Top news

In welcome news for all Central Government employees, the Ministry of Finance has increased the Dearness Allowance from 17% to 28% of basic pay.

RBI in a press release announced purchase of government bonds worth Rs 25,000 crore via open market under G-sec Acquisition Programme - G-SAP 2.0.

Shares of Devyani International and Krsnaa Diagnostics got listed at a premium of 56.5% and 5.4% over issue price of Rs 90 and Rs 954 while CarTrade Tech got listed at discount of 1.1% over the issue price of Rs 1,618 per share.

Canara Robeco Mutual Fund has launched the NFO for Canara Robeco Value Growth Direct Plan. The NFO closes on August 27.

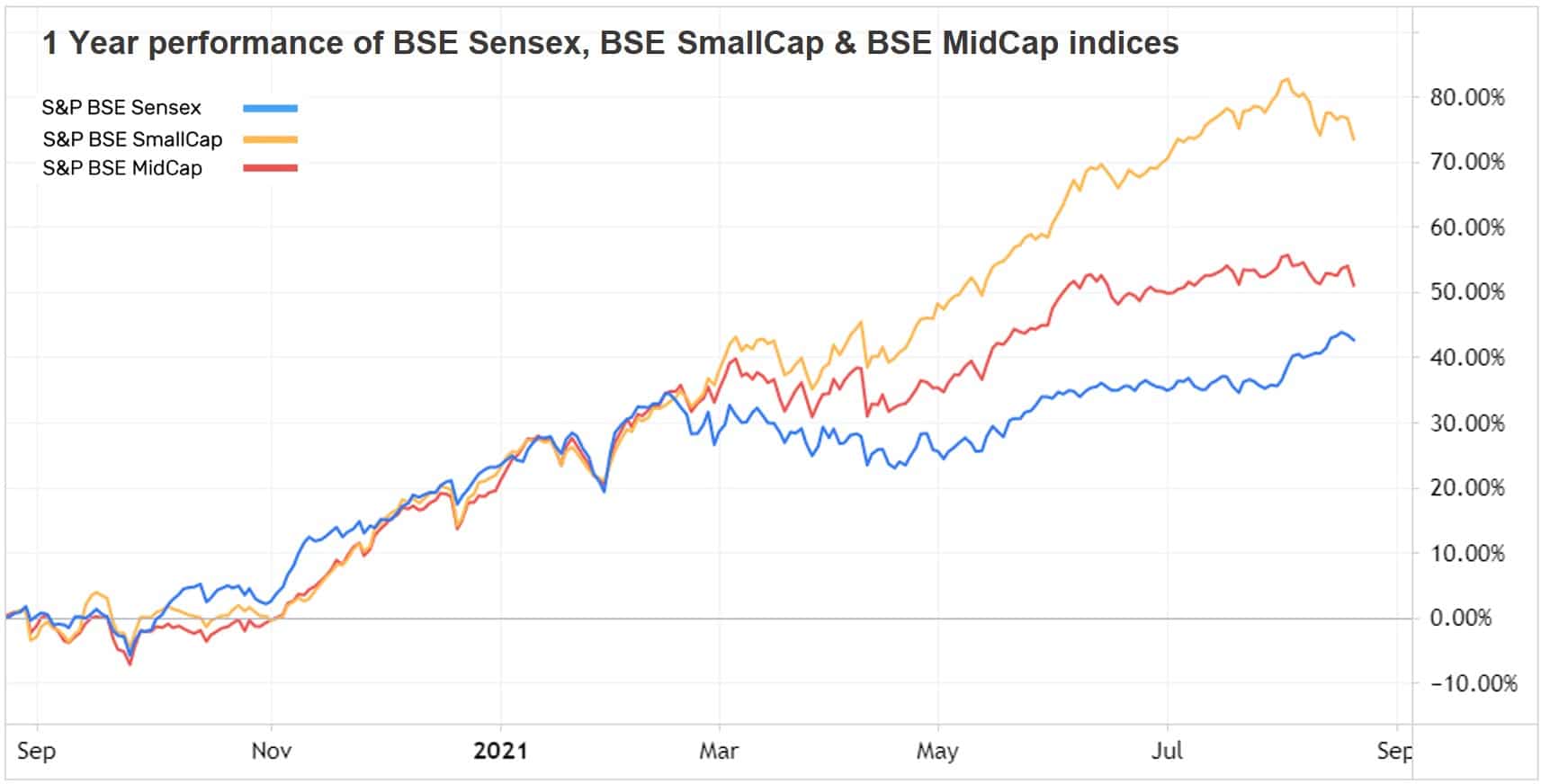

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.5% | 45.3% | 12.5% | 25.2 | 4.2 |

