Top news

Net inflows into open ended equity Mutual Funds stood at Rs 22,584 crore in July 2021, compared to inflows of Rs 5,988 crore in the previous month. The net asset under management (AUM) rose to an all-time high of Rs 35.32 lakh crore at July end.

India’s Industrial production has gone up by 13.6% in June 2021 as compared to a drop of 16.6% in June 2020.

IPOs of CarTrade Tech and Aptus Value Housing got oversubscribed by 20 times and 17 times respectively while shares of Rolex Rings got listed at premium of 33% over issue price of Rs 900

SBI Mutual Fund has launched the NFO for SBI Balanced Advantage Fund. The NFO closes on August 25.

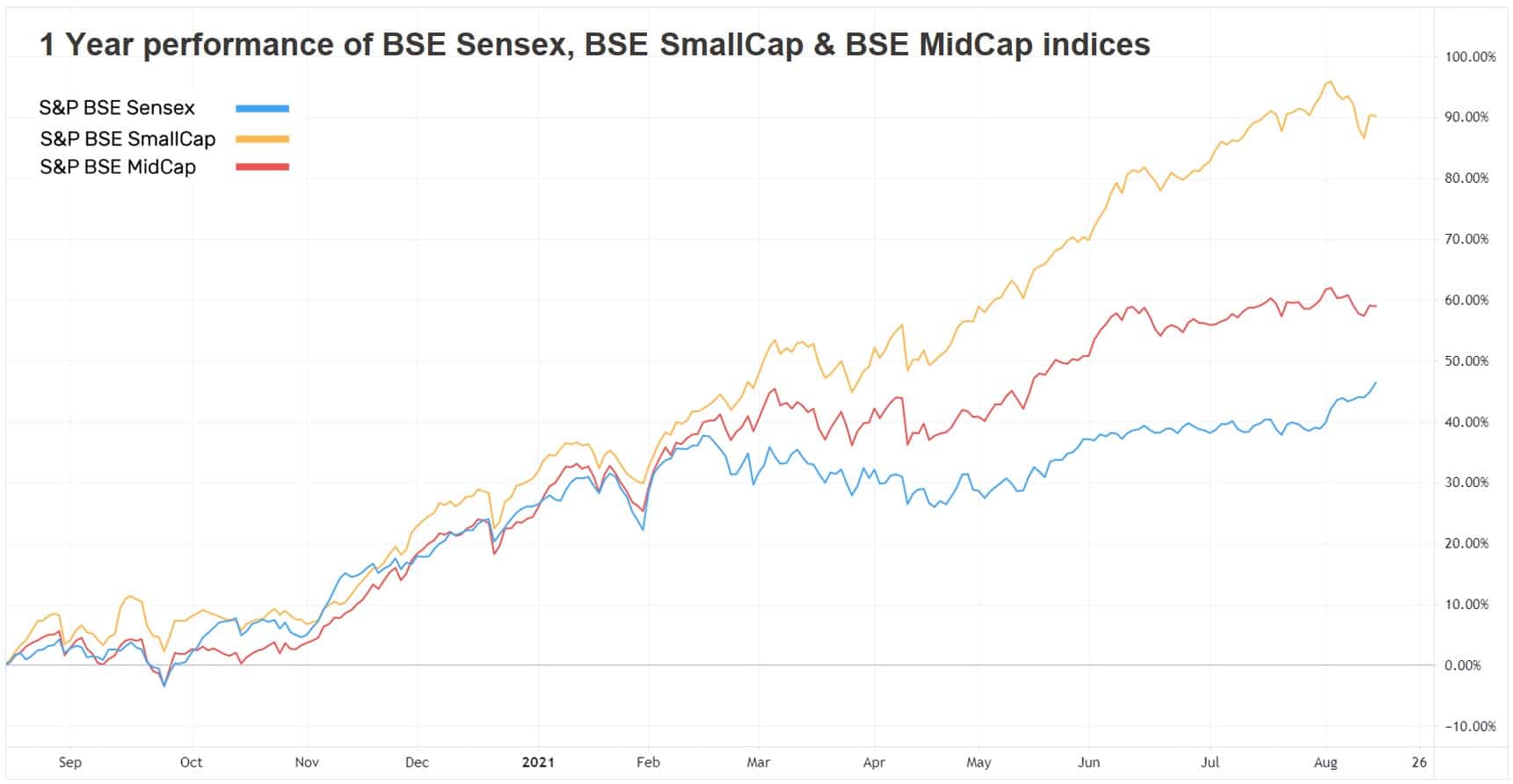

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.8% | 46.1% | 13.3% | 26.5 | 4.3 |

