Top news

NSE will launch four new indices on 08/April which are Nifty Tata Group 25 percent Cap, Nifty 500 Multicap India Manufacturing (50:30:20), Nifty 500 Multicap Infrastructure (50:30:20) and Nifty MidSmall Healthcare.

India’s foreign exchange reserves (Forex) reserves increased by USD 2.95 billion to reach USD 645.58 Billion for the week ending March 29.

Shares of SRM Contractors got listed at a premium of 7% over issue price of Rs 210.IPO of Bharti Hexacom Limited got over subscribed by 29.88 times.

TrustMF AMC has launched the NFO for TrustMF Flexi Cap Plan. The NFO closes on 19 April 2024.

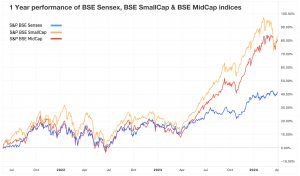

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 0.8% | 28.2% | 14.6% | 23.1 | 4.0 |

| NIFTY NEXT 50 | 3.4% | 64.6% | 21.4% | 23.5 | 4.1 |

| S&P BSE SENSEX | 0.8% | 24.4% | 17.9% | 25.4 | 3.8 |

| S&P BSE SmallCap | 6.6% | 67.2% | 35.2% | 33.1 | 3.6 |

| S&P BSE MidCap | 3.8% | 68.9% | 26.9% | 28.7 | 3.7 |

| NASDAQ 100 | -0.8% | 38.6% | 12.7% | 29.4 | 3.3 |

| S&P 500 | -1.0% | 26.8% | 10.4% | 28.3 | 4.8 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Aditya Birla Sun Life Silver ETF FoF | 7.4% | 10.1% | NA |

| ICICI Prudential Silver ETF FoF | 7.0% | 6.6% | NA |

| Nippon India Silver ETF FoF | 5.2% | 6.5% | NA |

| ABSL Gold | 5.1% | 16.5% | 14.7% |

| UTI Silver ETF FoF | 5.0% | NA | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant ELSS Tax Saver | 3.1% | 64.5% | 33.9% |

| HSBC ELSS Tax Saver | 2.2% | 45.0% | 19.7% |

| Bank Of India ELSS Tax Saver | 2.0% | 60.2% | 27.2% |

| JM ELSS Tax Saver | 2.0% | 49.8% | 23.1% |

| NJ ELSS Tax Saver | 1.6% | NA | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Schaeffler India | 18.1% | 14.4% | 25.5% |

| Vedanta | 17.4% | 12.9% | 21.2% |

| Adani Power | 17.4% | 228.9% | 65.8% |

| Aditya Birla Capital | 16.8% | 33.2% | 15.3% |

| Hindustan Zinc | 16.3% | 14.0% | 10.8% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| -3.0% | 8.7% | NA | |

| Kotak Global Innovation FoF | -2.2% | 24.9% | NA |

| IPRU Nasdaq 100 Index | -2.0% | 37.8% | NA |

| ABSL Global Excellence Equity FoF | -2.0% | 33.1% | 14.1% |

| Franklin India Feeder Franklin US Opportunities | -2.0% | 40.0% | 9.1% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| CG Power and Industrial Solutions | -4.9% | 73.4% | 66.9% |

| Hero MotoCorp Ltd | -4.2% | 86.1% | 13.8% |

| TVS Motor Co | -3.8% | 90.8% | 34.5% |

| Godrej Consumer Products | -3.3% | 25.5% | 12.6% |

| Tube Investments of India | -3.3% | 41.1% | 56.1% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.2% | 41.9% | 23.3% |

| Quant Small Cap | 6.1% | 75.3% | 43.6% |

| UTI Nifty 50 Index | 0.8% | 29.4% | 16.5% |

| Quant Momentum | 4.8% | NA | NA |

| Kotak Equity Arbitrage | 0.3% | 8.7% | 6.4% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Canara Robeco Emerging Equities | 1.9% | 39.7% | 20.3% |

| PGIM India Midcap Opportunities | 2.4% | 33.8% | 22.6% |

| Kotak Flexicap | 2.1% | 38.0% | 18.6% |

| 7.8% | NA | NA | |

| Mirae Asset Focused | 1.4% | 24.9% | 13.0% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Axis Nifty 50 Index | 0.8% | 29.4% | NA |

| Bandhan Small Cap | 5.4% | 77.9% | NA |

| Axis Small Cap | 3.7% | 45.5% | 28.1% |

| UTI Nifty Next 50 Index | 3.4% | 65.1% | 18.0% |

| Bandhan Core Equity | 2.9% | 58.2% | 21.4% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Motors | 1.4% | 137.4% | 38.1% |

| Suzlon Energy | 5.6% | 426.5% | 48.7% |

| Indian Railway Finance Corp | 3.9% | 431.8% | NA |

| Adani Power | 17.4% | 228.9% | 59.6% |

| Tata Steel | 4.8% | 56.9% | 27.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!