Tax Harvesting – Reduce your LTCG taxes for higher returns

In 2018, a 10% long-term capital gains (LTCG) tax was introduced when none existed before. The budget for 2024 further increased the LTCG tax rate to 12.5% for all classes of assets. This LTCG tax, however comes with a tax break.

The first Rs. 1.25 Lakhs of LTCG is exempt from the 12.5% LTCG tax.

Tax Harvesting is a technique that utilises the Rs. 1.25 Lakh annual LTCG exemption by selling and buying back your investment such that you “realise” gains and not pay taxes on the exempt Rs 1.25 Lakh of LTCG.

At a 12.5% LTCG tax rate, you could save up to Rs 15,625 in LTCG taxes every year by doing this diligently.

Ben Franklin famously said, “Nothing is certain except for death and taxes.” and Margaret Mitchell exclaimed, “Death, taxes and childbirth! There’s never any convenient time for any of them.”

Yes, no one likes paying taxes!

We, however, encourage every citizen to pay their rightful taxes for nation-building. That said it is also our responsibility to our financial future and to our children, to take advantage of tax breaks written in the tax code.

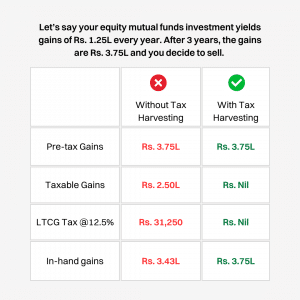

Let’s see a simple example of how LTCG Tax Harvesting works.

By harvesting Rs 1.25 Lakhs of LTCG every year, you reduced your LTCG Tax burden from Rs 31.2k to NIL.

This is the power of LTCG Tax Harvesting and we are bringing it to you.

How Tax Harvesting works?

It’s simple. We take over once you unlock the Tax Harvesting feature on Kuvera.

We monitor your portfolio and recommend a transaction when applicable. We use sophisticated modelling to decide when is the right time to harvest taxes. Then we recommend the transactions you need to execute to harvest LTCG.

As mentioned above, there are two opposing forces –

1. If I wait and the markets go up, I can harvest more taxes (something like 2017).

2. If I wait and the markets go down, I would have lost the opportunity to harvest the gains I had (something like 2018). And since tax harvesting is tied to the calendar year, once that opportunity goes, it won’t come back.

We run an optimization that solves for the above to ensure that you can harvest the optimal level of taxes as soon as possible.

The power of LTCG tax saving is now on your fingertips. Try it now.

Frequently Asked Questions

(Q) Why can’t I wait till Feb – Mar and harvest then?

(A) We would advise harvesting taxes as early in the Financial Year as possible.

There are two opposing forces –

1. If I wait and the markets go up, I can harvest more taxes (something like 2017).

2. If I wait and the markets go down, I would have lost the opportunity to harvest the gains I had (something like 2018). And since tax harvesting is tied to the calendar year, once that opportunity goes, it won’t come back.

We run an optimization that solves for the above to ensure that you can harvest the optimal level of taxes as soon as possible. Waiting after the optimal condition is met only increases the likelihood that the LTCG may not be there in the future to harvest.

(Q) I have subscribed to Tax Harvesting and I have a family account. Will my subscription cover all accounts?

(A) Tax Harvesting is enabled based on the taxpayer PAN. Say for example a husband and wife have 4 accounts –

- Wife’s Single

- Husband Single

- Wife + Husband Joint

- Husband + Wife Joint

If the Wife then enables Tax Harvesting in her account it will also enable it for Wife + Huband Joint account as for tax filing purposes LTCG in both the Wife and Wife + Husband account will be attributed to Wife’s tax returns. So, you will have to enable Tax Harvesting individually for every taxpayer in your family. In our example, it would mean to enable Tax Harvesting for Wife and Husband separately.

(Q) I have a few funds with considerable profits, but Tax Harvesting never recommends harvesting tax in them?

(A) Even if you have funds with considerable Long Term Capital Gains, there could be reasons why we don’t show them for Tax Harvesting. Chief among those reasons are –

- The fund is still under lockin. This is particularly true for ELSS and other speciality schemes.

- The fund house does not allow lumpsum purchase in the fund. For efficient tax harvesting, you have to be able to buy back the scheme at the same NAV.

(Q) If I sell now to harvest LTCG, will I lose out on future profits from that investment?

