Top news

From 1st Feb 21, Net Asset Value (NAV) date applicable to all mutual fund purchases will be the date on which funds are received by the fund house. Read our details note here.

Sundaram MF will take over Principal MF by acquiring 100% of the share capital of Principal AMC, Principal Trustee Company, and Principal Retirement Advisors. Sundaram MF has AUM of Rs 31,340 crore whereas Principal India MF has AUM of Rs 7,270 crore.

Axis Mutual Fund has launched the NFO for Axis Greater China Equity Fund of Fund. The fund will invest in - Schroder International Selection Fund Greater China. The NFO closes on February 05.

Indian Railway Finance Corporation (IRFC) listed at a discount of 4% over the issue price of Rs 26 while Stove Kraft IPO got oversubscribed by 18 times.

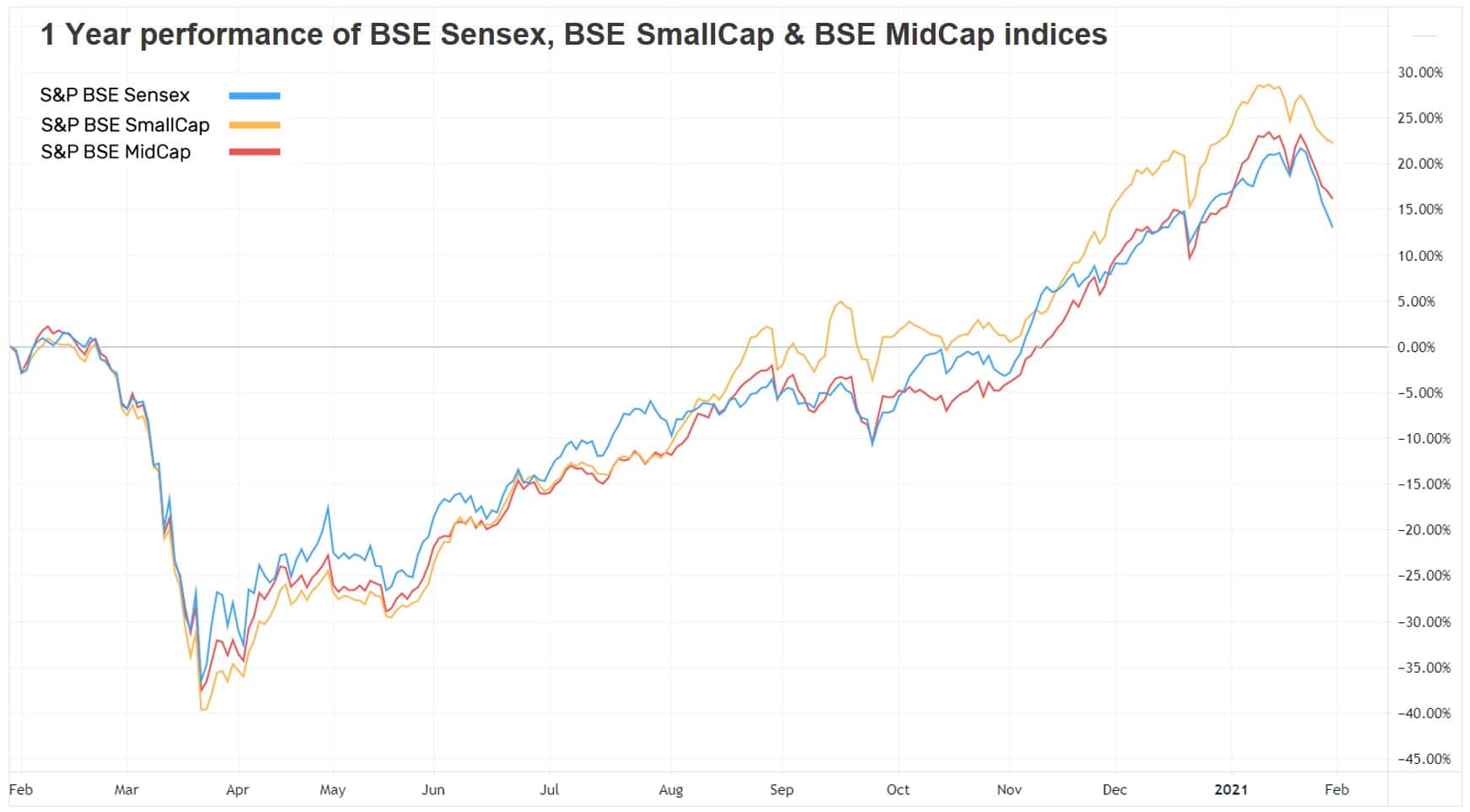

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -5.1% | 12.3% | 7.0% | 36.6 | 3.9 |

