Top news

RBI’s MPC kept the repo rate & reverse repo rate unchanged at 4% and 3.35% respectively with an accommodative stance. RBI kept GDP growth projection unchanged at 9.5% for FY22 while CPI inflation forecast has been revised to 5.7%. from 5.1%.

EPFO has made it mandatory for its subscribers to link their Aadhaar with UAN by 1 Sept.

IPOs of Devyani International, Krsnaa Diagnostics, Exxaro Tiles and Windlas Biotech got oversubscribed by 117 times, 64 times, 23 times and 22 times respectively.

Mirae Asset MF, HDFC MF and UTI MF have launched the NFOs for Mirae Asset Money Market Fund, HDFC NIFTY50 Equal Weight Index Fund and UTI Focused Equity Fund. NFOs close on 10 Aug, 13 Aug and 18 Aug respectively.

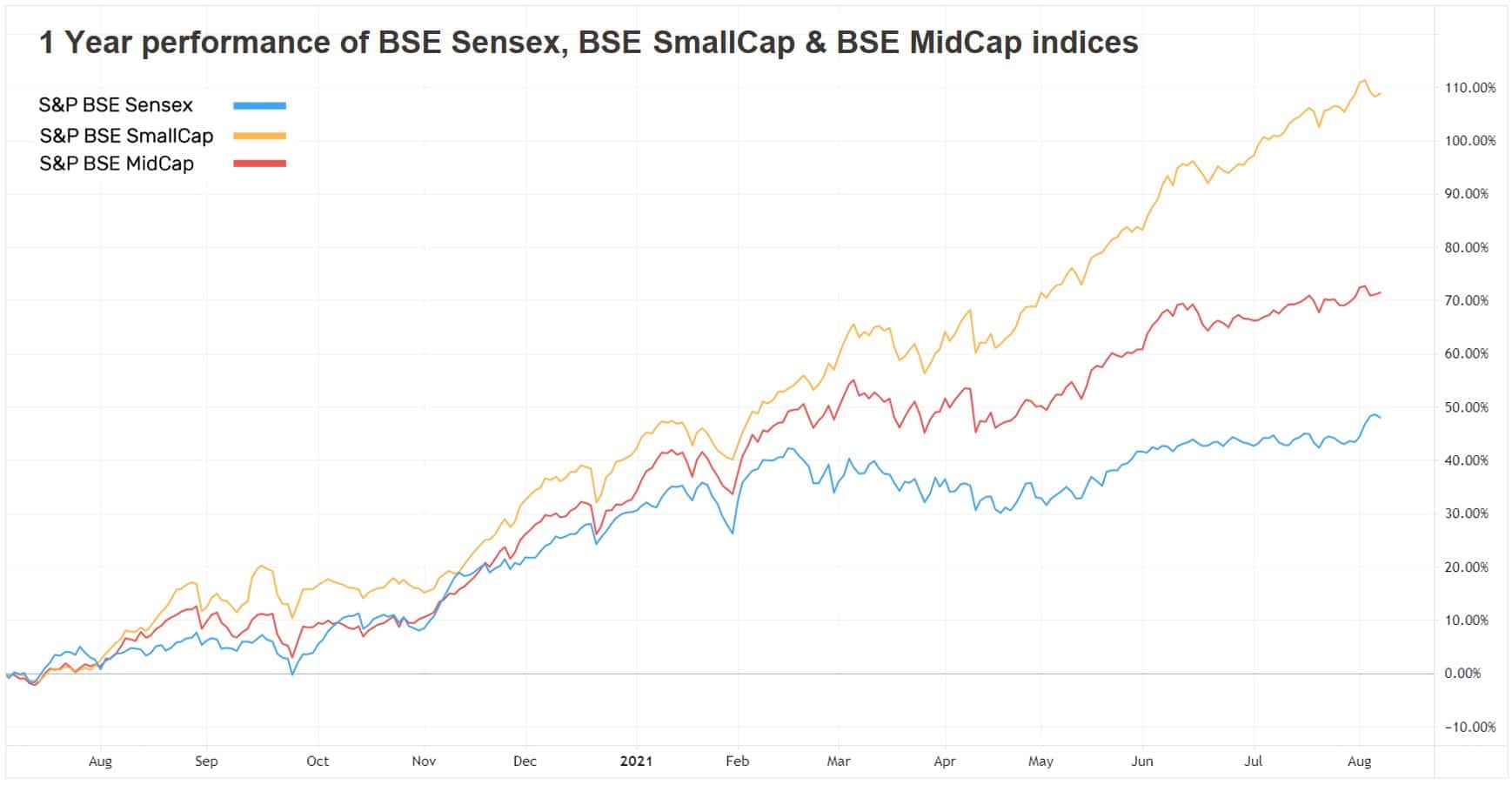

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 3.0% | 44.9% | 12.6% | 26.5 | 4.2 |

