Top news

Bitcoin’s market cap reached $1 trillion after the price of digital currency surpassed $54,000 levels. The currency has surged by 120% year to date(YTD).

IPOs of Nureca and RailTel went live this week. Nureca got oversubscribed by 40 times while RailTel got oversubscribed by 42 times.

IDFC Multicap Fund & UTI Equity Fund have now been re-classified as Flexi cap fund and renamed to IDFC Flexi cap Fund & UTI Flexi Cap Fund.

Kotak Mahindra Mutual Fund, ITI Mutual Fund and UTI Mutual Fund have launched the NFO for Kotak Nifty Next 50 Index Fund, ITI MidCap Fund and UTI Nifty200 Momentum 30 Index Fund. The NFOs close on February 24, March 01 and March 04 respectively.

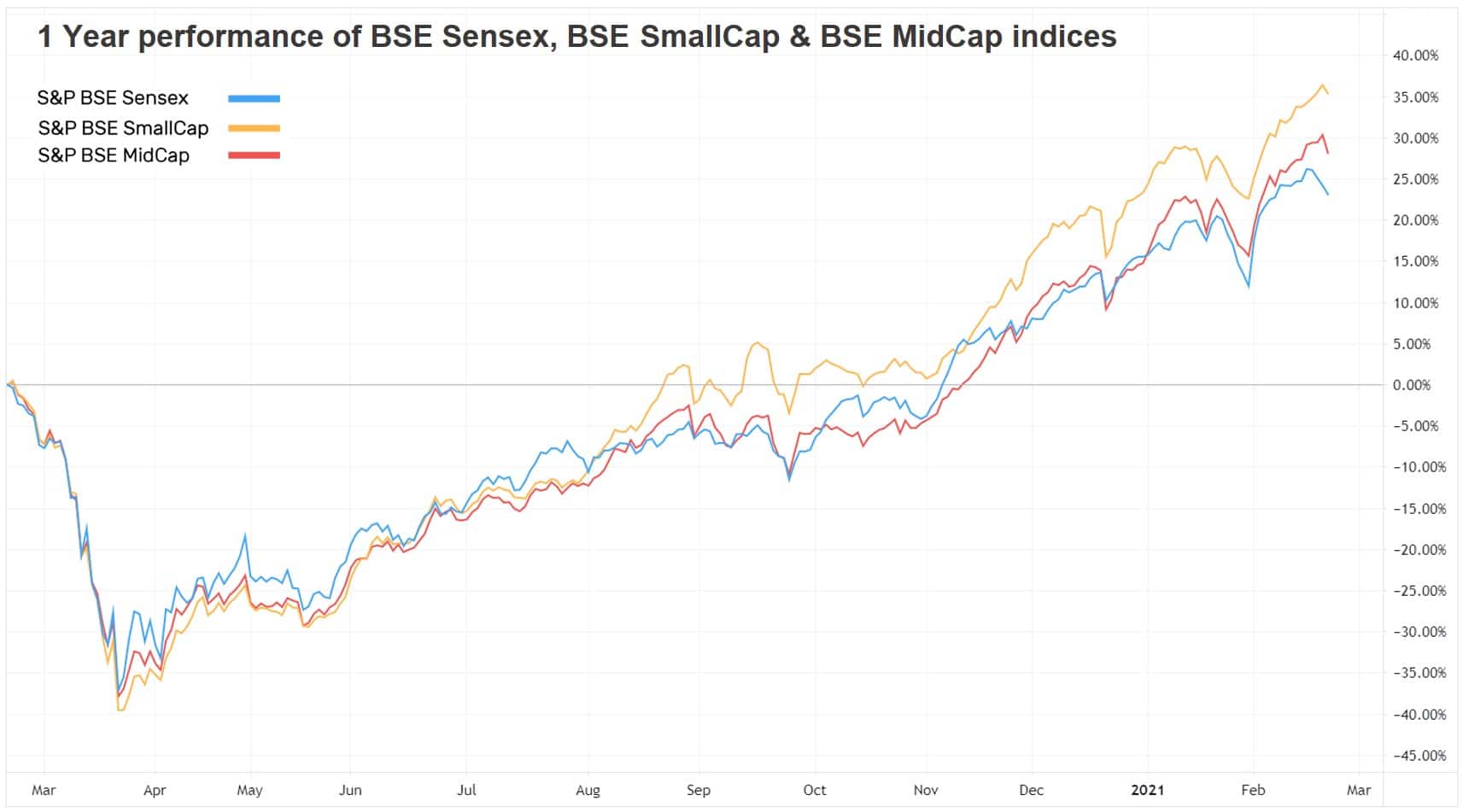

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -1.2% | 23.4% | 13.0% | 40.9 | 4.2 |

