Top news

SIP inflows stood steady at Rs 8,819 crore in May, up 2.5% from the previous month.

IPOs of Shyam Metalics, Dodla Dairy, KIMS Hospitals and Sona Comstar went live this week. Shyam Metalics was the most oversubscribed with 121.4 times subscription.

Direct tax collections stood at Rs 1.85 lakh crore till June 15, double on Y-o-Y basis compared to the same period last year where collections stood at Rs 92,762 crore.

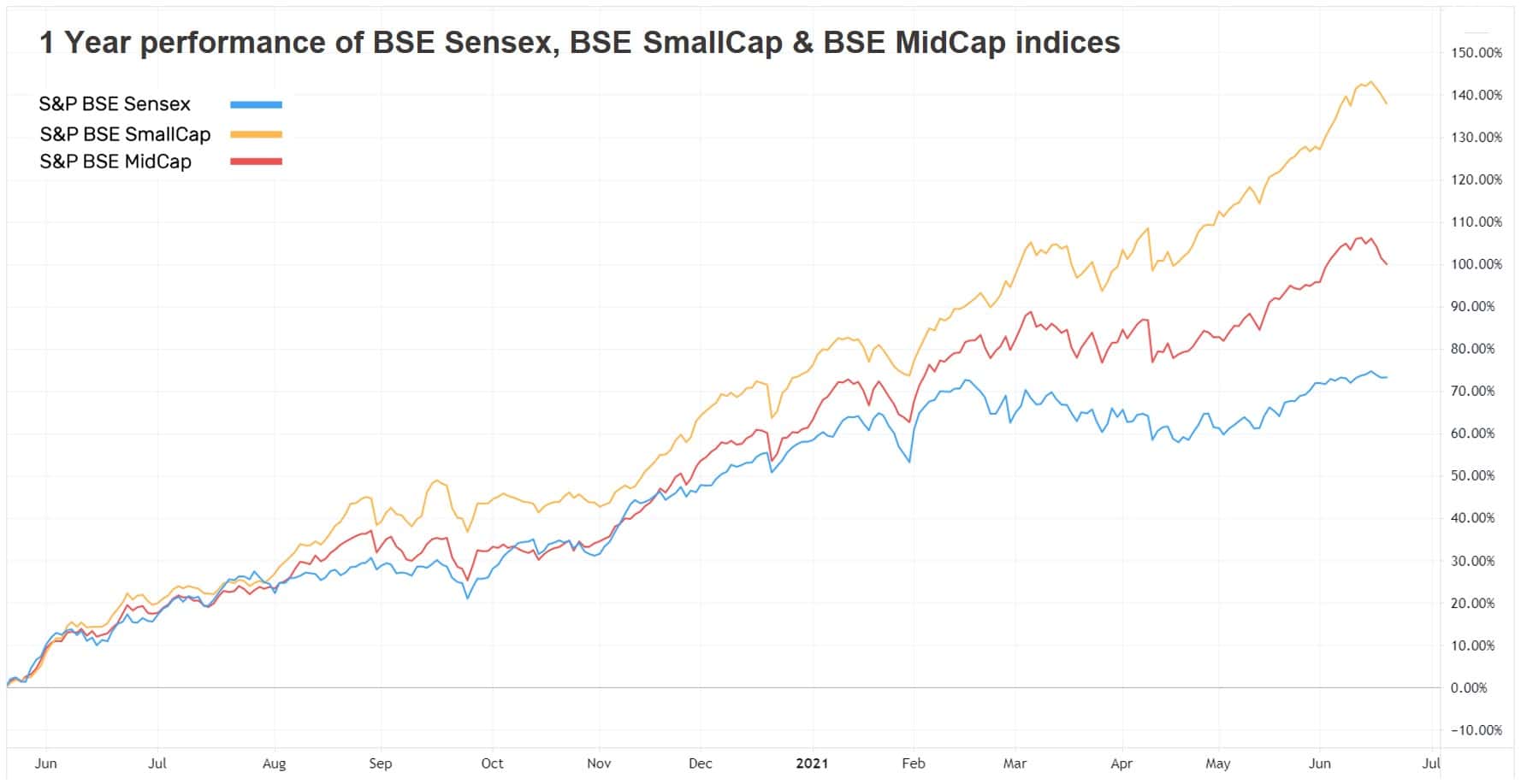

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.7% | 55.3% | 13.3% | 29.1 | 4.3 |

