Top news

As directed by the Supreme Court, distribution of Rs 9,122 crores will be undertaken by SBI Funds Management Pvt. Ltd. among unitholders of Franklin Templeton‘s six wound up schemes. Franklin has explained the process of disbursement here.

Net outflows from open ended equity mutual fund schemes stood at Rs 9,253 crore in January 2021 compared to outflow at Rs 10,147 crore in the previous month. The AUM of MF industry stood at Rs 30.5 lakh crore in January, marginally down from Rs 31.02 lakh crore in December.

IDFC Mutual Fund and Mahindra Manulife Mutual Fund have launched the NFO for IDFC Floating Rate Fund and Mahindra Manulife Short Term Fund. The NFOs close on February 16.

Milind Barve is retiring from the post of managing director of HDFC Asset Management Company.

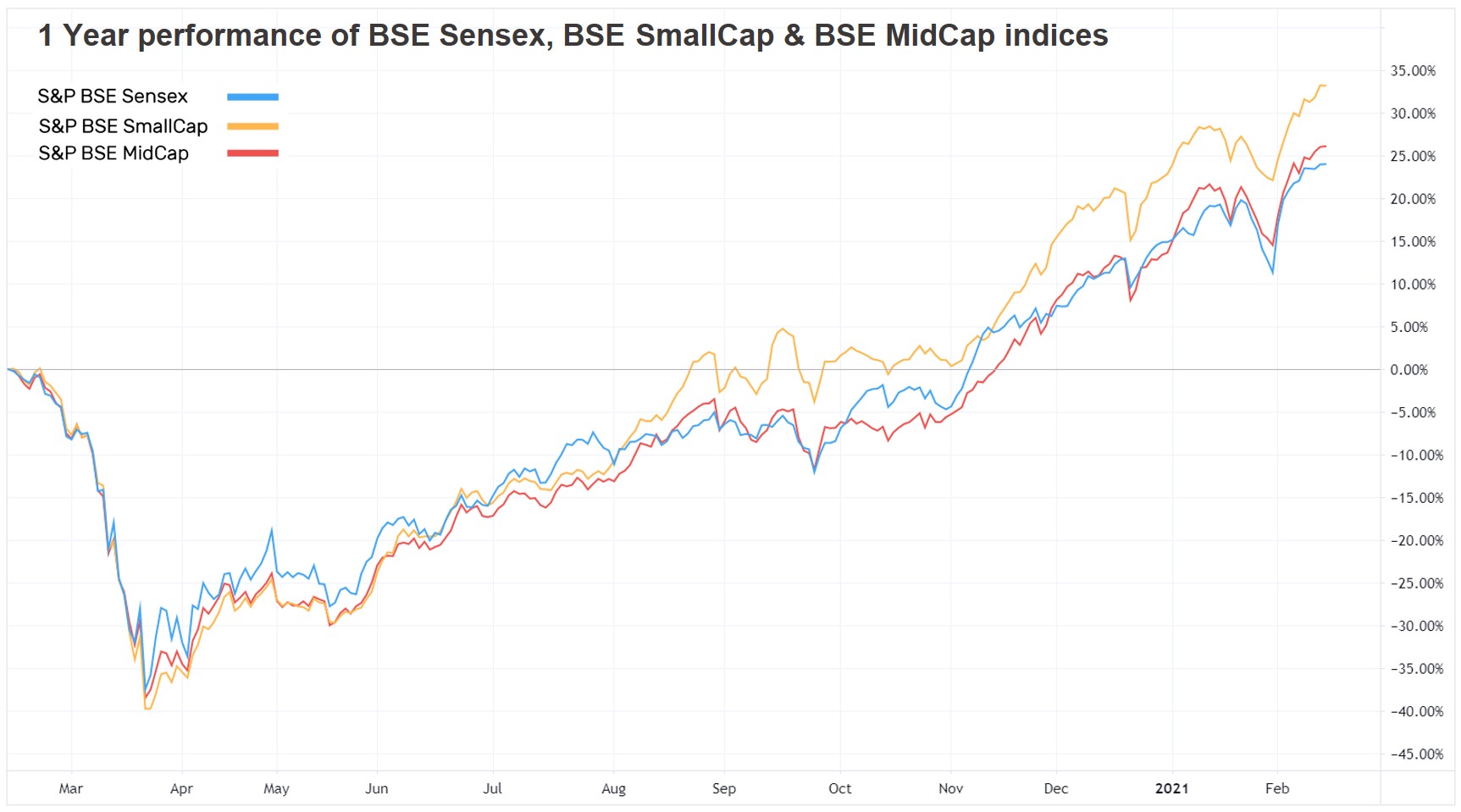

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.6% | 24.1% | 12.9% | 41.6 | 4.3 |