| NIFTY NEXT 50 | 0.8% | 21.8% | 6.1% | 39.3 | 4.7 |

| S&P BSE SENSEX | -1.3% | 23.0% | 14.6% | 35.6 | 3.5 |

| S&P BSE SmallCap | 1.2% | 35.2% | 3.6% | NA | 2.7 |

| S&P BSE MidCap | 0.6% | 28.0% | 6.8% | 57.0 | 3.0 |

| NASDAQ 100 | -1.6% | 39.5% | 26.1% | 39.8 | 8.7 |

| S&P 500 | -0.7% | 15.3% | 12.6% | 32.0 | 4.3 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| SBI PSU | 4.2% | 4.3% | -2.0% |

| IPRU Bharat 22 Fof | 3.9% | 19.3% | NA |

| Invesco India PSU Equity | 3.4% | 7.7% | 6.5% |

| DSP World Mining | 3.2% | 55.5% | 16.7% |

| 3.1% | 23.9% | 4.6% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 2.0% | 61.2% | 20.2% |

| Franklin India Taxshield | 0.4% | 23.7% | 10.6% |

| PGIM India Long Term Equity | 0.3% | 29.6% | 12.9% |

| Nippon India Tax Saver | 0.3% | 15.9% | 0.1% |

| 0.2% | 32.8% | 10.4% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Gas | 31.6% | 204.1% | NA |

| Adani Transmission | 30.6% | 155.3% | 90.6% |

| Motherson Sumi Systems | 19.1% | 73.0% | 17.1% |

| Adani Enterprises | 18.6% | 213.3% | 67.7% |

| 18.0% | 12.3% | -8.0% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -6.7% | 20.3% | 15.4% |

| Invesco India Gold | -4.5% | 10.3% | 13.5% |

| ABSL Gold | -3.6% | 8.5% | 13.4% |

| Kotak Gold | -3.3% | 12.8% | 14.60% |

| -3.1% | 12.4% | 13.6% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Vodafone Idea | -15.5% | 263.3% | 30.0% |

| Eicher Motors | -8.3% | 37.8% | 7.2% |

| Tata Motors - Class A | -7.4% | 85.8% | -12.7% |

| Titan Co | -6.5% | 8.7% | 34.0% |

| -6.4% | 14.4% | 13.1% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP Dynamic Asset Alloc... | -0.3% | 13.5% | 11.1% |

| L&T Balanced Advantage | -0.5% | 14.6% | 9.6% |

| Parag Parikh Flexi Cap | -0.9% | 36.0% | 18.6% |

| Axis Bluechip | -1.4% | 19.7% | 18.8% |

| -1.0% | 69.5% | 36.2% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Midcap | -0.7% | 30.2% | 8.1% |

| L&T Emerging Businesses | 0.9% | 26.0% | 2.9% |

| Sundaram Select Focus | -0.9% | 19.1% | 14.3% |

| Nippon India Value | -0.5% | 26.9% | 10.5% |

| 0.0% | 30.3% | 11.8% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | -1.0% | 69.5% | 36.2% |

| Tata Digital India | -2.0% | 54.4% | 29.7% |

| Parag Parikh Flexi Cap | -0.9% | 36.0% | 18.6% |

| Axis Bluechip | -1.4% | 19.7% | 18.8% |

| -1.7% | 68.6% | 28.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 1.2% | 43.3% | 35.2% |

| Adani Green Energy | 5.3% | 490.8% | NA |

| Infosys | -0.1% | 61.9% | 19.8% |

| Tata Consultancy Services | -4.2% | 38.7% | 23.0% |

| -1.8% | 27.3% | 25.9% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -4.3% | 334.4% | 88.0% |

| Apple | -4.1% | 62.2% | 40.2% |

| Amazon | -0.8% | 50.9% | 43.4% |

| NIO | -8.0% | 1192.0% | NA |

| -1.6% | 30.7% | 36.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Pallab Basak

February 23, 2021 AT 00:39

Do you have any helpline number?

Gaurav Rastogi

February 25, 2021 AT 01:51

Pls write to us at support@kuvera.in