Top news

As US election count proceeded during the week, popular US Indices - NASDAQ 100 and S&P 500 witnessed their best week since April 2020, gaining 9.4% and 7.3% respectively.

SEBI has decided to restore the mutual fund cut-off timings to pre-covid timings. The change will come in effect from Monday, November 9. Last month, SEBI had reinstated the normal cut-off timing for equity funds. Now, the same is being done for debt and conservative hybrid funds as well.

SEBI has enhanced foreign investment limit for Mutual Funds. The new limit is set as USD 600 million per fund house compared to the earlier limit of USD 300 million. In addition, a separate limit of USD 200 million is set for investments in overseas ETFs.

SEBI has introduced a new scheme category named ‘Flexi Cap Funds’. Equity schemes under this category will be able to invest across small, mid and large cap companies

Mirae Asset Emerging Bluechip Fund has revised the limit for fresh SIP registration to Rs 2,500. Existing active SIPs which were set-up before 6 November under the limit of Rs 25,000 should continue as is.

Index Returns

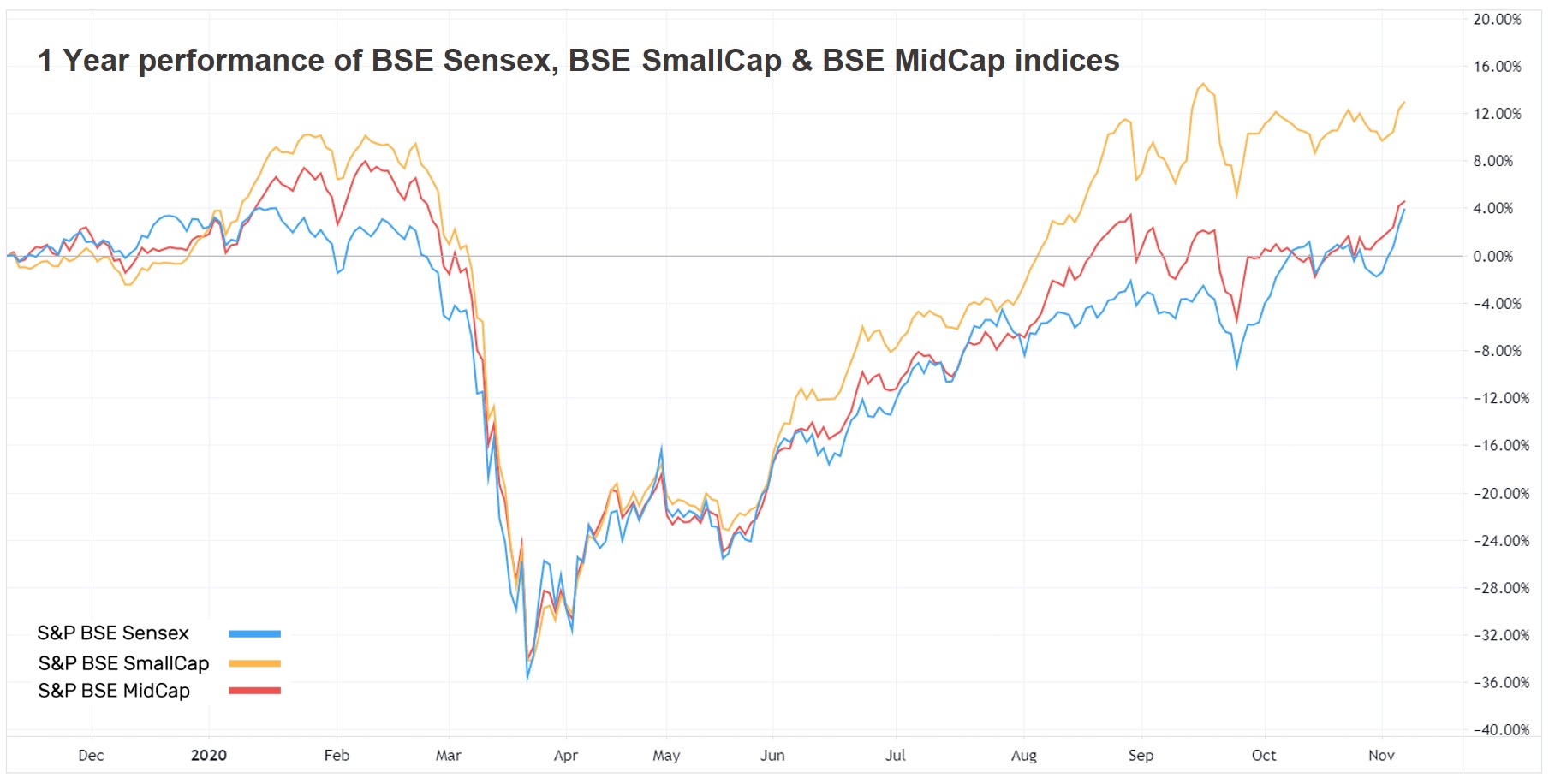

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 5.3% | 2.5% | 5.5% | 33.1 | 3.5 |

