Top news

The Securities and Exchange Board of India (SEBI) outlines the procedure for seeking a waiver or reduction of interest levied during recovery proceedings for penalty defaults, specifying eligibility criteria, the application process, and exclusions.

Indo Farm Equipment got listed at a premium of 20.2% over the issue price of ₹215. Standard Glass Lining got over subscribed by 185.48 times. Quadrant Future Tek got over subscribed by 195.96 times.

Bandhan AMC , Kotak AMC, Bajaj AMC , Whiteoak AMC, ICICI AMC , DSP AMC and Mirae AMC have launched the NFO for Bandhan Nifty Alpha Low Volatility 30 Index Growth , Kotak Nifty Smallcap 250 Index Growth, Whiteoak Capital Quality Equity Growth, ICICI Prudential Rural Opportunities Growth, DSP BSE Sensex Next 30 Index Growth and Mirae Asset Small Cap Growth

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -2.4% | 8.4% | 9.6% | 21.6 | 3.5 |

| NIFTY NEXT 50 | -7.1% | 18.8% | 14.5% | 23.5 | 3.6 |

| S&P BSE SENSEX | -2.3% | 8.0% | 17.9% | 22.4 | 4.0 |

| S&P BSE SmallCap | -5.7% | 18.0% | 35.2% | 31.8 | 3.7 |

| S&P BSE MidCap | -6.1% | 19.9% | 26.9% | 38.1 | 4.5 |

| NASDAQ 100 | 0.6% | 23.9% | 12.7% | 45.4 | 3.9 |

| S&P 500 | -0.7% | 21.9% | 10.4% | 29.7 | 5.1 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| 2.6% | 13.1% | NA | |

| Mirae Asset NYSE FANG ETF FoF | 2.6% | 96.6% | 36.0% |

| UTI Silver ETF FoF | 2.3% | 24.7% | NA |

| Mirae Asset S&P 500 Top 50 ETF FoF | 2.2% | 69.2% | 24.7% |

| Axis Nifty IT Index | 2.1% | 29.9% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh ELSS Tax Saver | -0.8% | 19.8% | 17.7% |

| 360 One ELSS Tax Saver Nifty 50 Index | -0.8% | 9.3% | NA |

| Navi ELSS Tax Saver Nifty 50 Index | -0.8% | 9.3% | NA |

| Navi ELSS Tax Saver | -0.9% | 12.5% | 11.4% |

| HDFC ELSS Tax Saver | -1.2% | 19.1% | 20.6% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| SRF | 16.9% | 12.5% | 30.1% |

| Lloyds Metals & Energy | 8.1% | 149.9% | NA |

| Godrej Consumer Products | 7.4% | 1.0% | 10.1% |

| Oil & Natural Gas Corporation | 6.9% | 21.4% | 16.3% |

| LTIMindtree | 6.5% | 3.6% | 27.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Shriram Multi Sector Rotation | -6.6% | NA | NA |

| HSBC Midcap | -5.9% | 32.1% | 24.0% |

| Tata Nifty200 Alpha 30 Index | -5.1% | NA | NA |

| Mirae Asset Nifty200 Alpha 30 ETF FoF | -5.1% | NA | NA |

| Bandhan Nifty Alpha 50 Index | -5.0% | 18.3% | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Kalyan Jewellers India | -20.5% | 63.9% | NA |

| JSW Energy | -15.8% | 18.6% | 50.7% |

| PB Fintech | -15.5% | 126.6% | NA |

| Godrej Properties | -15.1% | 6.5% | 19.9% |

| Premier Energies | -15.1% | NA | NA |

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -2.3% | 23.3% | 17.2% |

| Motilal Oswal Midcap | -5.8% | 48.6% | 33.3% |

| UTI Nifty 50 Index | -2.7% | 10.2% | 10.7% |

| Quant Small Cap | -2.2% | 19.1% | 24.3% |

| Edelweiss Balanced Advantage | -2.0% | 13.6% | 11.7% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| UTI Arbitrage | 0.1% | 8.0% | 6.9% |

| Mirae Asset Large Cap | -2.9% | 13.3% | 10.5% |

| SBI International Access US Equity FoF | 1.6% | 26.5% | 13.2% |

| Quant PSU | -2.5% | NA | NA |

| Quant Quantamental | -3.1% | 13.4% | 25.9% |

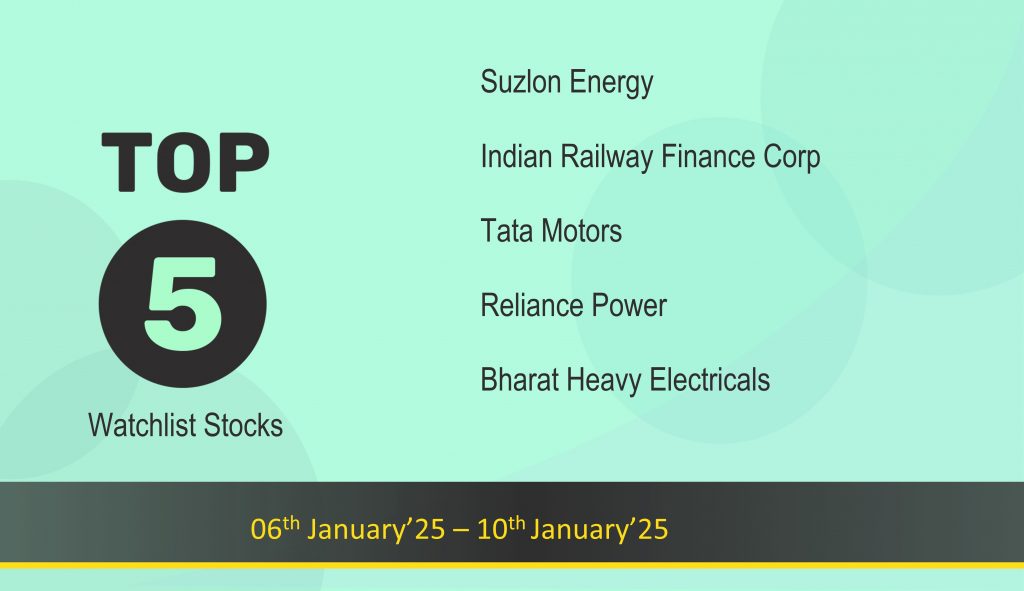

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Nifty 50 Index Growth Direct Plan | -2.4% | 10.2% | 10.8% |

| Axis Small Cap Growth Direct Plan | -4.7% | 23.1% | 20.1% |

| UTI Nifty Next 50 Index Growth Direct | -7.1% | 21.9% | 15.7% |

| Motilal Oswal Midcap Growth Direct Plan | -6.8% | 48.6% | 33.3% |

| Parag Parikh Flexi Cap Growth Direct Plan | -2.3% | 23.3% | 17.2% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Suzlon Energy | -11.7% | 27.6% | 84.3% |

| -10.7% | 35.6% | NA | |

| Tata Motors | 1.3% | -3.1% | 32.2% |

| Reliance Power | -12.0% | 24.8% | 70.2% |

| Bharat Heavy Electricals | -12.1% | 4.5% | 35.4% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| MicroStrategy Inc | 9.3% | 511.6% | 87.1% |

| NVIDIA Corporation | -1.7% | 147.9% | 85.9% |

| Tesla | 4.1% | 73.7% | 65.3% |

| Microsoft | 0.1% | 8.9% | 21.0% |

| Advanced Micro Devices, Inc. | -3.8% | 21.6% | 19.2% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!