Top news

SEBI has issued a circular that standardizes a periodic reporting format for Investment advisers (IAs) to submit information regarding their activities on half-yearly periods basis on September 30 and March 31 of every financial year.

NSE and BSE are conducting a special session for live trading on May 18, with an intra-day switchover from the Primary site (PR) to the Disaster Recovery (DR) site to check their preparedness to handle major disruption or failure at the PR site. It will be conducted from 9.15 am to 10 am from the PR site and then 11.45 am to 01.00 pm from the DR site.

IPO of Indegene, Aadhar Housing Finance and TBO Tek got over subscribed by 70.30 times, 26.76 times and 86.65 times respectively.

Baroda BNP Paribas AMC and Mirae AMC have launched the NFOs for Baroda BNP Paribas Retirement Fund and Mirae Asset Nifty Midsmallcap400 Momentum Quality 100 ETF FoF. The NFOs closes on 22nd May and 24th May respectively.

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -1.9% | 20.4% | 14.1% | 21.3 | 3.9 |

| NIFTY NEXT 50 | -2.8% | 57.7% | 21.2% | 24.0 | 4.5 |

| S&P BSE SENSEX | -1.6% | 17.3% | 17.9% | 23.3 | 3.5 |

| S&P BSE SmallCap | -3.8% | 54.2% | 35.2% | 32.2 | 3.4 |

| S&P BSE MidCap | -3.3% | 56.7% | 26.9% | 29.3 | 3.7 |

| NASDAQ 100 | 1.1% | 33.0% | 12.7% | 31.9 | 3.2 |

| S&P 500 | 1.9% | 26.6% | 10.4% | 27.1 | 4.7 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| UTI Silver ETF FoF | 5.8% | 10.5% | NA |

| Nippon India Silver ETF FoF | 5.5% | 9.8% | NA |

| ICICI Prudential Silver ETF FoF | 5.4% | 10.1% | NA |

| Kotak Silver ETF FoF | 5.3% | 9.6% | NA |

| HDFC Silver ETF FoF | 5.1% | 9.9% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| UTI ELSS Tax Saver | -1.1% | 29.5% | 15.8% |

| Quantum ELSS Tax Saver | -1.1% | 37.7% | 17.9% |

| ICICI Prudential ELSS Tax Saver | -1.2% | 32.9% | 18.4% |

| Franklin India ELSS Tax Saver | -1.3% | 42.6% | 22.4% |

| Axis ELSS Tax Saver | -1.3% | 28.1% | 11.7% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Hindustan Zinc | 21.6% | 68.1% | 18.2% |

| MARICO | 13.4% | 9.1% | 12.2% |

| Bharat Forge | 9.7% | 80.4% | 25.5% |

| Supreme | 9.7% | 88.1% | 39.7% |

| Prestige Estate | 8.5% | 215.8% | 42.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Multi Index FoF | -3.0% | 31.2% | NA |

| HSBC Managed Solutions India | -3.3% | 28.7% | 16.4% |

| HSBC Aggressive Hybrid | -2.6% | 30.3% | 14.9% |

| Mahindra Manulife Balanced Advantage | -2.6% | 29.1% | NA |

| ABSL Asset Allocator FoF | -2.8% | 28.3% | 14.8% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| SRF | -14.7% | -11.7% | 37.1% |

| Canara Bank | -12.8% | 81.0% | 17.6% |

| Torrent Power | -11.9% | 151.8% | 41.2% |

| Yes Bank | -11.6% | 39.7% | -31.1% |

| Power Finance Corp | -10.7% | 213.8% | 41.5% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -1.4% | 35.8% | 21.6% |

| Quant Small Cap | -5.3% | 62.2% | 34.6% |

| UTI Nifty 50 Index | -1.7% | 21.7% | 15.0% |

| Quant Mid Cap | -4.4% | 66.0% | 34.7% |

| Quant Infrastructure | -4.6% | 71.8% | 36.9% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Samco Active Momentum | -2.8% | NA | NA |

| Edelweiss Arbitrage | 0.3% | 8.5% | 6.5% |

| Sundaram Equity Saving | -1.0% | 20.2% | 14.1% |

| SBI Technology Opportunities | -1.3% | 23.9% | 16.2% |

| UTI Nifty 500 Value 50 Index | -4.6% | 85.1% | NA |

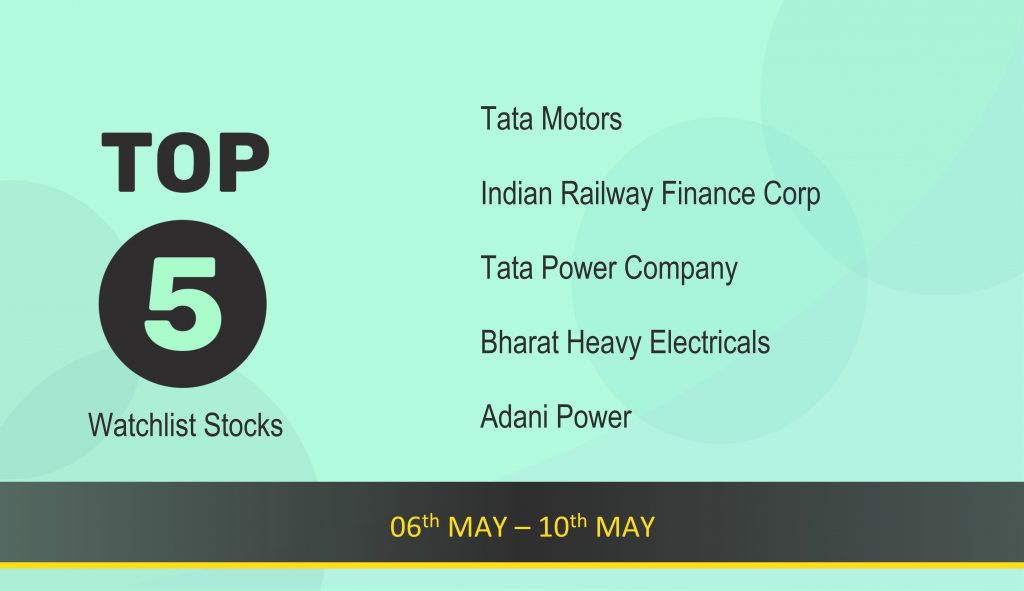

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Axis Nifty 50 Index | -1.7% | 21.6% | NA |

| Bandhan Small Cap | -3.5% | 69.4% | NA |

| Axis Small Cap | -2.1% | 36.2% | 28.3% |

| UTI Nifty Next 50 Index | -2.8 | 58.1% | 19.8% |

| Bandhan Core Equity | -2.6% | 53.0% | 22.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Motors | 1.8% | 107.9% | 40.5% |

| -6.8% | 349.7% | NA | |

| Tata Power Company | -9.4% | 103.9% | 47.1% |

| Bharat Heavy Electricals | -6.3% | 245.3% | 36.1% |

| Adani Power | -0.8% | 151.1% | 69.5% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Super Micro Computer | 2.0% | 491.8% | 108.7% |

| NVIDIA Corporation | 1.2% | 210.3% | 84.5% |

| Meta Platforms | 5.4% | 104.1% | 20.4% |

| Netflix, Inc. | 5.4% | 81.8% | 11.1% |

| Amazon.com | 0.7% | 69.8% | 14.7% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!