The Indian defence sector has witnessed a remarkable transformation over the last two decades. It has emerged as one of the fastest-growing sectors in the country. The government’s increasing focus on indigenisation of defence production, coupled with rising geopolitical tensions, has propelled the sector to new heights. With the rising revenue of defence companies, their stocks have been showing a higher growth potential.

Therefore, let us learn about the investment opportunities within the defence sector through mutual funds, highlighting the potential for significant returns and long-term growth.

The Defense Sector’s Meteoric Rise

India’s defence expenditure has consistently increased over the years, reflecting the government’s commitment to strengthening the country’s defence capabilities. The ‘Make in India’ initiative has further incentivised domestic manufacturing of defence equipment, creating a favourable environment for domestic companies.

Key factors driving the growth of the sector include:

Government’s Focus on Indigenisation

The government’s ‘Atmanirbhar Bharat’ initiative aims to reduce dependence on foreign defence imports, creating significant opportunities for domestic defence manufacturers.

Modernisation of Armed Forces

The Indian armed forces are undergoing a modernization drive, necessitating the acquisition of advanced weaponry and equipment.

Rising Geopolitical Tensions

Increasing geopolitical tensions in the region have prompted India to strengthen its military capabilities, leading to increased defence spending.

Nifty India Defence Index

This index, which tracks the performance of leading defence stocks, has surged significantly. In the past year alone, it has witnessed a remarkable growth of over 140%.

Government Spending

India’s defence budget has consistently increased, with a significant portion allocated to modernization and indigenous production. For instance, the defence budget for FY24 was allocated a substantial sum, marking a significant increase over the previous year.

Export Growth

The government’s focus on defence exports has led to substantial growth in this segment. India’s defence exports have grown exponentially, reaching a record high in recent years.

Investment Opportunities

Investors can capitalise on the growth potential of the defence sector through various investment avenues:

Direct Stock Investment

Investing directly in individual defence stocks like Paras Defence And Space, Cochin Shipyard, Bharat Electronics, Hindustan Aeronautics Limited, and Bharat Dynamics Limited.

Mutual Funds

Investing in defence-themed mutual funds that track a specific defence index or invest in a portfolio of defence stocks.

Investing in the Defense Sector Through Mutual Funds

Mutual funds offer an efficient way to invest in the defence sector. Investors can choose from a variety of funds, including passive funds India like index funds and thematic funds, that specialise in defence stocks.

Index Funds: A Passive Funds India Approach

Index funds track a specific index, such as the Nifty India Defense Index. These funds offer a passive approach to investing in the defence sector, providing exposure to a diversified basket of stocks. The Nifty India Defense Index, which has delivered a staggering 106% year-based return, is one of the highest-performing indices in recent times. To capitalise on this growth, two prominent Asset Management Companies (AMCs) – Motilal Oswal and Aditya Birla AMC – have recently launched index funds tracking the Nifty India Defence Index.

The Nifty India Defence Index has 15 constituents. Here are the top 10 constituents and their weightages as on Aug 31, 2024:

- Hindustan Aeronautics Limited (HAL): 18.23%

- Bharat Electronics Limited (BEL): 15.43%

- Bharat Dynamics Limited: 11.42%

- Cochin Shipyard Limited: 8.96%

- Mazagon Dock Shipbuilders Limited: 8.18%

- Larsen & Toubro Limited: 7.25%

- Bharat Forge Limited: 6.29%

- BEML Limited: 5.37%

- Bharat Heavy Electricals Limited: 4.21%

- Garden Reach Shipbuilders & Engineers Limited: 3.67%

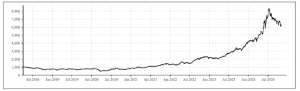

Here is a chart showing the rising potential of the Nifty Defence Index since 2018. The chart below shows that the index has grown by more than seven times over the period up to Sept 2024.

Thematic Funds: An Active Approach

Thematic funds invest in companies that are part of a specific theme or sector, such as defence. These funds are actively managed by experienced fund managers who select stocks based on their research and analysis. Thematic defence funds offer investors exposure to a concentrated portfolio of companies with high growth potential.

Benefits Of Investing In Defence Stocks Through Mutual Funds

Here are some of the key benefits of investing in defence sector mutual funds:

Long-Term Growth Potential

The defence sector is poised for long-term growth, driven by government initiatives and increasing defence expenditure.

Diversification

Investing in defence sector funds can help diversify your portfolio and reduce overall risk.

Professional Management

Mutual funds are managed by experienced professionals who conduct in-depth research and analysis.

Ease of Investment

Mutual funds offer a convenient way to invest in the defence sector through Systematic Investment Plans (SIPs).

Managing Defence Stock Investment Risk With Mutual Funds

Risk Appetite

Investing in the defence sector involves certain risks, including geopolitical risks and market volatility. Investors should carefully assess their risk tolerance before investing.

Long-Term Perspective

Investing in the defence sector is a long-term strategy. Short-term fluctuations in the market should not deter investors from their long-term goals.

Diversification

Investors should diversify their portfolio by investing in other asset classes, such as equity, debt, and gold.

Wrapping Up

In conclusion, the Indian defence sector presents a compelling investment opportunity for long-term growth. By investing in defence sector mutual funds through passive funds India or thematic funds, investors can participate in the growth story of this strategically important sector. However, it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Is UPI Killing the Toffee Business?