India is a land of rich heritage and diversity, making it a prosperous nation in all aspects of life. Let’s explore the valuable lessons that traditional games popular in India teach us about effective investment strategies. Reflecting on the cherished games of our Indian childhood, we discover profound lessons closely parallel to successful investing. These traditional games, though simple in design, encapsulate essential principles such as patience, strategy, risk management, and adaptability, which are the core tenets of effective investing.

Let’s delve into such games popular across different parts of India and uncover two valuable investment lessons from each:

North India

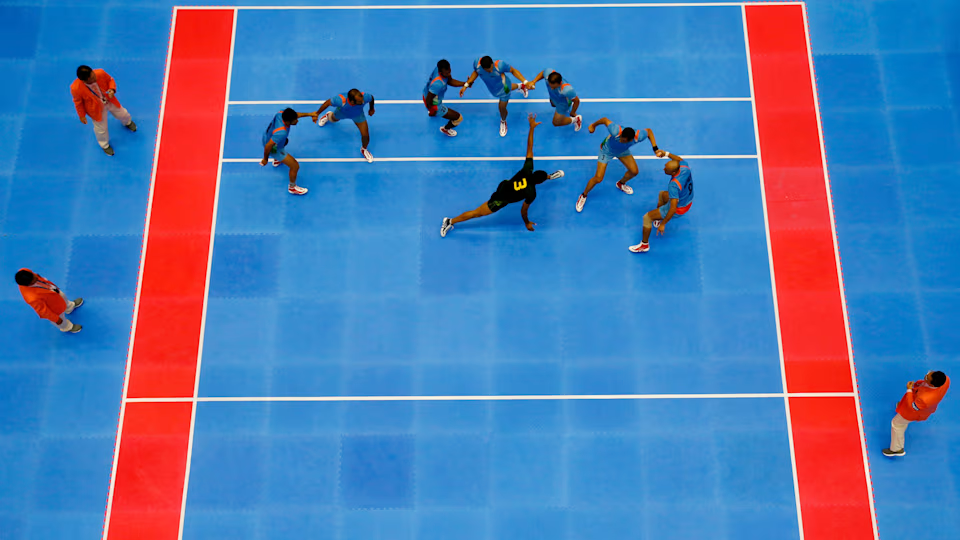

1. Kabaddi

(a) Calculated Risk-Taking

Raiders must assess the opposition’s defence before making a move, akin to investors evaluating market conditions before committing capital.

(b) Stamina and Perseverance

Sustaining breath while raiding mirrors the need for investors to maintain endurance through market volatility.

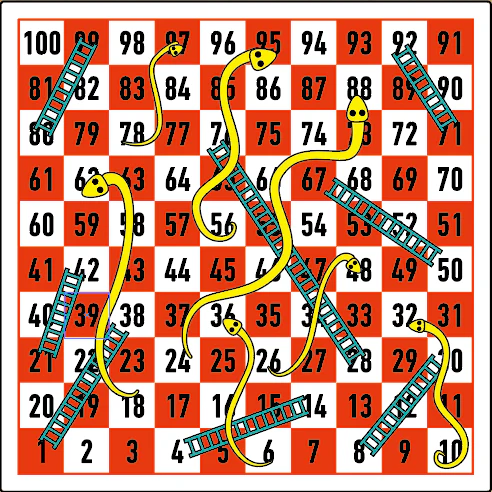

2. Snakes and Ladders

(a) Navigating Market Volatility

The unpredictability of snakes and ladders mirrors market ups and downs, teaching investors to remain resilient.

(b) Long-Term Focus

Despite setbacks, the objective is to reach the end, emphasising the importance of long-term investment horizons.

3. Hide and Seek

(a) Due Diligence

Seekers must thoroughly search, similar to investors conducting due diligence before investing.

(b) Patience

Waiting for the right moment to reveal oneself parallels waiting for the right investment opportunity.

South India

1. Aadu Huli Aata (Karnataka)

(a) Strategic Positioning

Players must position their pieces carefully, much like asset allocation in investing.

(b) Anticipating Opponent’s Moves

Success requires predicting the opponent’s strategy, which is crucial in understanding market sentiment.