| NIFTY NEXT 50 | 2.5% | 19.9% | 4.7% | 40.0 | 4.6 |

| S&P BSE SENSEX | 1.6% | 23.9% | 14.5% | 35.8 | 3.5 |

| S&P BSE SmallCap | 2.8% | 33.0% | 2.0% | NA | 2.7 |

| S&P BSE MidCap | 2.6% | 26.0% | 5.7% | 59.8 | 2.9 |

| NASDAQ 100 | 1.5% | 43.4% | 28.4% | 40.5 | 8.9 |

| S&P 500 | 1.2% | 16.3% | 14.0% | 32.2 | 4.3 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Small Cap Equity | 5.9% | 33.6% | 1.3% |

| DSP World Mining | 5.7% | 50.4% | 17.8% |

| IDFC Infrastructure | 5.1% | 26.1% | -0.7% |

| PGIM India Global Equity Opp... | 4.9% | 75.6% | 38.0% |

| 4.8% | 42.7% | 13.5% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| 3.3% | 26.5% | 9.4% | |

| BOI AXA Tax Advantage | 3.2% | 32.2% | 12.9% |

| Essel Long Term Advantage | 3.1% | 16.3% | 10.5% |

| Motilal Oswal Long Term Equity | 3.0% | 16.1% | 9.1% |

| 2.9% | 21.2% | 13.8% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Motherson Sumi Systems | 24.9% | 57.8% | 15.2% |

| Adani Enterprises | 21.9% | 193.4% | 64.5% |

| Adani Transmission | 21.1% | 85.5% | 85.2% |

| Piramal Enterprises | 13.7% | 10.8% | 14.7% |

| 12.2% | 79.2% | 49.4% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU FMCG | -2.2% | 8.7% | 8.8% |

| Nippon India Pharma | -1.7% | 57.7% | 22.0% |

| -1.2% | 53.8% | 20.9% | |

| IPRU Bharat 22 Fof | -0.7% | 10.1% | NA |

| -0.7% | 7.9% | 8.3% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Balkrishna Industries | -9.5% | 45.5% | 40.7% |

| Indian Oil Corp | -8.2% | -18.1% | 9.1% |

| Coal India | -6.7% | -25.3% | -5.4% |

| Larsen & Toubro Infotech | -6.2% | 102.1% | NA |

| -6.1% | 46.4% | 9.5% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.2% | 37.2% | 19.2% |

| IPRU Equity Arbitrage | 0.2% | 4.5% | 5.9% |

| DSP Dynamic Asset Allocation | 0.8% | 14.1% | 11.2% |

| Axis Bluechip | 1.5% | 21.2% | 18.9% |

| 4.9% | 75.6% | 38.0% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| L&T Emerging Businesses | 2.9% | 23.9% | 1.7% |

| Motilal Oswal Multicap 35 | 2.1% | 15.2% | 7.0% |

| L&T Hybrid Equity | 1.6% | 19.4% | 8.8% |

| SBI Blue Chip | 1.9% | 28.2% | 13.0% |

| 4.6% | 26.9% | 4.5% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | 4.9% | 75.6% | 38.0% |

| Tata Digital India | 2.1% | 60.8% | 30.0% |

| Axis Bluechip | 1.5% | 21.2% | 18.9% |

| Parag Parikh Flexi Cap | 1.2% | 37.2% | 19.2% |

| 2.0% | 73.1% | 28.9% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 6.1% | 41.9% | 35.8% |

| Adani Green Energy | -1.5% | 402.5% | NA |

| Infosys | 2.3% | 69.2% | 21.0% |

| Tata Consultancy Services | 0.1% | 48.3% | 24.9% |

| 0.3% | 27.6% | 27.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -4.2% | 407.8% | 93.4% |

| Apple | -1.0% | 66.6% | 41.9% |

| GameStop Corp. | -17.8% | 1174.9% | 14.2% |

| Amazon.com | -2.2% | 52.4% | 45.2% |

| 5.6% | 1385.1% | NA |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!