(A) Not at all. As part of Tax Harvesting, we will advise you to sell the units and buy it back with no NAV impact. So you will still get the benefits of all future profits if that investment continues to go up.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Jan Jose

June 17, 2019 AT 08:29

Hi.. Can you please explain how tax harvesting is done with the above example you provided. With tax harvesting, the tax on capital gain to the extend of Rs.3 lakhs is saved. But how..???

Its not clear from here.

Lamminlal

November 18, 2022 AT 06:45

How do I Deactivate my Tax Harvesting

Rupesh

July 5, 2019 AT 17:38

So you will still get the benefits of all future profits “if that investment continues to go up.”

There is an “if” condition there. If the future performance of that fund is in loss, you lose in a big way.

Gaurav Rastogi

July 6, 2019 AT 06:03

Not correct Rupesh, unless we are not understanding your question correctly.

If the future performance is a loss, you get to show higher LT or ST Capital Loss to offset any other STCG / LTCG you may have. The tax harvested is always and in every scenario a net positive. And since we will only advice you to harvest up to Rs 1 lakh, you won’t need to pay any taxes on it in the current financial year.

L S Gill

May 23, 2020 AT 17:13

Does this apply to debt funds as well?

How much tax is deducted if I break a debt fund when I need money.

Gaurav Rastogi

May 26, 2020 AT 02:30

Yes, taxes apply to debt funds too. Tax is not deducted, you have to file and pay taxes while filing IT returns.

Jignesh

October 1, 2019 AT 07:23

I would be glad if you can show some back testing scenarios which will help to understand the concept better.

Gaurav Rastogi

October 2, 2019 AT 02:41

Sure we will publish some shortly.

Swapnil Kortikar

October 9, 2019 AT 07:22

How does this concept work? I opted for this option, so are you suggesting to sell specific mutual funds based on the portfolio analysis or I have to ask to save tax?

Gaurav Rastogi

October 12, 2019 AT 13:03

We will ask you to sell and buy specific funds as and when required. You do not have to ask to save tax.

Chandradada J.w.p.

November 3, 2019 AT 05:49

I am OK now.

Avanish Singh

October 15, 2019 AT 05:35

You are suggesting to sell and buy on the same day. But after selling, it takes some days for the money to reach back into our bank accounts. So, for buying we need to have additional money (equal to the amount we are selling) in our accounts. Isn’t it? Is there a way to avoid this?

Gaurav Rastogi

October 15, 2019 AT 08:07

Thanks, right Avinash, you will need some cash in your account. The other way to avoid this is to do smaller transactions with a gap in buy and sell and hopefully the small gains/losses will net out.

Nav K

November 17, 2019 AT 07:44

What if i redeem from 1 fund and invest in another fund while tax harvesting? This approach may be combined with asset reallocation if the fund am redeeming from hasn’t been performing well. Correct? And do you also suggest/advise on that?

Gaurav Rastogi

November 18, 2019 AT 02:18

Yes, you can use this as an opportunity to rebalance as well. Nit just funds, but asset allocation too.

Nav K

November 23, 2019 AT 08:21

So what will be the basis of your recommendation to sell/buy while tax harvesting? Is it just the tax amount (within the limit) and/or something else like a particular fund in portfolio is not performing well? I’d really like to know the details of your services under tax harvesting feature.

Gaurav Rastogi

November 25, 2019 AT 01:48

Under Tax Harvesting, we will recommend based purely on tax amount within the limit.

Rahul

December 29, 2019 AT 04:14

Is there any way in which you can suggest the tax harvesting considering LTCG derived from equity shares sales as well? Or if I am correct this will be restricted to the mutual fund portfolio that one has on Kuvera only

Gaurav Rastogi

December 30, 2019 AT 01:55

We will add support for stocks soon.

Ravi

January 12, 2020 AT 03:58

What about giving support for mutual funds – regular plan from other platforms but have an aggregao view in kuvera?

Amaresh Kumaar

January 15, 2020 AT 05:00

Tax Harvesting is good but please clarify me on following. I have a XIRR returns to my portfolio and once I do yax harvesting, I wouldn’t be getting the actual returns. How will I get to know the actual overall portfolio return?

Gaurav Rastogi

January 20, 2020 AT 01:09

On our dashboard we show “Current returns” and “All time returns”. Realized profits are shown in “All time returns” as an XIRR.

Arun kumar

January 22, 2020 AT 01:47

Sir i am a salary person and my incom tax is Rs120000 and my 80c saving is 150000 can i save my tax by selling and buying my sip i.e by tax harvesting suggest by you.