| NIFTY NEXT 50 | 1.0% | 46.8% | 9.9% | 29.8 | 5.0 |

| S&P BSE SENSEX | 3.2% | 42.6% | 12.9% | 29.8 | 3.5 |

| S&P BSE SmallCap | 0.1% | 97.4% | 16.6% | 44.0 | 3.4 |

| S&P BSE MidCap | 0.5% | 65.4% | 12.6% | 44.7 | 3.2 |

| NASDAQ 100 | 1.0% | 34.0% | 25.8% | 35.5 | 9.0 |

| S&P 500 | 0.9% | 32.4% | 15.7% | 27.2 | 4.7 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Taurus Banking & Fin... | 3.3% | 54.2% | 11.8% |

| LIC MF Index Sensex | 3.2% | 43.1% | 13.5% |

| Nippon India Index Sensex | 3.2% | 43.7% | 13.8% |

| HDFC Index Sensex | 3.2% | 43.9% | 13.8% |

| 3.2% | 43.6% | 13.9% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Navi Long Term Advantage | 2.4% | 45.4% | 11.9% |

| PGIM India Long Term Equity | 2.4% | 59.3% | 16.7% |

| LIC MF Tax | 2.3% | 49.6% | 13.6% |

| Franklin India Taxshield | 2.2% | 64.7% | 13.2% |

| 2.2% | 46.4% | 11.6% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Piramal Enterprises | 14.9% | 85.9% | 12.7% |

| SRF | 12.9% | 134.6% | 42.5% |

| Tech Mahindra | 12.2% | 94.9% | 22.6% |

| Sun Pharma | 11.8% | 48.6% | -0.9% |

| 10.1% | 176.1% | 13.7% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Brazil | -3.9% | 14.0% | 1.7% |

| DSP World Mining | -2.9% | 36.1% | 22.2% |

| IDBI Gold | -1.9% | -16.4% | 15.6% |

| Invesco India Gold | -1.5% | -15.2% | 14.9% |

| -1.5% | -15.5% | 16.1% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Vodafone Idea | -13.9% | -14.5% | -35.6% |

| Zomato | -7.4% | NA | NA |

| UPL | -5.1% | 71.4% | 14.6% |

| Bajaj Finserv | -4.0% | 124.4% | 39.3% |

| -3.9% | 11.5% | -5.7% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 0.7% | 56.6% | 23.6% |

| UTI Nifty Index | 3.0% | 46.5% | 13.6% |

| Axis Bluechip | 2.3% | 43.2% | 16.5% |

| Quant Small Cap | -0.5% | 143.6% | 36.0% |

| 1.6% | 104.1% | 36.8% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Mirae Asset Arbitrage | 0.0% | 4.5% | NA |

| Kotak Equity Arbitrage | 0.0% | 4.7% | 5.8% |

| HDFC Flexicap | 1.8% | 62.2% | 13.3% |

| Axis Arbitrage | 0.0% | 4.4% | 5.70% |

| 2.1% | 55.8% | 11.9% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | -0.5% | 143.6% | 36.0% |

| Parag Parikh Flexi Cap | 0.7% | 56.6% | 23.6% |

| IPRU Technology | 1.6% | 104.1% | 36.8% |

| Mirae Asset Emerging Bluechip | 1.6% | 67.5% | 23.3% |

| 1.9% | 92.6% | 32.8% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 1.6% | -1.8% | 33.4% |

| Adani Green Energy | -1.1% | 166.0% | NA |

| Infosys | 2.1% | 74.7% | 26.8% |

| Tata Motors | 2.4% | 159.7% | -10.3% |

| 3.6% | 46.5% | 21.5% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 1.7% | 140.5% | 72.3% |

| Apple | 0.2% | 31.5% | 40.3% |

| Microsoft Corporation | 1.6% | 36.2% | 37.9% |

| Amazon.com | 0.5% | 5.6% | 34.3% |

| 2.0% | 35.4% | 23.8% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!