Top news

Finance Minister Nirmala Sitharaman announced a stimulus package worth Rs 2.65 lakh crore in the form of Atmanirbhar Bharat 3.0. This includes income tax relief for home buyers and fertiliser subsidy of Rs 65,000 crore for farmers.

The net AUM of the mutual fund industry grew by 5.1% to Rs 28.2 lakh crore in October. Liquid funds witnessed the most traction within the debt category with inflows of Rs 19,583 crore

Kotak Standard Multicap Fund and Motilal Oswal Multicap 35 Fund are to be re-classified as Flexi cap Funds, and renamed as ‘Kotak Standard Flexi cap Fund’ and ‘Motilal Oswal Flexi Cap 35 Fund’.

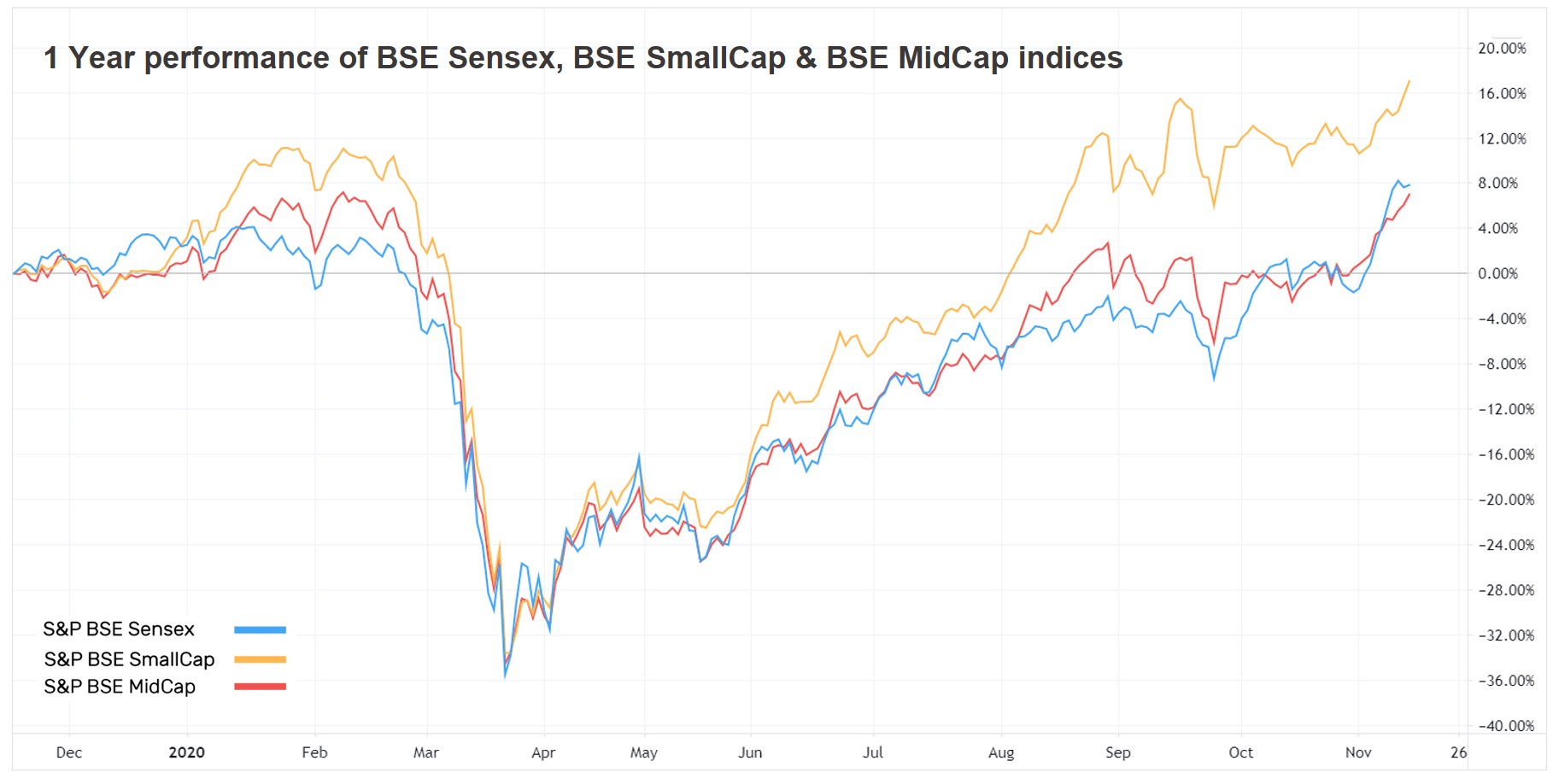

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 3.7% | 7.4% | 7.5% | 34.6 | 3.6 |