Jagdish Patel

February 8, 2020 AT 11:39

When i sell, the amount will come after few days, how can buy the same fund on same day with same nav if i am not having extra cash?

Gaurav Rastogi

February 10, 2020 AT 02:03

You will need some surplus cash to implement this strategy so there is no NAV mismatch.

Aswin Francis

October 10, 2020 AT 19:54

Can I wait for the amount to be added to my account and then reinvest it in a different fund or buy stocks?

Also, I have tax harvesting addon enabled. I was recently recommended to redeem about 63k from my Elss fund. If I put buy the same again,then I wouldn’t need to continue my SIPin Elss since 80c will be maxed out.so is it wise to invest the bulk amount in the same fund and cancel my sip in this ELSS and put start in some other fund?

Gaurav Rastogi

November 17, 2020 AT 03:44

Under tax harvesting, you can buy any other fund as well. You can redeem into a bank account and buy another fund altogether.

Manjunath

October 2, 2020 AT 08:41

Hi,

If I sell & buy every year, wouldn’t it be counted into my short term gains? Is it applicable to NRIs as well?

Gaurav Rastogi

October 5, 2020 AT 03:42

So we only advice to harvest your units already held for over 1 year so they qualify for long term capital gains taxes.

Hardik Thaker

April 16, 2021 AT 10:27

Will it affect compounding interest of my MFs?

Gaurav Rastogi

May 17, 2021 AT 01:22

No

Navin Kumar Aggarwal

November 27, 2022 AT 08:34

If I sell after one year , and if sell after 5 yrs why compounding won’t be affected.

Plus I buy the new units today as part of tax harvesting its tenure is definitely less ,so compounding is affected . Please clear

George

May 8, 2021 AT 02:56

Hi I am an NRI working in Singapore. I sold few of my SBI small cap mutual fund units last month. And that’s my only income in India. At the time of selling, 10% LTCG deducted from the gains. So, will I be able to claim it by filing tax return? If yes, which ITR I need to file? And under which section I can claim?

Vikas Tiwari

June 9, 2021 AT 09:51

I want to enrol in this tax harvesting. How I can activate that .

Sahil kumar

January 30, 2022 AT 08:19

Is there any video available to understand the tax harvesting feature ,if available please provide the link,thank you

Jack

March 5, 2022 AT 03:23

Why don’t u show tax-loss harvesting for STCG? I have observed you are suggesting it only for LTCG. Why not STCG recommendation? ?? I have enabled your feature but it is of no use to me if you are not going to show opportunities for STCG

Gaurav Rastogi

March 7, 2022 AT 05:00

The Rs 1L exception apply only to LTCG and not to STCG, thus we show it only for LTCG.

Pradeep

March 10, 2022 AT 20:10

There is a flip side too of LTCG tax harvesting. You may end up paying STCG if you sell the units within one year after repurchase due to tax harvesting. Mind you, STCG is taxed in the tax slab as per your income, and most likey you may end up paying 30% STCG tax.

Gaurav Rastogi

March 12, 2022 AT 05:33

not true, a transaction has either ETCG or LTCG. If you are harvesting LTCG, there will be no STCG attached.

Nikhil

November 2, 2022 AT 09:53

i sell 1L invested from 4 years with plan to exit in 5 years from date of initial investment. Now this 1L (reinvested) is an investment from 1 year (STCG) and not 4 years.

Mahesh

August 3, 2022 AT 18:40

When we do tax harvesting, the amount credited to bank after selling units will be considered as income ? while filing income tax as capital gain ?

If Yes then how can we manage such transactions

Abhishek Jangid

September 16, 2022 AT 01:53

Hi Gaurav,

This is definitely an amazing feature but I have a doubt here. Now when I purchased the MF units, I would have possibly bought my units at a lower NAV value and now after selling these units, if I purchase new MF units for the same amount, I would now be getting lesser units if the NAV would have gone further up from the time I initially purchased them. So don’t you think this can impact the overall returns had we just stuck to the old units without selling them? Request you to please advise.

Lamminlal

November 18, 2022 AT 06:20

How do I Deactivate Tax Harvesting in Kuvera App.

SHRIKANT

April 29, 2023 AT 17:34

EXCELLENT EXPLANATION

Kushal Jayswal

July 19, 2023 AT 10:42

How the invested amount and gained returns will be displayed for that particular MF which has been harvested? I think the gain/return amount will be lessened than the actual gain will be visible then right? By the following harvesting, we would buy back the same MF units at the current available price.