Top news

India’s exports during the April-June quarter jumped to $95.4 billion, a 85% rise Y-o-Y basis compared to exports of $51.4 billion in the same period last year.

SEBI has reduced the minimum application value for REITs and InvITs. A trading lot can be of a single unit and will be in the range of Rs 10,000-15,000 reduced from the earlier minimum value Rs 50,000.

ICICI MF and Invesco MF have launched the NFOs for ICICI Prudential Flexicap Fund and Invesco India Medium Duration Fund. NFOs close on 12 July and 13 July respectively.

Index Returns

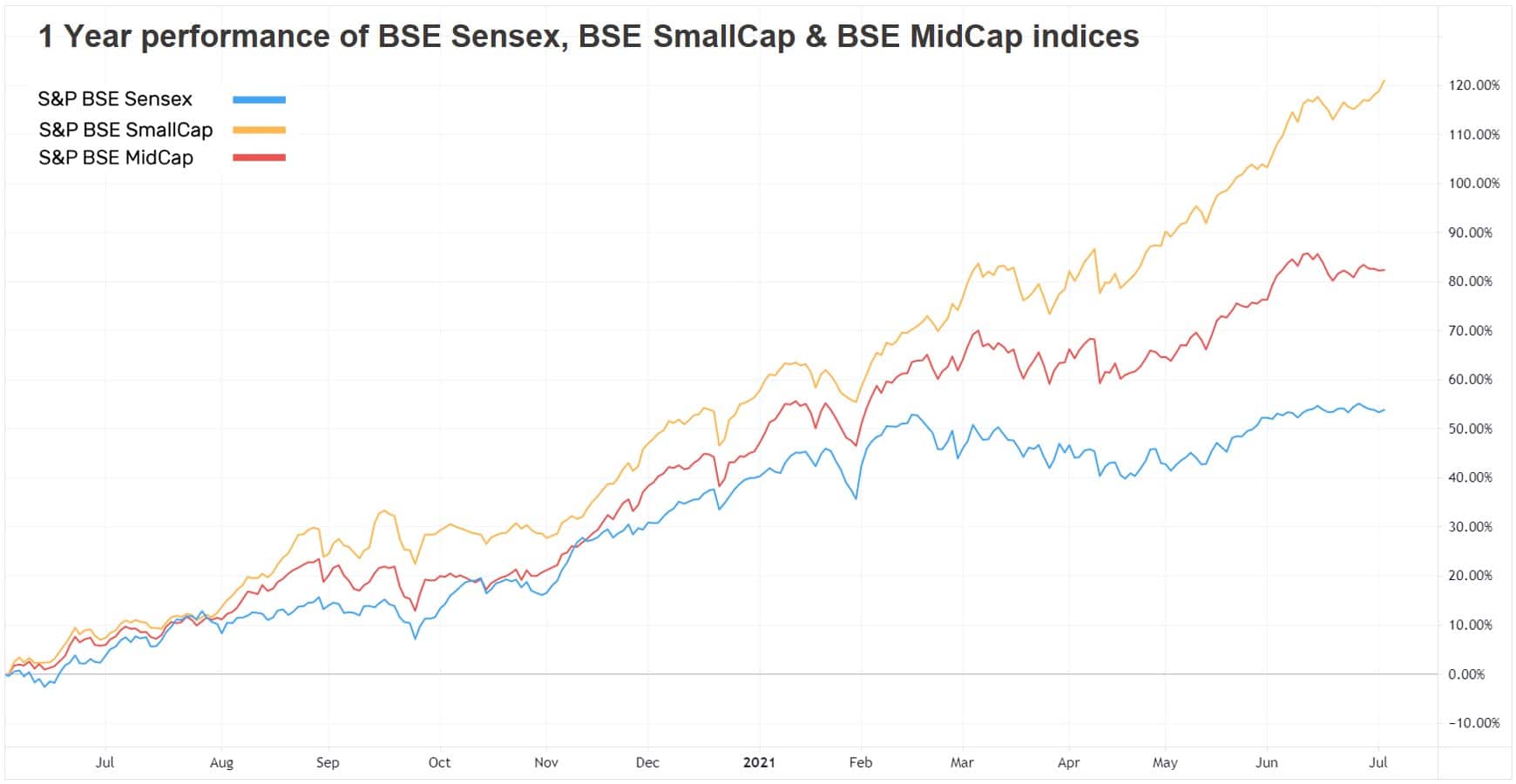

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.9% | 53.0% | 13.8% | 28.3 | 4.2 |

