term investments, helping to buffer the impact of short-term market fluctuations.

5. Government Policies

Pro-business reforms and government initiatives aimed at boosting economic growth have positively influenced market sentiment and contributed to the Nifty 50’s resilience.

Benefits of investing in Nifty 50 index through Passive Funds in India

Them working for you, while you Netflix and chill.#Memes pic.twitter.com/Sm0ZVWbQHV

— Kuvera (@Kuvera_In) June 27, 2024

Diversification

The Nifty 50 comprises 50 of the largest and most liquid stocks across various sectors, providing investors with diversified exposure to the Indian economy. By investing in a range of companies, the risks associated with individual stocks are mitigated, reducing overall portfolio volatility.

Benchmarking Performance

Investing in the index helps investors stay aligned with market trends as it reflects the collective performance of major companies.

Cost Efficiency

Index funds or ETFs (Exchange Traded Funds) that track the Nifty 50 typically have lower management fees compared to actively managed funds, enhancing overall returns. Since the index is passively managed, investors avoid high costs associated with active stock selection.

Simplicity and Accessibility

Investing in the Nifty 50 is straightforward through passive funds India (index funds or ETFs), making it accessible to both novice and experienced investors. Nifty 50 ETFs are traded on stock exchanges, providing high liquidity, allowing investors to buy and sell easily making it one of the unique passive investment India strategies.

Transparency

The composition of the Nifty 50 is regularly updated and publicly available, providing investors with transparency about what they are investing in. The index undergoes periodic reviews to ensure it reflects the best-performing and most liquid stocks in the market.

Inflation Hedge

Historically, equities have provided returns that can outpace inflation over the long term, making Nifty 50 investments a potential hedge against rising prices.

Dividends

Many of the companies in the Nifty 50 distribute dividends, providing a source of income in addition to capital appreciation.

Automatic Rebalancing

The Nifty 50 is periodically rebalanced to include the most relevant stocks, ensuring that the index remains reflective of market conditions and trends.

Wrapping Up

The Nifty 50 has established itself as a crucial indicator of the Indian stock market and economy. While it has faced short-term volatility due to various global and domestic challenges, its long-term growth trajectory remains robust. The combination of strong economic fundamentals, sectoral diversification and increased investor confidence has enabled the index to overcome short-term disruptions and continue its journey of growth. As a reflection of the Indian economy, the Nifty 50’s resilience reinforces the potential for sustained investment returns over the long term. Investing in passive funds India with NIFTY 50 index funds provides a cost-effective, diversified and straightforward way to gain exposure to the Indian equity market. With strong long-term growth potential and added benefits like income generation and tax efficiency, these funds are an attractive option for a wide range of investors.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Is UPI Killing the Toffee Business?