Top news

SEBI in a consultation paper has proposed to introduce a mechanism to adjust NAV in case of significant inflow or outflow from funds.

Shares of G R Infraprojects, Clean science and Zomato got listed at premiums of 105%, 98% and 53% over the issue price of Rs 837, Rs 900 and Rs 76 respectively. Meanwhile, Tatva Chintan Pharma IPO got oversubscribed by 180 times.

Trust Mutual Fund has launched the NFO for Trustmf Short Term Fund. The NFO closes on August 03.

Index Returns

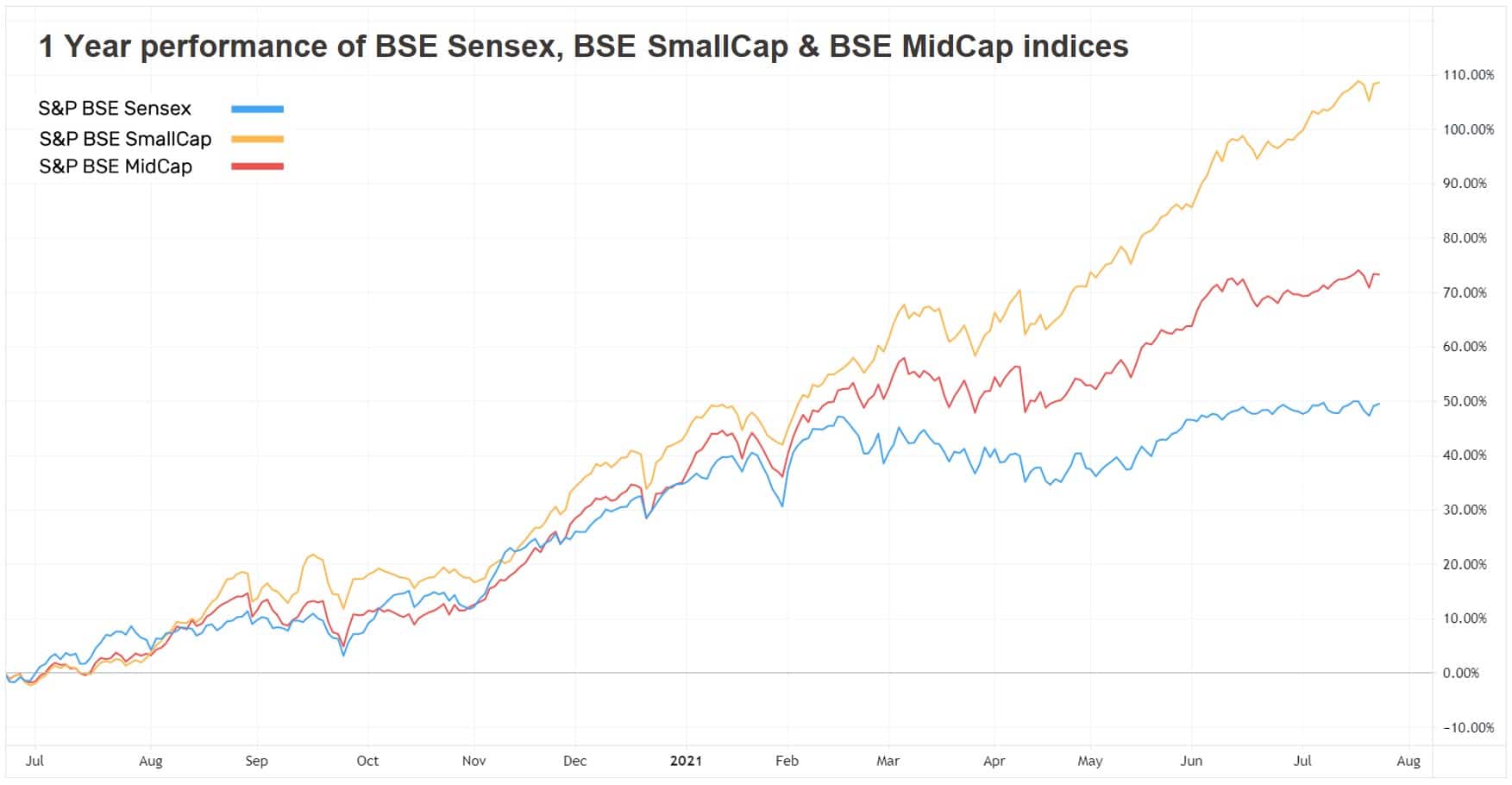

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.4% | 41.3% | 12.7% | 28.3 | 4.2 |

