Top news

FM Nirmala Sitharaman announced some key reforms in her budget speech -

- CAPEX at Rs 5.54 lakh crores, Rs 2.23 lakh crores for healthcare and Rs 1.1 lakh crores for railways

- Strategic disinvestment of BPCL, Air India besides divesting 2 PSBs, 1 Insurance company and IPO of LIC

- Fiscal deficit at 9.5% of GDP for FY21

- Citizens over 75 years exempted from filing tax returns

RBI’s MPC maintained an accommodative stance and kept the repo rate & reverse repo rate unchanged at 4% and 3.35% respectively. GDP growth is projected at 10.5% for FY22.

The Supreme Court has directed Franklin Templeton to distribute Rs 9,122 crore among unitholders of the six wound up schemes in proportion to their respective holdings. The disbursement will be overseen by SBI Mutual Fund.

Nippon Mutual Fund has launched the NFOs for two Index Funds - Nippon India Nifty Midcap 150 Fund and Nippon India Nifty 50 Value 20 Fund. The NFOs close on February 12.

Index Returns

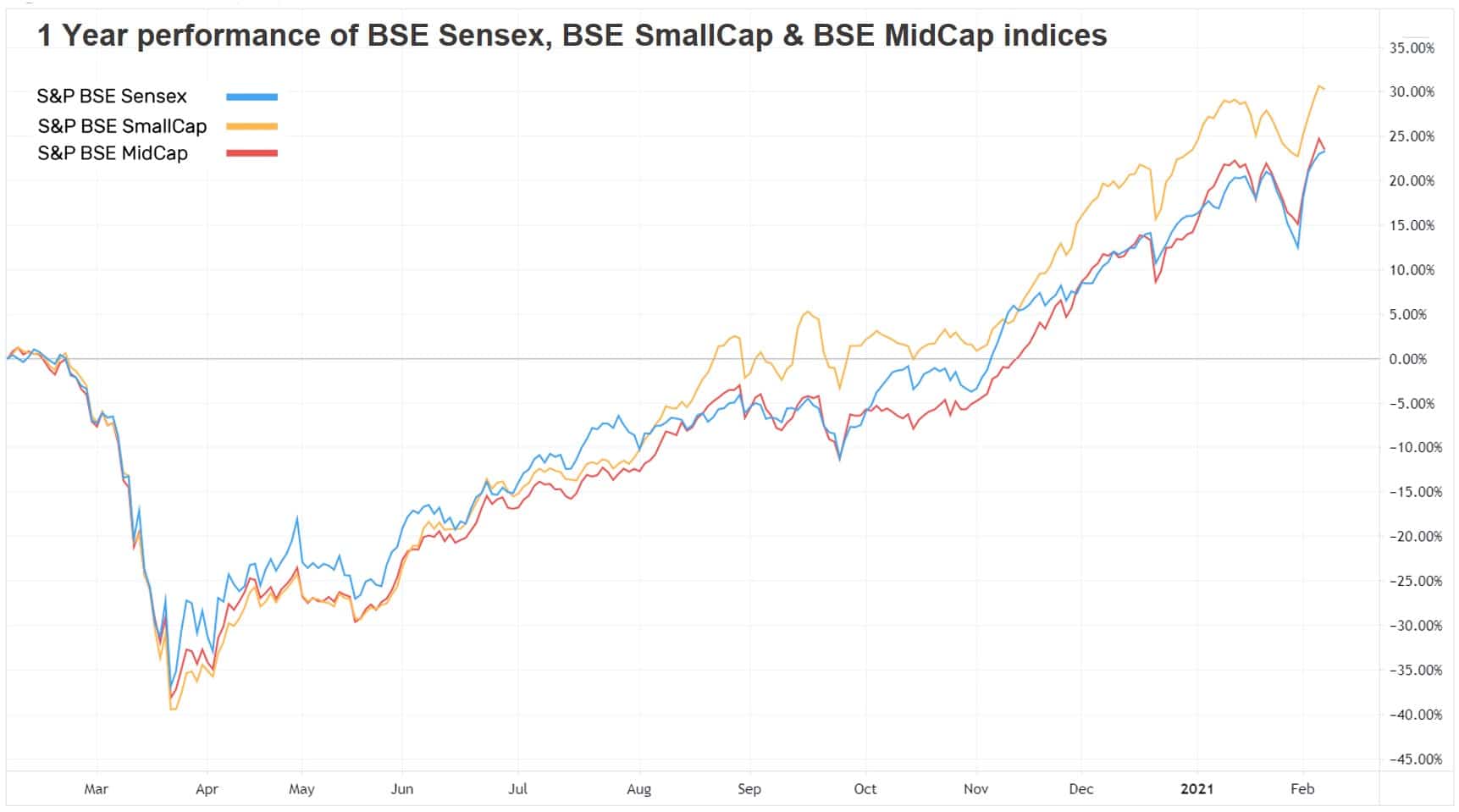

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 9.5% | 23.3% | 11.8% | 41.5 | 4.2 |