| NIFTY NEXT 50 | -0.7% | 43.4% | 10.2% | 28.7 | 4.8 |

| S&P BSE SENSEX | 2.1% | 44.6% | 13.8% | 30.1 | 3.5 |

| S&P BSE SmallCap | -1.7% | 88.8% | 16.5% | 40.8 | 3.4 |

| S&P BSE MidCap | -1.1% | 57.2% | 12.5% | 39.5 | 3.2 |

| NASDAQ 100 | 0.2% | 35.3% | 26.9% | 35.6 | 9.0 |

| S&P 500 | 0.7% | 32.4% | 16.5% | 27.1 | 4.7 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Digital India | 3.3% | 92.9% | 35.5% |

| Tata Digital India | 3.3% | 99.4% | 33.7% |

| IPRU Technology | 3.3% | 109.0% | 37.6% |

| SBI Technology Opp... | 3.2% | 92.9% | 32.8% |

| 2.1% | 45.5% | 14.8% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| LIC MF Tax | 1.7% | 50.0% | 13.9% |

| Sundaram Diversified Equity | 1.6% | 51.1% | 10.8% |

| 1.3% | 58.9% | 20.7% | |

| Nippon India Tax Saver | 1.3% | 61.8% | 9.3% |

| 1.2% | 61.8% | 16.6% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Tech Mahindra | 10.8% | 99.8% | 24.8% |

| Siemens | 9.1% | 91.7% | 12.0% |

| Bajaj Holdings and Investment | 6.9% | 57.3% | 19.0% |

| Bharti Airtel | 6.4% | 16.1% | 15.2% |

| 5.8% | NA | NA |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -6.3% | -18.6% | 17.9% |

| HSBC Brazil | -2.6% | 16.4% | 3.9% |

| SBI Healthcare Opp... | -2.6% | 35.6% | 26.1% |

| DSP Small Cap | -2.6% | 81.9% | 20.3% |

| -2.4% | 41.4% | 28.6% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Aurobindo Pharma | -16.2% | -18.5% | 0.4% |

| Muthoot Finance | -8.3% | 26.6% | 32.6% |

| Shree Cement | -8.2% | 24.5% | 9.8% |

| Eicher Motors | -6.8% | 15.2% | 3.2% |

| -6.5% | 89.5% | 9.9% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 0.0% | 53.9% | 23.7% |

| UTI Nifty Index | 1.8% | 47.7% | 14.4% |

| Mirae Asset Large Cap | 1.1% | 46.8% | 16.1% |

| IPRU Technology | 3.3% | 109.0% | 37.6% |

| 0.3% | 63.3% | 23.3% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | -3.1% | 127.1% | 34.40% |

| IPRU US Bluechip Equity | 0.4% | 35.4% | 22.2% |

| HDFC Small Cap | -1.4% | 93.7% | 17.4% |

| Union Small Cap | -1.4% | 85.2% | 21.70% |

| -2.0% | NA | NA |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | -3.1% | 127.1% | 34.4% |

| Parag Parikh Flexi Cap | 0.0% | 53.9% | 23.7% |

| IPRU Technology | 3.3% | 109.0% | 37.6% |

| IPRU Commodities | -1.5% | 132.7% | NA |

| 0.3% | 63.3% | 23.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 0.5% | 0.8% | 33.5% |

| Adani Green Energy | 2.3% | 153.3% | NA |

| Infosys | 3.5% | 79.3% | 27.8% |

| Tata Motors | 2.5% | 145.1% | -0.098 |

| 5.4% | 53.4% | 21.7% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 2.6% | 117.1% | 73.9% |

| Apple | 2.0% | 29.7% | 40.7% |

| Microsoft Corporation | 1.2% | 40.2% | 38.3% |

| Amazon.com | -1.5% | 4.7% | 33.6% |

| -2.4% | 11901.4% | 56.4% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Rajendra Ambhore

August 20, 2021 AT 13:59

Is there any advice for trading on kuvera. Any advice

Gaurav Rastogi

September 3, 2021 AT 02:25

Yes, dont trade 🙂

Rajendra Ambhore

August 20, 2021 AT 14:01

How to explore tradesmart