| NIFTY NEXT 50 | 0.3% | 47.4% | 11.9% | 31.1 | 5.2 |

| S&P BSE SENSEX | -0.3% | 38.8% | 13.0% | 31.8 | 3.4 |

| S&P BSE SmallCap | -0.1% | 103.1% | 18.5% | 48.2 | 3.4 |

| S&P BSE MidCap | -0.5% | 66.8% | 14.3% | 42.0 | 3.2 |

| NASDAQ 100 | 2.9% | 42.7% | 26.7% | 39.4 | 9.2 |

| S&P 500 | 2.0% | 36.2% | 16.2% | 29.4 | 4.7 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| SBI Magnum Childrens Benefit | 2.4% | 26.4% | 11.3% |

| Franklin India Feeder US Opp... | 2.1% | 33.5% | 26.2% |

| SBI Technology Opportunities | 1.9% | 87.2% | 30.40% |

| Tata India Consumer | 1.7% | 45.1% | 11.9% |

| 1.6% | 58.7% | 25.0% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal Long Term Equity | 1.2% | 56.8% | 13.80% |

| Quant Tax | 0.9% | 113.9% | 33.5% |

| UTI Long Term Equity | 0.5% | 56.8% | 17.70% |

| Parag Parikh Tax Saver | 0.4% | 54.4% | NA |

| 0.2% | 52.5% | 15.9% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Jubilant Foodworks | 14.9% | 110.0% | 44.1% |

| Havells India | 10.0% | 95.5% | 25.4% |

| Gujarat Gas | 7.8% | 143.6% | 45.70% |

| Gland Pharma | 7.4% | NA | NA |

| 5.7% | 154.3% | 37.4% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -4.4% | -18.9% | 16.8% |

| HSBC Brazil | -4.0% | 10.9% | 3.4% |

| DSP World Mining | -3.5% | 39.0% | 20.60% |

| Nippon India Japan Equity | -2.2% | 22.4% | NA |

| -2.2% | 20.4% | 12.8% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Varun Beverages | -8.0% | 53.9% | NA |

| Tata Motors Class A | -7.5% | 234.3% | -16.5% |

| IndusInd Bank | -6.3% | 92.6% | -2.2% |

| HDFC Asset Management Co... | -6.0% | 15.9% | NA |

| -5.9% | 10.1% | -3.8% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 0.5% | 59.7% | 23.7% |

| Quant Small Cap | 0.8% | 170.4% | 35.2% |

| UTI Nifty Index | -0.4% | 42.8% | 13.7% |

| IPRU Flexicap | 0.0% | NA | NA |

| 0.2% | 63.4% | 22.7% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| L&T Midcap | -0.1% | 62.0% | 14.4% |

| Tata Equity PE | 0.1% | 39.0% | 10.5% |

| Quant Mid Cap | -0.9% | 90.90% | 25.50% |

| Nippon India Banking | -1.2% | 68.8% | 9.3% |

| 2.7% | 65.4% | NA |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | 0.8% | 170.4% | 35.2% |

| Parag Parikh Flexi Cap | 0.5% | 59.7% | 23.7% |

| IPRU Technology | 1.5% | 114.6% | 35.2% |

| Mirae Asset Emerging Bluechip | 0.2% | 64.1% | 24.4% |

| 1.4% | 101.4% | 32.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 1.1% | 5.0% | 33.6% |

| Adani Green Energy | -1.7% | 191.1% | NA |

| Infosys | 0.6% | 73.0% | 25.8% |

| Tata Motors | -4.7% | 181.2% | -10.2% |

| 0.3% | 46.7% | 22.1% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | 1.5% | 60.4% | 43.2% |

| Tesla | -0.1% | 127.2% | 70.7% |

| Microsoft Corporation | 3.2% | 43.9% | 38.6% |

| Amazon.com | 2.3% | 21.5% | 37.5% |

| 8.4% | 60.2% | 25.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!