| NIFTY NEXT 50 | 3.4% | 3.6% | -0.2% | 37.4 | 4.0 |

| S&P BSE SENSEX | 3.7% | 8.2% | 9.6% | 30.5 | 2.9 |

| S&P BSE SmallCap | 2.8% | 17.1% | -3.8% | NA | 2.1 |

| S&P BSE MidCap | 3.1% | 8.3% | -1.3% | 57.3 | 2.4 |

| NASDAQ 100 | -1.3% | 44.3% | 23.6% | 37.2 | 8.2 |

| S&P 500 | 2.2% | 15.8% | 11.5% | 28.1 | 3.9 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Bharat 22 Fof | 7.6% | -20.2% | NA |

| Invesco India Feeder Euro... | 7.6% | -2.7% | 0.6% |

| DSP World Energy | 7.4% | -4.7% | -0.4% |

| ABSL Banking & Finan... | 7.4% | -6.4% | 1.6% |

| 7.3% | -1.4% | 4.3% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Franklin India Taxshield | 5.1% | 3.1% | 2.6% |

| Motilal Oswal Long Term Equity | 4.5% | 1.7% | 4.6% |

| JM Tax Gain | 4.3% | 8.9% | 7.4% |

| UTI Long Term Equity | 4.2% | 13.9% | 6.5% |

| 3.9% | 6.2% | 6.0% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Indiabulls Housing Finance | 18.1% | -23.6% | -12.0% |

| Bajaj Finserv | 15.4% | -18.5% | 30.5% |

| Eicher Motors | 17.7% | 17.8% | 8.7% |

| Bajaj Finance | 14.8% | 4.9% | 52.0% |

| 12.9% | 955.7% | NA |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -6.7% | 50.5% | 19.0% |

| Quantum Gold Saving | -2.8% | 30.9% | 18.5% |

| Nippon India Gold Saving | -2.8% | 31.1% | 18.7% |

| Kotak Gold | -2.7% | 32.9% | 19.5% |

| -2.7% | 31.5% | 18.8% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Ipca Laboratories | -12.2% | 90.7% | 24.2% |

| Bayer CropScience | -8.2% | 50.3% | 9.6% |

| SBI Cards & Payments | -6.4% | NA | NA |

| Cipla | -6.2% | 63.8% | 3.2% |

| -4.9% | 84.5% | NA |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 1.7% | 27.2% | 14.1% |

| Mirae Asset Emerging Bluechip | 3.1% | 16.8% | 10.0% |

| Edelweiss Greater China Equity | -1.4% | 57.6% | 21.0% |

| Motilal Oswal Nasdaq 100 FOF | 1.0% | 52.6% | NA |

| -2.0% | 65.0% | 28.7% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Nifty Next 50 Index | 3.4% | 3.5% | 0.20% |

| Sundaram Mid Cap | 2.1% | 2.6% | -2.6% |

| Kotak Standard Multicap | 4.0% | 6.2% | 7.0% |

| IPRU Bluechip | 4.6% | 7.3% | 6.10% |

| 3.5% | 6.6% | 4.6% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | -2.0% | 65.0% | 28.7% |

| PGIM India Global Equity Opp... | -0.1% | 40.3% | 27.2% |

| Parag Parikh LTE | 1.7% | 27.2% | 14.1% |

| IPRU Technology | 1.0% | 51.4% | 26.1% |

| 3.1% | 16.8% | 10.0% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -2.9% | 41.1% | 34.5% |

| TCS | -1.1% | 26.6% | 18.3% |

| Infosys | 1.8% | 59.5% | 17.0% |

| 12.9% | 955.7% | NA | |

| HDFC Bank | 3.5% | 7.5% | 21.5% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | -0.5% | 80.3% | 33.5% |

| Amazon | -2.0% | 78.4% | 37.3% |

| Microsoft | -3.7% | 47.0% | 32.6% |

| Tesla | -9.5% | 490.5% | 58.0% |

| -4.1% | 43.4% | 21.7% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!