Top news

The net Asset Under Management (AUM) of the Mutual Fund industry rose to an all time high of Rs 37.72 lakh crore at December 2021 end. An overall increase of 22% from previous year.

SIP inflows hit an all time high of Rs 11,305 crore in December 2021. SIP contribution for the year 2021 stood at Rs 1.14 lakh crore while the number of SIP folios jumped to 4.9 crore from 3.47 crore of previous year.

Motilal Oswal MF has suspended lump sum and switch-in investments for Motilal Oswal Nasdaq 100 FOF, Motilal Oswal S&P 500 Index Fund, Motilal Oswal Msci Eafe Top 100 Select Index Fund w.e.f 17 January. The AMC restriction came after it neared SEBI’s overseas investment limits of $1 billion.

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 2.5% | 25.0% | 19.3% | 25.3 | 4.6 |

| NIFTY NEXT 50 | 1.7% | 26.8% | 16.5% | 23.7 | 4.4 |

| S&P BSE SENSEX | 2.5% | 23.4% | 19.5% | 29.0 | 3.8 |

| S&P BSE SmallCap | 3.1% | 63.7% | 28.6% | 48.1 | 3.6 |

| S&P BSE MidCap | 2.4% | 36.2% | 20.0% | 27.8 | 3.2 |

| NASDAQ 100 | 0.1% | 21.0% | 33.6% | 38.1 | 8.8 |

| S&P 500 | -0.3% | 22.8% | 21.8% | 25.6 | 4.8 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Mining | 7.8% | 19.6% | 26.6% |

| HSBC Brazil | 6.1% | -25.7% | -12.7% |

| Nippon India Focused Equity | 4.5% | 37.3% | 22.6% |

| ABSL Infrastructure | 4.4% | 48.3% | 20.7% |

| 4.3% | 57.0% | 29.4% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 3.9% | 61.0% | 39.1% |

| Taurus Taxshield | 3.9% | 23.0% | 17.1% |

| IDFC Tax Advantage | 3.5% | 48.8% | 26.5% |

| Nippon India Tax Saver | 3.2% | 38.3% | 15.1% |

| 3.1% | 35.8% | 21.0% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Green Energy | 19.3% | 53.4% | NA |

| Adani Transmission | 14.8% | 352.2% | 102.9% |

| Bandhan Bank | 12.1% | -20.9% | NA |

| InterGlobe Aviation | 28.9% | 25.1% | 20.3% |

| 14.6% | -49.6% | 52.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp.. | -4.3% | -2.9% | 27.9% |

| -3.9% | 7.8% | 26.4% | |

| ABSL Global Emerging... | -1.1% | 15.6% | 19.3% |

| -0.9% | -11.8% | 10.1% | |

| -0.7% | 19.1% | 18.3% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Wipro | -9.3% | 39.4% | 28.6% |

| Avenue Supermart | -8.1% | 47.7% | NA |

| Gland Pharma | -6.5% | 69.2% | NA |

| Asian Paints | -4.3% | 24.4% | 29.2% |

| -4.2% | -8.2% | NA |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 1.1% | 44.1% | 31.2% |

| Motilal Oswal Nasdaq 100 FOF | -2.2% | 21.2% | 35.3% |

| Tata Digital India | 2.0% | 62.7% | 45.5% |

| Motilal Oswal S&p 500 Index | -1.1% | 24.0% | NA |

| 2.5% | 26.3% | 20.4% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Flexi Cap | 2.6% | 30.1% | 21.2% |

| SBI Blue Chip | 2.4% | 26.3% | 20.9% |

| HDFC Hybrid Equity | 2.4% | 26.2% | 17.7% |

| IPRU Commodities | 2.6% | 69.1% | NA |

| 0.0% | 4.8% | 5.3% |

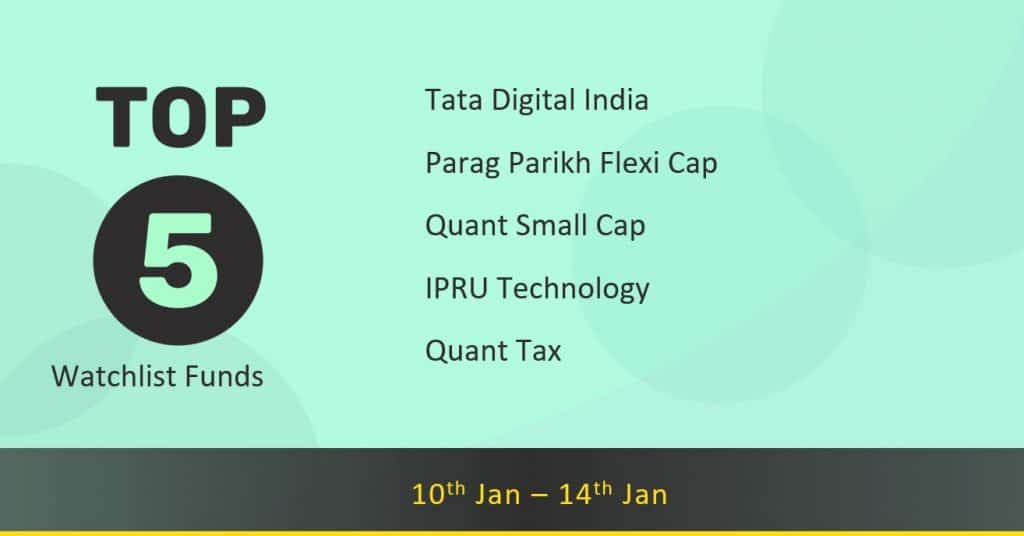

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | 2.0% | 62.7% | 45.5% |

| Parag Parikh Flexi Cap | 1.1% | 44.1% | 31.2% |

| Quant Small Cap | 2.9% | 93.8% | 41.1% |

| IPRU Technology | 2.0% | 65.5% | 46.1% |

| 3.9% | 61.0% | 39.1% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 7.4% | 79.5% | 36.6% |

| Adani Green Energy | 19.3% | 53.4% | NA |

| Tata Motors | 7.9% | 177.0% | -0.2% |

| Infosys | 3.8% | 55.5% | 33.1% |

| 8.4% | 36.5% | 29.9% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | 0.4% | 36.8% | 43.9% |

| Tesla | 0.7% | 25.2% | 85.1% |

| Microsoft Corporation | -1.2% | 47.1% | 39.7% |

| Amazon.com | -0.3% | 4.5% | 31.7% |

| Meta Platforms | -1.0% | 30.7% | 20.7% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!