All that you need to know about Mutual Funds this week

The mutual fund Industry has added 1.18 crore folios during the past year, with Equity funds (including ELSS and Balanced funds) contributing to 90% of the total growth.The total investor accounts stood at 8.18 crore in February, with the total Assets under management (AUM) at Rs 23.16 lakh crore.

After a decade of operations, Mirae Asset is now ranked 16th in the list of Top AMCs in terms of Average Assets Under Management, and 12th in terms of Equity Assets. The AMC now has over Rs 25,000 crores Assets in Management, with Rs 22,000 crore in Equity Assets.

Goldman Sachs (GS), the global investment banking firm, has upgraded India to “overweight” and expects NIFTY to reach 12,500 in the next 12 months.

The Reserve Bank of India (RBI) has raised concerns over the conflict of interest in the functioning of credit rating agencies in their dual practice of both rating the bond, as well as deciding its valuation, which is used by AMCs to calculate the NAV (Net Asset Value) of schemes.

One week of tax planning is left and we are seeing some last minute ELSS flows. One Tax Saving ELSS fund featured in the top 5 most bought fund on Kuvera this week. Visit our ELSS Help Center to learn everything you need to know to save taxes while investing in Mutual Funds.

Index Returns:

| Index | Weekly open | Weekly close | Change |

| BSE Sensex | 38,024.32 | 38,164.61 | 0.37% |

| Nifty | 11,426.85 | 11,456.90 | 0.26% |

| S&P BSE SmallCap | 14,837.18 | 14,758.80 | -0.53% |

| S&P BSE MidCap | 15,171.52 | 15,076.89 | -0.62% |

Source- BSE/NSE

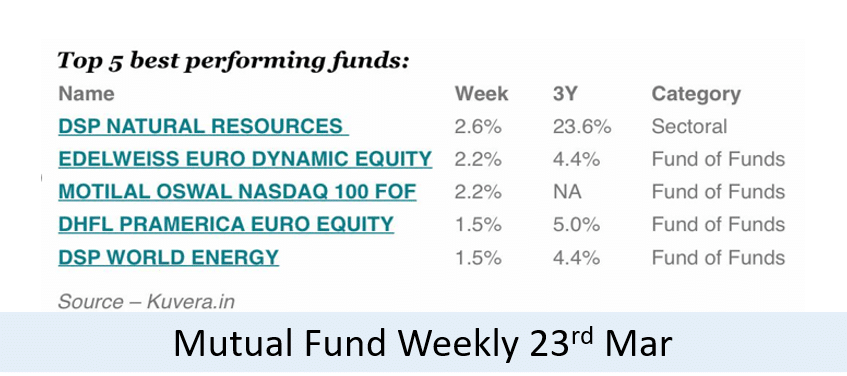

Top 5 best performing funds:

| Name | Week | 3Y | Category |

| DSP NATURAL RESOURCES | 2.6% | 23.6% | Sectoral |

| EDELWEISS EURO DYNAMIC EQUITY | 2.2% | 4.4% | Fund of Funds |

| MOTILAL OSWAL NASDAQ 100 FOF | 2.2% | NA | Fund of Funds |

| DHFL PRAMERICA EURO EQUITY | 1.5% | 5.0% | Fund of Funds |

| DSP WORLD ENERGY | 1.5% | 4.4% | Fund of Funds |

Source – Kuvera.in

Top 5 worst performing funds:

| Name | Week | 3Y | Category |

| KOTAK WORLD GOLD | -4.0% | -2.4% | Fund of Funds |

| UTI TRANSPORTATION & LOGISTICS | -3.1% | 7.1% | Sectoral |

| IDBI MIDCAP | -2.2% | NA | Mid Cap |

| INVESCO INDIA FEEDER PAN EURO | -1.8% | 6.5% | Fund of Funds |

| DSP WORLD GOLD | -1.7% | -0.2% | Fund of Funds |

Source – Kuvera.in

Top 5 best performing ELSS funds:

| Name | Week | 3Y | Category |

| TATA INDIA TAX SAVING | 0.7% | 17.8% | ELSS |

| ICICI PRU LONG TERM EQUITY | 0.5% | 15.2% | ELSS |

| TAURUS TAXSHIELD | 0.4% | 18.5% | ELSS |

| JM TAX GAIN | 0.4% | 18.2% | ELSS |

| DHFL PRAMERICA LONG TERM EQUITY | 0.4% | 15.6% | ELSS |

Source – Kuvera.in

Top 5 worst performing ELSS funds:

| Name | Week | 3Y | Category |

| AXIS LONG TERM EQUITY | -1.2% | 15.9% | ELSS |

| IDBI EQUITY ADVANTAGE | -1.1% | 12.8% | ELSS |

| MOTILAL OSWAL LONG TERM EQUITY | -0.7% | 19.6% | ELSS |

| RELIANCE TAX SAVER | -0.5% | 11.2% | ELSS |

| HSBC TAX SAVER EQUITY | -0.4% | 15.0% | ELSS |

Source – Kuvera.in

What investors bought:

We saw the most inflows in these 5 Funds –

| Name | 1Y | 3Y | Category |

| HDFC SMALL CAP | 0.5% | 22.9% | Small Cap |

| HDFC MID CAP OPP | -0.4% | 17.0% | Mid Cap |

| MIRAE ASSET TAX SAVER | 12.5% | 23.7% | ELSS |

| PARAG PARIKH LONG TERM EQUITY | 9.2% | 15.5% | Multi Cap |

| AXIS FOCUSED 25 | 9.5% | 19.2% | Focused Fund |

Source – Kuvera.in

What investors sold:

We saw the most outflows in these 5 Funds (excluding liquid and short-term schemes) –

| Name | 1Y | 3Y | Category |

| MIRAE ASSET INDIA EQUITY | 13.6% | 19.4% | Multi Cap |

| AXIS MULTICAP | 15.3% | NA | Multi Cap |

| MOTILAL OSWAL MULTICAP 35 | 1.4% | 17.8% | Multi Cap |

| HDFC HYBRID EQUITY | 3.0% | 14.2% | Hybrid |

| SBI BLUE CHIP | 5.8% | 13.6% | Large Cap |

Source – Kuvera.in

Quote of the week:

One of the frustrating things for people who miss the first rally in a bull market is that they wait for the big correction, and it never comes. The market just keeps climbing and climbing.

:Martin Zweig

This market update was initially published by CNBCTV18 in the Personal Finance section.

Niveditha Vishwamithra is an Analyst at Kuvera.in: India’s first completely free Direct Mutual Fund investing platform.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!