2. Nondi/Hopscotch

(a) Sequential Progression

Players advance step by step, highlighting the need for a systematic approach in investing.

(b) Focus and Balance

Maintaining balance while hopping emphasises a balanced investment portfolio.

3. Kho-Kho

(a) Timing the Market

Chasers must decide the optimal moment to sprint, just like investors timing their market entries and exits.

(b) Team Collaboration

Success depends on teamwork, underscoring the importance of financial diversification.

4. East India

1. Yubi Lakpi (Manipur)

(a) Aggressive Goal Pursuit

Players aggressively pursue the objective, mirroring the determination required in achieving financial goals.

(b) Team Coordination

Success requires teamwork, highlighting the importance of collaboration in investment planning.

2. Dhopkhel (Assam)

(a) Offensive and Defensive Strategies

Balancing attack and defence mirrors managing aggressive and conservative investments.

(b) Adaptability

Adjusting strategies in real-time is crucial in dynamic financial markets.

3. Carrom (Popular across India)

(a) Focus and Precision

Accurate striking highlights the importance of thorough analysis in investment decisions.

(b) Resource Management

Effective use of the striker mirrors prudent capital allocation.

West India

1. Pithoo

(a) Risk and Reward Assessment

Balancing risk and reward is key, similar to investment decisions.

(b) Resilience and Recovery

The game teaches investors to recover from losses and rebuild portfolios.

2. Gilli Danda

(a) Precision in Execution

Hitting the gilli accurately reflects meticulous planning same as required in investments.

(b) Anticipating Outcomes

Players gauge the gilli’s trajectory, much like investors forecasting returns.