| NIFTY NEXT 50 | -4.8% | 9.2% | 0.9% | 39.3 | 4.3 |

| S&P BSE SENSEX | -5.3% | 12.3% | 8.4% | 31.8 | 3.2 |

| S&P BSE SmallCap | -2.4% | 21.1% | -2.0% | NA | 2.5 |

| S&P BSE MidCap | -3.6% | 14.7% | 0.7% | 61.2 | 2.7 |

| NASDAQ 100 | -3.3% | 40.1% | 23.8% | 38.6 | 8.4 |

| S&P 500 | -3.3% | 13.6% | 10.5% | 29.8 | 4.1 |

We recently published “State of Personal Finance Report 2020-21”. Check how investor’s behaved and the lessons we all learned in a pandemic year. Download a detailed version of the report here

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Credit Risk | 0.5% | -0.8% | 3.2% |

| Nippon India Nivesh Lakshya | 0.4% | 14.2% | NA |

| Invesco India Gold | 0.4% | 21.0% | 17.6% |

| Baroda Credit Risk B | 0.4% | 3.0% | 4.5% |

| 0.3% | 12.2% | 10.6% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Tax Saver | -2.4% | 28.0% | NA |

| Motilal Oswal Long Term Equity | -2.6% | 6.9% | 4.4% |

| Kotak Tax Saver | -3.0% | 11.0% | 8.7% |

| DSP Tax Saver | -3.1% | 13.8% | 7.5% |

| -3.1% | 10.0% | 4.7% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Bajaj Auto | 8.1% | 30.9% | 13.2% |

| Adani Gas | 6.7% | 123.8% | NA |

| Colgate-Palmolive (India) | 4.2% | 7.8% | 14.8% |

| Grasim Industries | 3.8% | 30.6% | 14.6% |

| Cipla | 1.5% | 77.7% | 7.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Mining | -6.8% | 42.3% | 12.6% |

| Axis Focused 25 | -6.5% | 13.3% | 10.8% |

| UTI Transportation & Logistics | -6.4% | 17.2% | -3.4% |

| Axis Long Term Equity | -6.2% | 12.0% | 10.4% |

| -6.0% | 17.5% | -0.1% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Steel | -18.3% | 250.5% | NA |

| Info Edge (India) | -16.0% | 57.9% | 40.80% |

| Biocon | -15.8% | 28.9% | 35.6% |

| Berger Paints India | -12.3% | 26.0% | 30.4% |

| Reliance Industries | -12.1% | 26.5% | 29.6% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -1.3% | 31.4% | 14.6% |

| Axis Bluechip | -5.6% | 14.2% | 13.50% |

| IPRU Equity Arbitrage | 0.0% | 4.4% | 5.9% |

| -4.2% | 67.4% | 31.0% | |

| -6.2% | 12.0% | 10.40% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Nippon India Index Sensex | -5.3% | 13.6% | 9.4% |

| IPRU Nifty Next 50 Index | -4.8% | 9.2% | 1.3% |

| HDFC Small Cap | -2.4% | 15.4% | 1.3% |

| ICICI Prudential Bluechip | -3.8% | 12.8% | 6.7% |

| SBI Blue Chip | -4.3% | 13.3% | 7.0% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | -4.4% | 52.0% | 25.3% |

| PGIM India Global Equity Opp... | -4.2% | 67.4% | 31.0% |

| Axis Bluechip | -5.6% | 14.2% | 13.5% |

| ICICI Prudential Technology | -3.8% | 61.7% | 24.8% |

| -1.3% | 31.4% | 14.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -12.1% | 26.5% | 29.6% |

| Adani Green Energy | -4.2% | 435.5% | NA |

| Infosys | -7.4% | 59.4% | 18.0% |

| Tata Consultancy Services | -4.9% | 42.5% | 22.5% |

| HDFC Bank | -5.6% | 13.7% | 22.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -6.3% | 519.2% | 83.5% |

| Apple | -5.1% | 62.9% | 40.3% |

| GameStop | 402.9% | 8169.7% | 65.4% |

| NIO | -8.0% | 1297.1% | NA |

| Amazon.com | -2.6% | 71.3% | 40.5% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Mohammed gani

February 9, 2021 AT 11:43

Good job