Top news

RBI’s Monetary Policy Committee kept the repo rate & reverse repo rate unchanged at 4% and 3.35% respectively. RBI maintained an accommodative stance. Real GDP growth is projected at -7.5% for Financial Year 2020-21.

November saw a gain of 11.27% for the S&P 500 benchmark. This is the best November gain for the S&P 500 ever. The Dow Jones rose 10.75% during the same time, biggest monthly gain since January 1987.

Burger King IPO received an overwhelming response. The IPO was oversubscribed by 157 times. The issue was open for subscription with a price band at Rs 59-60 per share.

NFOs of 5 funds have gone live this week. These funds are - UTI Small Cap Fund, Axis Special Situations Fund, Aditya Birla Sun Life ESG Fund, Invesco Global Consumer Trends Fund of Fund, ITI Large Cap Fund.

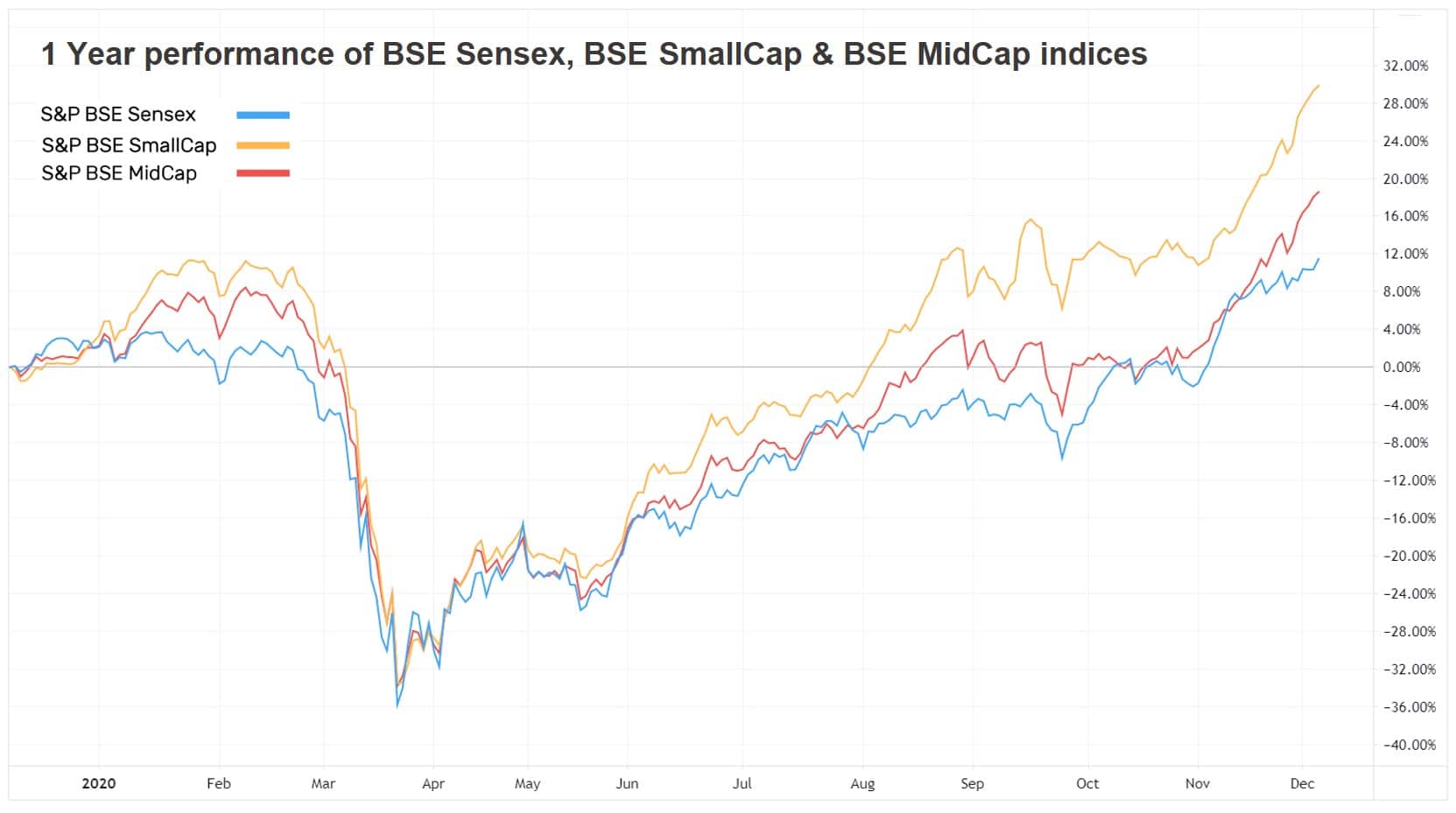

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 2.2% | 10.0% | 9.4% | 36.5 | 3.8 |

