Top news

GDP data shows that the Indian economy grew by 0.4% in the October-December quarter after contracting for two quarters in a row. This marks India’s emergence from technical recession.

Retail inflation stood at 3.15% in January, down from 3.67% the previous month. In comparison, the retail inflation stood at 7.49% during January of the previous year.

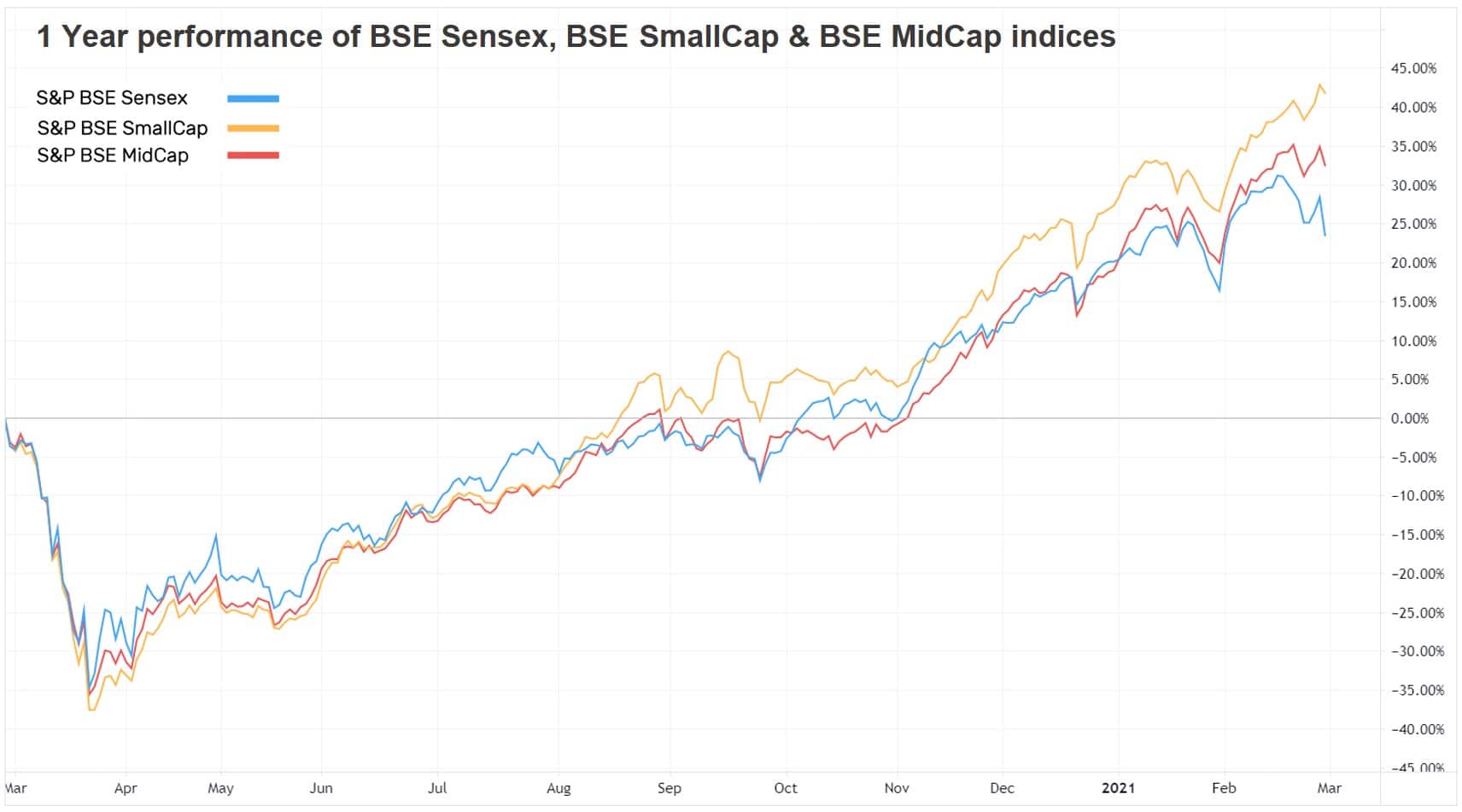

Nifty50 and Sensex fell 3.76% and 3.8% respectively on 26 February, the biggest single-day drop since March 2020 and May 2020 for respective indices.