| NIFTY NEXT 50 | -2.5% | 53.4% | 9.7% | 31.7 | 5.2 |

| S&P BSE SENSEX | -0.2% | 52.9% | 13.8% | 32.8 | 3.3 |

| S&P BSE SmallCap | -1.9% | 103.2% | 13.6% | 47.9 | 3.2 |

| S&P BSE MidCap | -3.0% | 75.3% | 11.7% | 44.2 | 3.1 |

| NASDAQ 100 | 0.4% | 40.2% | 24.6% | 36.9 | 8.6 |

| S&P 500 | -1.9% | 33.6% | 14.5% | 29.4 | 4.5 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Franklin India Feeder US Opp... | 3.9% | 33.1% | 24.4% |

| Franklin India Technology | 3.2% | 78.8% | 25.5% |

| PGIM India Global Equity Opp... | 3.2% | 35.6% | 30.00% |

| HSBC Brazil | 2.5% | 27.2% | 9.1% |

| 2.4% | 33.4% | 12.1% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| LIC MF Tax | 0.2% | 55.1% | 12.4% |

| Axis Long Term Equity | -0.1% | 56.3% | 16.0% |

| Mahindra Mutual Kar Bachat... | -0.2% | 67.4% | 14.40% |

| -0.2% | 69.6% | 20.70% | |

| -0.3% | 61.0% | 16.1% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Gujarat Gas | 7.4% | 129.3% | 44.9% |

| Infosys | 5.6% | 113.8% | 22.2% |

| Info Edge (India) | 5.6% | 78.6% | 44.30% |

| Marico | 5.1% | 57.3% | 16.5% |

| 4.5% | 100.2% | 43.2% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Mining | -6.3% | 55.2% | 18.1% |

| DSP World Gold | -5.5% | 4.3% | 18.7% |

| UTI Transportation & Logistics | -4.5% | 63.7% | 1.20% |

| Nippon India Gold Saving | -3.9% | -2.1% | 14.2% |

| -3.9% | -1.5% | 14.2% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Power | -26.3% | 212.2% | 31.0% |

| Adani Transmission | -22.1% | 469.7% | 104.6% |

| Adani Gas | -21.1% | 829.2% | NA |

| Adani Ports & SEZ | -17.9% | 103.7% | 27.6% |

| -15.2% | 134.2% | -2.8% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -0.1% | 62.1% | 21.2% |

| IPRU Equity Arbitrage | 0.2% | 4.1% | 5.8% |

| Kotak Equity Arbitrage | 0.2% | 4.3% | 5.8% |

| UTI Arbitrage | 0.2% | 4.3% | 5.8% |

| 0.2% | 4.0% | 5.7% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP Small Cap | -1.8% | 95.1% | 16.1% |

| Sundaram Mid Cap | -1.5% | 65.9% | 8.1% |

| Quantum Long Term Equity... | -1.8% | 64.8% | 10.8% |

| Franklin India Prima | -1.5% | 69.7% | 13.1% |

| -2.0% | 57.3% | 12.30% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | -0.1% | 181.1% | 30.2% |

| Parag Parikh Flexi Cap | -0.1% | 62.1% | 21.2% |

| Mirae Asset Emerging Bluechip | -0.8% | 73.5% | 21.7% |

| IPRU Technology | 0.9% | 133.2% | 32.3% |

| 1.1% | 114.7% | 30.1% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 1.9% | 37.7% | 36.2% |

| Adani Green Energy | -14.4% | 178.5% | NA |

| Infosys | 5.6% | 113.8% | 22.2% |

| Tata Consultancy Services | 2.5% | 61.0% | 21.8% |

| -2.0% | 253.6% | -6.1% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 2.2% | 211.5% | 70.6% |

| Apple | 2.4% | 49.3% | 40.5% |

| Amazon.com | 4.2% | 30.6% | 37.6% |

| Microsoft Corporation | 0.6% | 33.0% | 38.9% |

| -0.5% | 38.1% | 23.9% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Darshit Karia

June 23, 2021 AT 05:27

Can I invest in Cryptocurrency through KUVERA? I tried in the app but couldn’t do so. Could you please update me on the matter?