| NIFTY NEXT 50 | 3.6% | 10.8% | 2.1% | 39.4 | 4.3 |

| S&P BSE SENSEX | 2.1% | 10.3% | 11.1% | 32.2 | 3.0 |

| S&P BSE SmallCap | 2.6% | 28.6% | -1.2% | NA | 2.4 |

| S&P BSE MidCap | 2.8% | 16.6% | 1.3% | 62.4 | 2.6 |

| NASDAQ 100 | 2.2% | 50.7% | 26.0% | 39.1 | 8.5 |

| S&P 500 | 1.7% | 18.7% | 11.9% | 29.0 | 4.0 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HDFC Infrastructure | 7.3% | -13.5% | -14.4% |

| IPRU Infrastructure | 7.0% | 1.6% | -2.0% |

| IPRUThematic Advantage | 6.6% | 21.5% | 8.1% |

| HSBC Brazil | 6.5% | -15.6% | 1.7% |

| 6.2% | 40.9% | 16.5% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 4.7% | 38.0% | 13.5% |

| IDFC Tax Advantage | 3.8% | 16.2% | 5.0% |

| PGIM India Long Term Equity | 3.4% | 13.5% | 7.6% |

| IPRU Long Term Equity | 3.2% | 10.3% | 8.1% |

| 3.1% | 8.7% | 5.4% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Power | 55.8% | -0.3% | 12.4% |

| Edelweiss Financial Services | 22.8% | -26.5% | 7.4% |

| Adani Transmission | 19.9% | 38.8% | 61.3% |

| SAIL | 17.9% | 44.4% | 1.9% |

| 17.3% | -1.9% | 16.0% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Energy | -1.0% | 4.9% | 2.5% |

| Invesco India Gold | -0.3% | 25.9% | 17.9% |

| PGIM India Emerging Market... | -0.3% | 16.1% | 7.4% |

| Nippon India Japan Equity | -0.3% | NA | NA |

| -0.3% | 4.6% | 5.1% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Future Retail | -11.6% | -77.5% | NA |

| Honeywell Automation | -5.0% | 13.4% | 29.3% |

| Shriram Transport Finance | -4.6% | -5.7% | 5.2% |

| Sanofi India | -4.3% | 12.4% | 14.2% |

| -4.2% | 30.3% | 34.7% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 1.4% | 31.5% | 15.4% |

| Axis Bluechip | 1.7% | 15.2% | 15.6% |

| Edelweiss Balanced Advantage | 1.8% | 20.9% | 11.6% |

| Axis Mid Cap | 1.1% | 23.7% | 14.7% |

| 0.9% | 12.9% | NA |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| HDFC Small Cap | 3.2% | 15.8% | 1.7% |

| L&T Emerging Businesses | 1.9% | 12.9% | -1.1% |

| 2.0% | 10.0% | 4.0% | |

| Invesco India Gold | -0.3% | 25.9% | 17.9% |

| 2.4% | 13.1% | 8.2% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Op... | 2.8% | 69.4% | 31.0% |

| Tata Digital India | 2.3% | 44.3% | 27.6% |

| Parag Parikh LTE | 1.4% | 31.5% | 15.4% |

| IPRU Technology | 2.6% | 59.4% | 27.2% |

| 1.7% | 15.2% | 15.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -0.3% | 24.5% | 32.7% |

| Adani Green Energy | 2.3% | 805.5% | NA |

| TCS | 0.3% | 32.9% | 19.9% |

| Infosys | 1.9% | 62.5% | 18.4% |

| -2.9% | 10.3% | 21.7% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | 2.6% | 86.8% | 32.7% |

| Tesla | 0.7% | 799.5% | 67.1% |

| Amazon | -0.4% | 79.7% | 36.3% |

| Microsoft | -0.3% | 43.1% | 30.8% |

| 2.2% | 40.8% | 21.4% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Vistasp edibam

December 7, 2020 AT 12:15

Will you be starting stock market investment?

Gaurav Rastogi

January 2, 2021 AT 04:02

We already allow the facility to link to 4 brokers. We will expand it to more brokers soon.

J.W.P. CHANDRADASA

September 17, 2021 AT 04:25

I am really ready pursue this online shop.

Abdul Rahman

September 18, 2021 AT 04:47

I will grow more time with you