| NIFTY NEXT 50 | -0.2% | 47.8% | 10.7% | 30.8 | 5.2 |

| S&P BSE SENSEX | -0.8% | 46.3% | 14.2% | 31.8 | 3.4 |

| S&P BSE SmallCap | 2.3% | 103.5% | 17.1% | 49.5 | 3.2 |

| S&P BSE MidCap | -0.2% | 70.1% | 13.7% | 43.0 | 3.1 |

| NASDAQ 100 | 2.7% | 42.3% | 27.5% | 38.6 | 9.0 |

| S&P 500 | 1.7% | 38.9% | 16.9% | 30.7 | 4.7 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HDFC Dynamic Debt | 5.3% | 10.4% | 8.0% |

| Mirae Asset Healthcare | 4.5% | 66.0% | 33.9% |

| UTI Healthcare | 4.2% | 62.2% | 28.20% |

| Union Small Cap | 4.1% | 104.8% | 21.8% |

| 4.1% | 63.5% | 28.5% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| BOI AXA Tax Advantage | 2.9% | 77.3% | 21.2% |

| Invesco India Tax | 1.3% | 57.0% | 16.5% |

| Baroda Elss 96 B | 1.1% | 60.3% | 12.80% |

| IDFC Tax Advantage | 1.0% | 83.9% | 17.20% |

| 0.9% | 59.2% | 13.6% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Indian Overseas Bank | 18.8% | 137.0% | 0.3% |

| Apollo Hospitals Enterprise | 16.5% | 183.0% | 23.1% |

| Info Edge (India) | 11.3% | 92.9% | 44.60% |

| Gland Pharma | 9.8% | NA | NA |

| 7.2% | 97.3% | 33.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Brazil | -3.5% | 27.3% | 8.2% |

| Franklin Asian Equity | -1.5% | 31.5% | 13.7% |

| -1.5% | 48.9% | 12.70% | |

| Motilal Oswal Focused 25 | -1.3% | 45.5% | 15.5% |

| -1.3% | 49.3% | 10.4% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Gas | -26.5% | 477.6% | NA |

| Adani Transmission | -23.7% | 264.0% | 89.7% |

| Adani Green Energy | -10.8% | 196.0% | NA |

| Vodafone Idea | -7.9% | -13.3% | -32.8% |

| -5.7% | 802.1% | 77.1% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.4% | 59.5% | 23.1% |

| IPRU Equity Arbitrage | 0.1% | 4.4% | 5.7% |

| Axis Bluechip | -0.5% | 46.3% | 17.1% |

| UTI Nifty Index | -0.8% | 50.6% | 14.9% |

| 3.1% | 181.9% | 33.1% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Banking & Financial ... | -0.5% | 67.0% | 13.0% |

| HDFC Small Cap | 3.9% | 108.2% | 17.0% |

| Motilal Oswal Asset Allocat... | 0.1% | NA | NA |

| HDFC Top 100 | -0.6% | 52.5% | 13.7% |

| 0.1% | 4.2% | 5.80% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | 3.1% | 181.9% | 33.1% |

| Parag Parikh Flexi Cap | 1.4% | 59.5% | 23.1% |

| IPRU Technology | 1.7% | 133.6% | 33.9% |

| Mirae Asset Emerging Bluechip | 0.4% | 69.6% | 24.2% |

| 1.5% | 114.5% | 31.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -1.1% | 22.5% | 35.0% |

| Adani Green Energy | -10.8% | 196.0% | NA |

| Infosys | 0.5% | 114.0% | 23.2% |

| Tata Motors | 3.1% | 242.5% | -5.5% |

| Tata Consultancy Services | -1.4% | 58.9% | 22.9% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 1.0% | 180.9% | 73.4% |

| Apple | 5.1% | 53.8% | 42.3% |

| Amazon.com | 3.2% | 21.7% | 37.1% |

| Microsoft Corporation | 4.8% | 34.7% | 40.3% |

| 3.9% | 51.9% | 25.4% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!