Top news

SEBI has asked the Association of Mutual Funds in India (AMFI) to come up with a liquidity risk management framework for debt funds within one month.

Shares of Shyam Metalics got listed at Rs 380, a premium of 24% over its issue price of Rs 306 while India Pesticides IPO got oversubscribed by 29 times.

Tata Mutual Fund has launched the NFO for Tata Floating Rate Fund. The NFO closes on July 05.

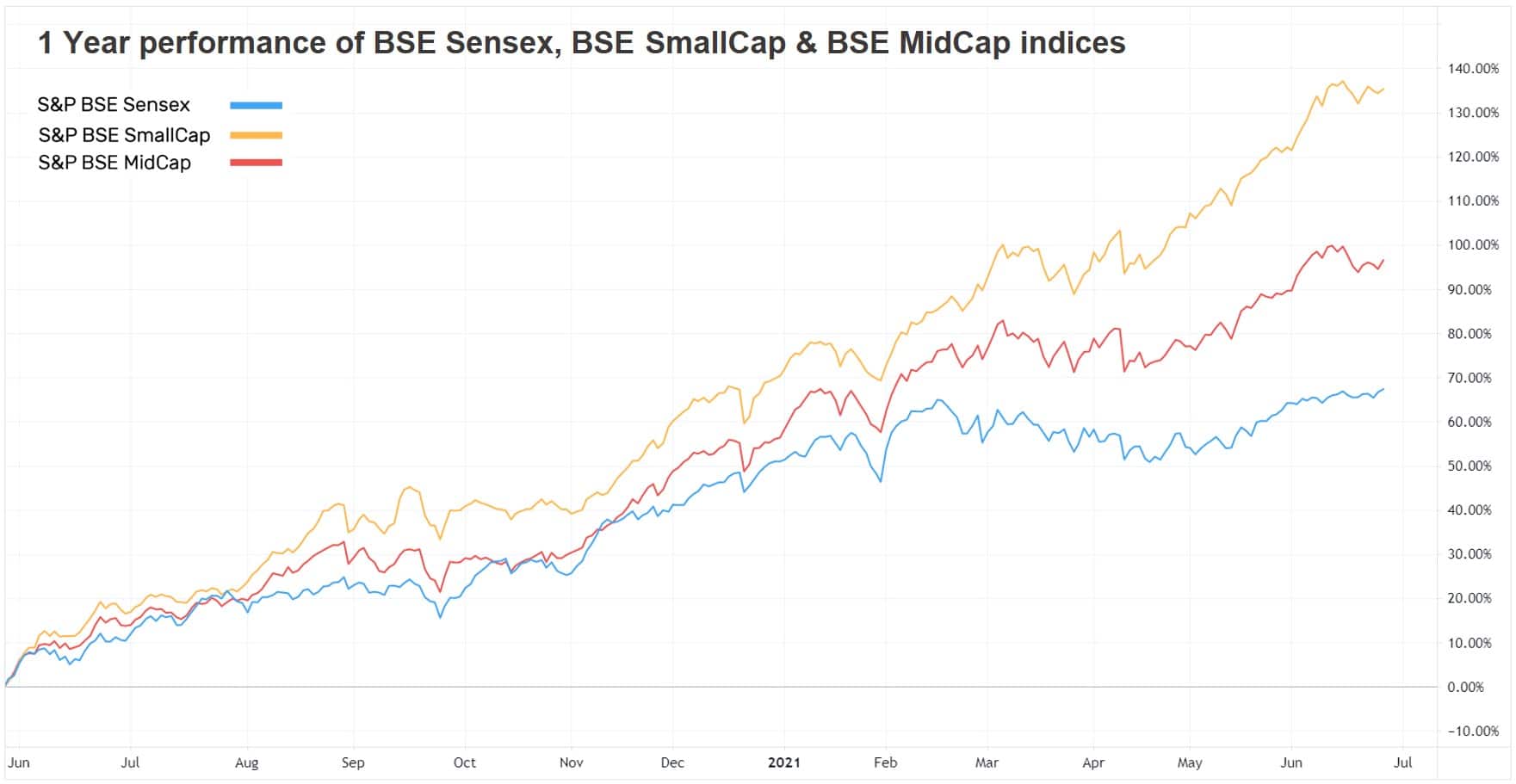

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.1% | 54.0% | 13.8% | 29.2 | 4.3 |