ICICI Prudential Mutual Fund has appointed Dharmesh Kakkad as the co-fund manager (Equity) of ICICI Prudential Equity Savings Fund, he will be replacing Prakash Gaurav in the role.

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -3.0% | 24.3% | 11.1% | 39.7 | 4.1 |

| NIFTY NEXT 50 | -1.9% | 24.5% | 4.9% | 38.5 | 4.6 |

| S&P BSE SENSEX | -3.5% | 23.0% | 12.5% | 33.9 | 3.3 |

| S&P BSE SmallCap | 1.5% | 40.4% | 3.5% | NA | 2.7 |

| S&P BSE MidCap | -0.3% | 31.5% | 6.2% | 55.9 | 2.9 |

| NASDAQ 100 | -4.9% | 45.2% | 22.7% | 37.9 | 8.2 |

| S&P 500 | -2.4% | 22.2% | 11.1% | 31.4 | 4.1 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Mining | 4.6% | 64.8% | 18.7% |

| 4.4% | 49.9% | 6.6% | |

| DSP World Energy | 3.0% | 21.5% | 7.0% |

| 2.6% | 16.5% | 12.7% | |

| 2.2% | 41.3% | 9.2% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| IDFC Tax Advantage | -0.4% | 36.4% | 9.6% |

| Nippon India Tax Saver | -0.7% | 19.5% | -0.5% |

| Quant Tax | -0.7% | 65.8% | 19.1% |

| ITI Long Term Equity | -0.7% | 25.7% | NA |

| -0.8% | 25.3% | 7.0% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Hindalco Industries | 9.8% | 95.1% | 38.2% |

| Coal India | 8.7% | -13.1% | -4.4% |

| Vedanta | 5.9% | 55.7% | 31.6% |

| Adani Green Energy | 4.8% | 547.8% | NA |

| 4.1% | -1.4% | 16.4% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Emerging Markets | -9.3% | 34.3% | 12.7% |

| Franklin India Feeder US Opp... | -6.2% | 38.8% | 23.8% |

| -6.2% | 73.1% | 26.9% | |

| PGIM India Global Equity Opp... | -5.9% | 65.8% | 32.50% |

| -5.5% | 39.2% | 13.1% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Bank of India | -11.5% | 41.3% | -0.3% |

| Bank of Baroda | -10.7% | 6.7% | -8.1% |

| Berger Paints India | -10.4% | 19.5% | 33.8% |

| Mahindra & Mahindra | -10.0% | 57.9% | 6.40% |

| -9.2% | 15.3% | 13.9% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -2.6% | 38.5% | 16.9% |

| Edelweiss Balanced Advantage | -1.3% | 27.9% | 13.3% |

| UTI Nifty Index | -3.0% | 25.3% | 12.2% |

| Axis Bluechip | -3.6% | 18.5% | 16.5% |

| -4.2% | 48.7% | NA |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata India Consumer | -1.1% | 19.0% | 8.8% |

| ABSL Pure Value | 0.1% | 32.6% | -2.1% |

| DSP Small Cap | 1.1% | 36.7% | 6.2% |

| HDFC Mid Cap Opportunities | 0.5% | 30.9% | 9.2% |

| 0.2% | 36.1% | 5.8% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | -5.9% | 65.8% | 32.5% |

| Tata Digital India | -2.1% | 54.8% | 26.8% |

| Parag Parikh Flexi Cap | -2.6% | 38.5% | 16.9% |

| Axis Bluechip | -3.6% | 18.5% | 16.5% |

| IPRU Technology | -2.0% | 69.1% | 26.5% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 0.9% | 48.5% | 34.6% |

| Adani Green Energy | 4.8% | 547.8% | NA |

| Infosys | -3.1% | 56.9% | 19.9% |

| Tata Consultancy Services | -5.3% | 34.3% | 23.1% |

| -1.3% | 27.8% | 26.3% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -13.5% | 397.5% | 77.7% |

| Apple | -6.6% | 77.7% | 38.0% |

| GameStop | 150.7% | 2823.6% | 27.2% |

| Amazon.com | -4.8% | 64.1% | 41.0% |

| Microsoft Corporation | -3.6% | 47.1% | 35.3% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!