Passive Fund NFO in 2024: The rise of passive investment India or passive funds India in 2024 has been truly remarkable. Passive funds India aim to replicate the performance of specific market indices and have gained significant traction among Indian investors. This shift reflects a growing preference for cost-effective and efficient investment strategies, appealing to both retail and institutional participants.

As more investors recognize the benefits of lower fees and diversification, passive investing is reshaping the investment landscape across the country. The below key points highlight this trend:

1. Growth in Assets Under Management (AUM)

The AUM of passive funds India has grown by 61% to reach ₹11.21 lakhs crore by September 2024 with a total of 468 funds. This substantial increase reflects the growing acceptance among investors looking for cost-effective and efficient investment solutions. With increasing awareness and understanding, more individuals are diversifying their portfolios with these options.

2. Performance and stability:

Passive Funds India have shown resilience and steady performance, closely tracking the broader market indices. For instance, the Nifty 50 TRI returned 13.5% and the Nifty Midcap 150 TRI returned 20.6% from September 2014 to August 2024. This consistent performance has made passive funds a preferred choice for many investors, particularly during market downturns. As investors seek reliable options that can weather volatility, passive funds have emerged as a go-to solution for those looking to safeguard their portfolios while still participating in market growth.

3. Increased Financial Literacy and investor awareness:

The rise of financial literacy initiatives in India has empowered investors to understand the benefits of passive investment India strategy. With more information available online, potential investors can easily grasp concepts related to index funds and exchange-traded funds (ETFs). Regulatory support, exemplified by the introduction of the MF Lite framework has streamlined access to passive funds for investors.

This initiative simplifies the investment process, making it more user-friendly and accessible. By reducing barriers to entry, the framework fosters greater participation in the passive investing space. Also, NSE launched India’s first dedicated website for passive funds which aims to empower retail investors by providing comprehensive information and insights, making it easier to navigate and understand the Indian passive funds industry.

4. Technological Innovations

Digital platforms and robo-advisors have revolutionized how investors access financial products. In 2024, the rise of mobile apps and online investment platforms has made it easier than ever for individuals to invest in index funds and ETFs. User-friendly interfaces and automated investment options are particularly appealing to younger investors.

5. Cost-Effectiveness

With the emphasis on minimizing costs, passive investing India continues to attract attention. Investors are increasingly scrutinizing fund expenses, and the lower expense ratios associated with passive funds make them an attractive choice for those looking to maximize returns without incurring high fees.

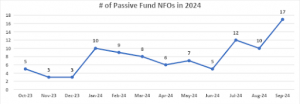

6. New Fund Offerings (NFO)

The year 2024 saw a surge in the launch of new passive funds India.

In September 2024 alone, 17 passive mutual fund NFO’s were launched, mobilizing more than ₹4,000 crore. A total of 95 passive fund NFO’s have been launched over the 12-month period from October 2023 to October 2024, showcasing a generally increasing trend in the introduction of new passive investment options. Passive funds India cover various themes including healthcare, tourism and private banks.

| Month | # of Passive Fund NFOs |

|---|---|

| Oct-23 | 5 |

| Nov-23 | 3 |

| Dec-23 | 3 |

| Jan-24 | 10 |

| Feb-24 | 9 |

| Mar-24 | 8 |

| Apr-24 | 6 |

| May-24 | 7 |

| Jun-24 | 5 |

| Jul-24 | 12 |

| Aug-24 | 10 |

| Sep-24 | 17 |

| Total | 95 |

Upcoming Passive Funds India NFO

| Mutual Fund | Scheme Name | Scheme Category | Launch Date | Closure Date | |

|---|---|---|---|---|---|

| Groww Mutual Fund | Groww Gold ETF FOF | FoF Domestic | 16-Oct-24 | 30-Oct-24 | To provide returns that are in line with returns provided by Groww Gold ETF. |

| Motilal Oswal Mutual Fund | Motilal Oswal Nifty MidSmall Financial Services Index Fund | Index Funds | 29-Oct-24 | 06-Nov-24 | To provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall Financial Services Total Return Index, subject to tracking error. |

| Motilal Oswal Mutual Fund | Motilal Oswal Nifty MidSmall Healthcare Index Fund | Index Funds | 29-Oct-24 | 06-Nov-24 | To provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall Healthcare Total Return Index, subject to tracking error. |

| Motilal Oswal Mutual Fund | Motilal Oswal Nifty MidSmall India Consumption Index Fund | Index Funds | 29-Oct-24 | 06-Nov-24 | To provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall India Consumption Total Return Index, subject to tracking error. |

| Motilal Oswal Mutual Fund | Motilal Oswal Nifty MidSmall IT and Telecom Index Fund | Index Funds | 29-Oct-24 | 06-Nov-24 | To provide returns that, before expenses, correspond to the total returns of the securities as represented by Nifty MidSmall IT and Telecom Total Return Index, subject to tracking error. |

| Zerodha Mutual Fund | Zerodha Gold ETF FoF | FoF Domestic | 25-Oct-24 | 08-Nov-24 | To seek capital appreciation by investing in units of Gold ETF. |

Wrapping Up

As of October 2024, the data shows that Exchange-Traded Funds (ETFs) are tracking 85 indices, while Index Funds are tracking 139 indices. This disparity provides insights into the current state of passive investing in India, highlighting the distinct roles and characteristics of ETFs and Index Funds. This illustrates a robust landscape for passive funds India, with Index Funds leading in the number of indices tracked.

This trend suggests a growing interest among investors for a diverse array of passive investment options. The complementary nature of ETFs and Index Funds allows investors to tailor their portfolios according to their investment goals, whether seeking broad market exposure or specific sector plays. As the market continues to evolve, both ETFs and Index Funds are likely to play integral roles in shaping the future of passive investment India strategy.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch here: Is UPI Killing the Toffee Business?