| NIFTY NEXT 50 | -0.3% | 42.1% | 9.1% | 27.4 | 4.8 |

| S&P BSE SENSEX | -0.2% | 44.6% | 13.1% | 28.8 | 3.5 |

| S&P BSE SmallCap | -2.3% | 78.4% | 15.1% | 37.6 | 3.3 |

| S&P BSE MidCap | -1.1% | 52.4% | 11.2% | 37.5 | 3.2 |

| NASDAQ 100 | -0.3% | 31.4% | 26.9% | 35.2 | 8.9 |

| S&P 500 | -0.6% | 31.1% | 15.8% | 26.8 | 4.6 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Invesco India Gold | 2.4% | -10.1% | 16.3% |

| IPRU FMCG | 2.3% | 25.2% | 7.8% |

| IDBI Gold | 1.9% | -11.8% | 15.6% |

| Franklin India Technology | 1.8% | 63.3% | 28.4% |

| 1.4% | -10.9% | 15.5% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Long Term Equity | 0.5% | 50.3% | 16.4% |

| LIC MF Tax | -0.2% | 47.9% | 13.3% |

| JM Tax Gain | -0.8% | 53.5% | 15.8% |

| BOI AXA Tax Advantage | -0.8% | 64.1% | 20.0% |

| -0.9% | 51.1% | 12.5% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Transmission | 18.2% | 357.3% | 96.2% |

| Adani Gas | 17.9% | 554.8% | NA |

| Apollo Hospitals | 15.0% | 182.5% | 27.9% |

| MindTree | 14.4% | 185.6% | 43.4% |

| 9.6% | 54.7% | 43.6% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Edelweiss Greater China Eq... | -5.7% | 15.3% | 25.7% |

| HSBC Brazil | -5.5% | 13.1% | 2.7% |

| Tata Resources & Energy | -5.3% | 61.4% | 24.4% |

| DSP World Mining | -4.7% | 32.4% | 22.9% |

| -4.4% | 57.5% | 2.1% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Aurobindo Pharma | -17.6% | -21.2% | -0.7% |

| Vedanta | -16.8% | 108.7% | 13.8% |

| SAIL | -11.7% | 189.8% | 19.4% |

| Motherson Sumi | -9.0% | 62.8% | 7.2% |

| -8.7% | NA | NA |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -1.0% | 51.5% | 22.9% |

| UTI Arbitrage | 0.1% | 4.7% | 5.8% |

| UTI Nifty Index | -0.5% | 46.9% | 13.5% |

| IPRU Technology | 0.8% | 108.0% | 37.2% |

| -0.6% | 32.2% | 14.4% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Nippon India Arbitrage | 0.1% | 4.7% | 5.9% |

| HDFC Top 100 | -2.0% | 44.0% | 10.7% |

| HDFC Small Cap | -2.9% | 81.8% | 15.8% |

| L&T Midcap | -0.6% | 50.3% | 12.7% |

| 1.1% | -10.3% | 16.0% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | -5.0% | 111.6% | 32.0% |

| Parag Parikh Flexi Cap | -1.0% | 51.5% | 22.9% |

| IPRU Commodities | -7.6% | 108.3% | NA |

| IPRU Technology | 0.8% | 108.0% | 37.2% |

| -1.2% | 59.3% | 21.9% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 1.7% | 0.6% | 34.1% |

| Adani Green Energy | 2.4% | 151.1% | NA |

| Infosys | 2.5% | 80.6% | 29.1% |

| Tata Motors | -7.5% | 126.3% | -11.10% |

| 6.1% | 57.7% | 23.6% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -5.1% | 65.9% | 72.1% |

| Apple | -0.6% | 19.2% | 40.2% |

| Microsoft Corporation | 3.9% | 42.8% | 39.5% |

| -1.0% | 34.6% | 23.8% | |

| -2.9% | -2.6% | 33.4% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

K UNNIKRISHNAN

August 22, 2021 AT 07:07

How to add KYC in KUVERA

Gaurav Rastogi

September 3, 2021 AT 02:25

Pls email us at support@kuvera.in