| NIFTY NEXT 50 | 3.6% | -0.7% | -2.1% | 37.2 | 3.8 |

| S&P BSE SENSEX | 5.8% | 3.5% | 7.5% | 29.3 | 2.8 |

| S&P BSE SmallCap | 2.2% | 12.9% | -5.3% | NA | 2.1 |

| S&P BSE MidCap | 3.4% | 4.4% | -2.8% | 58.0 | 2.4 |

| NASDAQ 100 | 9.4% | 47.3% | 24.1% | 37.8 | 8.3 |

| S&P 500 | 7.3% | 14.0% | 10.6% | 27.2 | 3.9 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Brazil | 10.9% | -30.6% | -4.0% |

| UTI Banking & Financial Serv... | 10.8% | -15.2% | -4.7% |

| 10.2% | -6.4% | 3.2% | |

| 10.1% | -7.2% | 5.2% | |

| 10.1% | -9.7% | 2.6% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata India Tax Saving | 5.7% | 2.8% | 4.5% |

| Franklin India Taxshield | 5.6% | -3.8% | 0.6% |

| Nippon India Tax Saver | 5.6% | -11.1% | -9.4% |

| Principal Tax Saving | 5.6% | 6.6% | 0.3% |

| 5.3% | 4.9% | 0.2% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Indusind Bank | 25.5% | -44.0% | -3.8% |

| Cholamandalam Investment | 21.4% | -4.4% | 20.3% |

| Shriram Transport Finance | 21.1% | -23.8% | -0.4% |

| Adani Gas | 17.4% | 62.8% | NA |

| 16.2% | -31.4% | -0.9% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| BOI AXA Arbitrage | -0.1% | 4.1% | NA |

| PGIM India Arbitrage | 0.0% | 4.6% | 5.8% |

| JM Arbitrage | 0.0% | 3.2% | 5.0% |

| Indiabulls Arbitrage | 0.0% | 4.0% | 5.7% |

| 0.0% | 5.4% | 6.5% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| UPL | -6.2% | -30.2% | 8.6% |

| -5.4% | -13.2% | -1.0% | |

| Jubilant Life Sciences | -5.2% | 29.9% | 12.6% |

| Oberoi Realty | -4.6% | -14.1% | 9.1% |

| -4.1% | -0.6% | 24.4% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 4.5% | 23.6% | 13.6% |

| Axis Bluechip | 5.0% | 7.3% | 12.3% |

| Mirae Asset Emerging Bluechip | 5.0% | 12.7% | 8.50% |

| UTI Nifty Index | 5.4% | 3.1% | 6.5% |

| 5.3% | NA | NA |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal Nasdaq 100 FoF | 5.5% | 52.5% | NA |

| ABSL Frontline Equity | 5.6% | 2.1% | 2.7% |

| Franklin India Prima | 4.3% | 4.3% | 1.8% |

| IPRU Pharma Healthcare & ... | 2.1% | 60.6% | NA |

| 3.5% | -5.0% | 0.9% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | 2.0% | 38.6% | 28.2% |

| PGIM India Global Equity Opp... | 3.5% | 69.0% | 29.8% |

| Parag Parikh LTE | 4.5% | 23.6% | 13.6% |

| IPRU Technology | 2.5% | 47.7% | 27.9% |

| 5.0% | 12.7% | 8.5% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 0.1% | 41.5% | 33.7% |

| TCS | 2.8% | 23.0% | 18.2% |

| Infosys | 3.5% | 60.0% | 16.3% |

| HDFC Bank | 10.2% | 5.5% | 19.2% |

| 5.4% | 848.6% | NA |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | 7.8% | 84.6% | 31.4% |

| Amazon | 8.9% | 84.4% | 38.1% |

| Microsoft | 9.3% | 55.2% | 32.4% |

| Tesla | 6.2% | 558.2% | 56.1% |

| 8.9% | 53.2% | 22.3% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Hiteshkumar

November 17, 2020 AT 15:31

Hi,I am looking for investment which pay me monthly payment .I am retired and do not have much money (10lacs-currently invested in ICICI prudential equity and debt fund-monthly dividend -which stopped monthly dividend ) to invest.Where I can invest so that I can get monthly payments.I do not have any pension,so I need to arrange for monthly payment type investment.

If possible, reply me in my email.