| NIFTY NEXT 50 | 0.8% | 48.7% | 10.7% | 31.2 | 5.2 |

| S&P BSE SENSEX | 1.1% | 51.8% | 14.3% | 32.3 | 3.4 |

| S&P BSE SmallCap | 1.4% | 98.0% | 15.1% | 52.6 | 3.2 |

| S&P BSE MidCap | 1.4% | 70.3% | 12.8% | 43.8 | 3.1 |

| NASDAQ 100 | 2.1% | 41.9% | 26.8% | 37.8 | 8.8 |

| S&P 500 | 2.7% | 38.7% | 16.4% | 30.3 | 4.6 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Emerging Markets... | 4.7% | 39.7% | 14.9% |

| PGIM India Global Equity Opp... | 4.6% | 37.3% | 32.3% |

| Nippon India Multi Cap | 2.7% | 70.6% | 12.90% |

| Franklin India Feeder US Opp... | 2.7% | 37.9% | 25.9% |

| 2.7% | 58.3% | 28.6% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 2.3% | 114.1% | 31.5% |

| DSP Tax Saver | 2.1% | 67.4% | 19.3% |

| Mahindra Mutual Kar Bachat... | 2.1% | 67.4% | 15.60% |

| IDFC Tax Advantage | 2.0% | 84.1% | 16.20% |

| 2.0% | 69.6% | 13.4% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Indian Overseas Bank | 23.6% | 128.0% | -0.8% |

| Piramal Enterprises | 12.0% | 95.3% | 12.7% |

| Adani Enterprises | 11.1% | 882.2% | 84.20% |

| Adani Ports & SEZ | 10.1% | 102.7% | 29.00% |

| 9.7% | 32.9% | 14.4% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | -1.7% | -3.3% | 18.4% |

| Edelweiss Asean Equity... | -1.1% | 19.3% | 6.4% |

| -0.8% | 92.3% | 16.50% | |

| -0.7% | 38.2% | 11.7% | |

| -0.7% | 24.9% | 0.0% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Gas | -10.2% | 642.4% | NA |

| Varun Beverages | -9.4% | 56.1% | NA |

| Adani Transmission | -8.2% | 366.8% | 102.90% |

| Sbi Cards And Payment | -7.5% | 46.4% | NA |

| -5.0% | 21.8% | 35.3% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.4% | 60.2% | 21.6% |

| Mirae Asset Large Cap | 1.9% | 56.6% | 16.6% |

| UTI Nifty Index | 1.1% | 55.8% | 14.9% |

| Axis Bluechip | 1.1% | 48.8% | 17.3% |

| 3.6% | 178.5% | 31.7% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Digital India | 1.6% | 116.2% | 33.1% |

| Kotak Equity Arbitrage | 0.1% | 4.4% | 5.8% |

| HDFC Small Cap | 0.7% | 102.0% | 14.4% |

| L&T Emerging Businesses | 1.9% | 98.6% | 13.3% |

| 0.1% | 4.2% | 5.80% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | 3.6% | 178.5% | 31.7% |

| Parag Parikh Flexi Cap | 1.4% | 60.2% | 21.6% |

| IPRU Technology | 2.3% | 140.0% | 33.8% |

| Mirae Asset Emerging Bluechip | 2.0% | 71.3% | 23.3% |

| 2.0% | 121.5% | 31.2% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -5.0% | 21.8% | 35.3% |

| Adani Green Energy | 4.2% | 163.5% | NA |

| Infosys | 5.2% | 120.4% | 22.9% |

| Tata Consultancy Services | 1.8% | 65.5% | 22.7% |

| -1.8% | 224.2% | -5.4% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!