| NIFTY NEXT 50 | 6.5% | 18.3% | 4.5% | 41.7 | 4.5 |

| S&P BSE SENSEX | 9.6% | 23.2% | 13.4% | 34.3 | 3.4 |

| S&P BSE SmallCap | 6.2% | 30.2% | 2.4% | NA | 2.6 |

| S&P BSE MidCap | 7.4% | 23.5% | 5.4% | 59.5 | 2.9 |

| NASDAQ 100 | 5.2% | 60.8% | 25.7% | 40.0 | 8.8 |

| S&P 500 | 4.6% | 31.6% | 12.7% | 31.8 | 4.3 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| UTI Banking & Finan... | 15.1% | 9.5% | 5.0% |

| Baroda Banking & Finan... | 14.6% | 12.0% | 11.8% |

| SBI Banking & Finan... | 14.6% | 16.3% | 17.2% |

| Taurus Banking & Finan... | 14.2% | 13.8% | 14.4% |

| 14.2% | 5.9% | 4.9% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata India Tax Saving | 10.8% | 23.2% | 11.9% |

| JM Tax Gain | 10.7% | 24.4% | 14.0% |

| Nippon India Tax Saver | 10.4% | 10.1% | -1.7% |

| 10.2% | 34.9% | 18.4% | |

| 9.6% | 29.2% | 8.9% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| State Bank of India | 39.2% | 28.3% | 18.8% |

| IndusInd Bank Ltd | 27.7% | -19.5% | 3.0% |

| Canara Bank | 25.7% | -13.4% | -1.9% |

| Bank of Baroda | 23.6% | -5.3% | -8.0% |

| 23.0% | -29.3% | -15.8% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Invesco India Gold | -4.2% | 16.1% | 15.2% |

| IDBI Gold | -4.1% | 15.0% | 14.0% |

| Aditya Birla Sun Life Gold | -3.9% | 15.9% | 15.3% |

| Kotak Gold | -3.9% | 17.2% | 15.9% |

| -3.8% | 16.7% | 14.7% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Havells India | -6.2% | 82.4% | 30.2% |

| UPL | -5.2% | 2.7% | 15.3% |

| ICICI Prudential Life Insurance Co | -3.8% | 0.4% | NA |

| Godrej Consumer Products | -3.5% | 14.5% | 13.4% |

| -2.7% | 25.7% | 22.0% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 5.9% | 37.2% | 18.3% |

| UTI Nifty Index | 9.4% | 24.2% | 12.9% |

| Axis Bluechip | 8.8% | 22.1% | 18.6% |

| Motilal Oswal Nasdaq 100 FoF | 4.1% | 49.1% | NA |

| 5.1% | 83.7% | 27.8% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| 7.7% | 25.2% | 12.4% | |

| ABSL Frontline Equity | 9.0% | 23.4% | 9.9% |

| HDFC Hybrid Equity | 8.4% | 22.8% | 9.9% |

| L&T Emerging Businesses | 6.4% | 20.5% | 1.8% |

| 8.9% | 26.5% | 7.7% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | 3.4% | 57.8% | 28.4% |

| PGIM India Global Equity Opp... | 4.5% | 71.7% | 33.7% |

| Axis Bluechip | 8.8% | 22.1% | 18.6% |

| IPRU Technology | 4.6% | 70.4% | 27.7% |

| 5.9% | 37.2% | 18.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 2.5% | 36.2% | 32.3% |

| Adani Green Energy | 4.2% | 443.7% | NA |

| Infosys | -0.3% | 61.5% | 18.4% |

| Tata Consultancy Services | -1.3% | 49.8% | 22.5% |

| 16.5% | 29.9% | 25.2% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 7.4% | 469.5% | 92.2% |

| GameStop Corp. | -80.4% | 1440.3% | 18.9% |

| Apple | 3.6% | 68.2% | 42.2% |

| Amazon.com | 4.6% | 63.5% | 46.2% |

| 4.4% | 31.9% | 37.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!