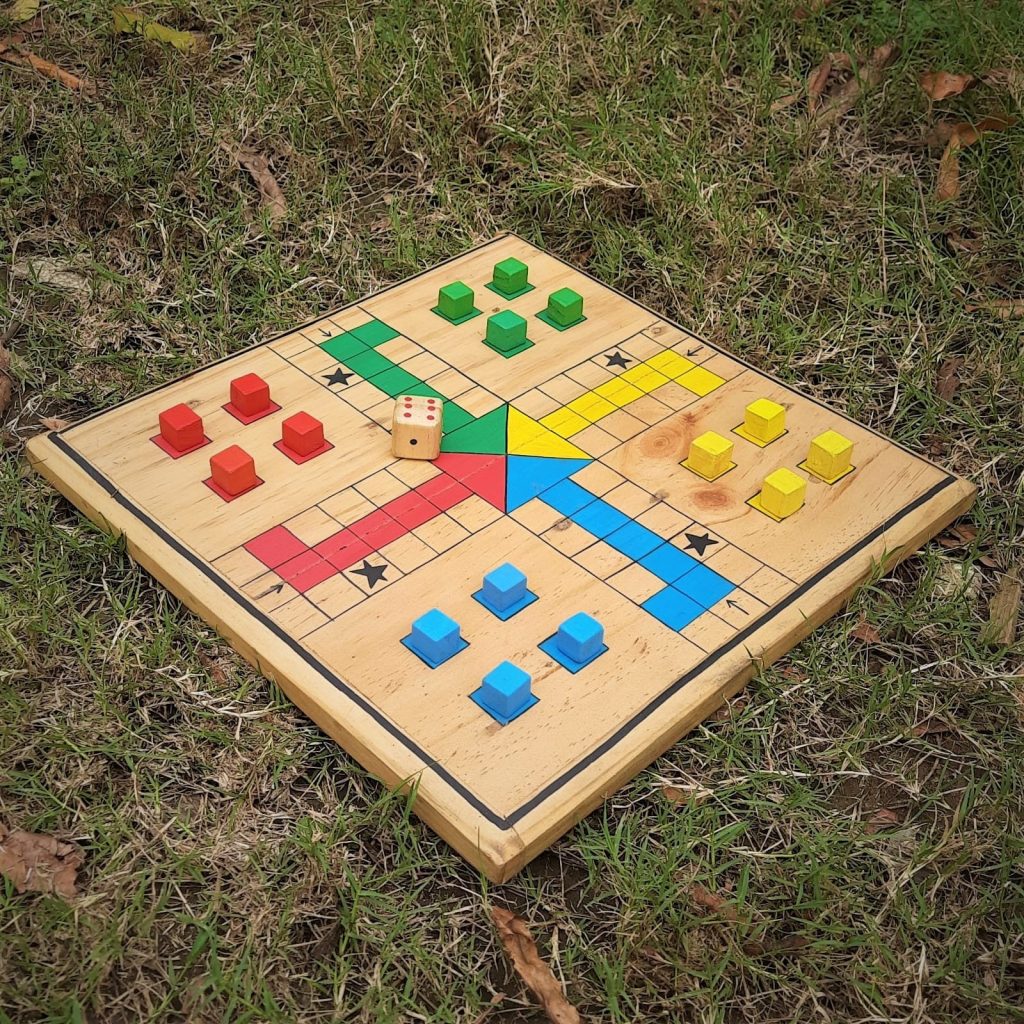

3. Ludo

(a) Risk Management

Advancing tokens or keeping them safe mirrors managing investment risks.

(b) Diversification

Progressing multiple tokens simultaneously underscores portfolio diversification.

Central India

1. Seven Stones (Lagori)

(a) Strategic Offense and Defense

Balancing offense and defense mirrors managing investment aggression.

(b) Recovery from Setbacks

Players strive to rebuild, reflecting resilience after market downturns.

2. Chess

(a) Strategic Planning

Each move is calculated, similar to a well-thought-out investment strategy.

(b) Adaptability

Adjusting tactics based on the game’s progression mirrors market adaptability.

3. Antakshari

(a) Building on Knowledge

Success relies on a vast repertoire, similar to investors building financial knowledge.

(b) Sequential Thinking

Connecting songs in sequence reflects the importance of strategic financial planning.

Key Takeaways From Each Regional Childhood Games

- North India’s traditional games emphasise resilience, patience, and strategic risk-taking—qualities essential for successful investing in dynamic market environments.

- South India’s games highlight precision, planning, and teamwork—crucial factors for a well-structured investment approach.

- East India’s games emphasise adaptability, strategic thinking, and resource management—critical attributes for financial success in evolving markets.

- West Indian games focus on risk management, precision, and resilience—essential skills for navigating volatile investment89+ landscapes.

- Central Indian games highlight strategic planning, adaptability, and knowledge-building—key factors for making informed investment choices.

Some childhood games are cherished across the country, such as Carrom, Ludo, and Snakes and Ladders. Their widespread popularity highlights their universal relevance in shaping valuable life skills, including financial acumen. These games teach critical investing principles applicable to different investment products:

- Carrom and Mutual Funds: This requires precision and strategy, similar to selecting a diversified mutual fund portfolio with the right asset allocation.

- Ludo and Equity Investments: Balancing risk and reward by advancing tokens mirrors the potential gains and pitfalls of investing in equities.

- Snakes and Ladders and Fixed Deposits: Emphasises patience and long-term planning, similar to the steady growth and security offered by fixed deposits.

Wrapping Up

The above-mentioned traditional games encapsulate timeless principles that are remarkably relevant to modern investment strategies. They impart valuable lessons on patience, strategic planning, risk management, adaptability, and resilience. By internalising these insights, investors can navigate the complexities of financial markets with greater confidence and acumen.

Much like in these games, success in investing hinges on understanding the rules, anticipating challenges, and making informed decisions. Embracing the wisdom embedded in our childhood games offers a unique and effective framework for achieving financial goals.

As the Securities and Exchange Board of India (SEBI) continues to refine regulatory frameworks to protect investors and uphold market integrity, it is crucial for investors to stay informed and adapt their strategies accordingly. For example, SEBI’s consultation papers review the regulatory framework for various investment avenues, which aim to enhance transparency and accountability in the securities market.

Thus, by drawing parallels between the strategic elements of traditional games and modern investment practices, investors can cultivate a disciplined and informed approach to wealth management, ensuring that the lessons of the past guide us toward a prosperous financial future.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Rebalancing for Mutual Fund Investors