Top news

SEBI, in a consultation paper, has introduced measures to oversee the association between registered intermediaries and unregistered entities, particularly fin-fluencers. The measures are designed to bolster transparency and ethical standards to establish a trustworthy financial landscape.

RBI has increased UPI's offline payment cap to Rs 500 from Rs 200, promoting wider usage.The move maintains security with a Rs 2000 overall limit and aligns with RBI's earlier strategy for Small Value Digital Payments in Offline Mode since January 2022.

IPOs of Aeroflex Industries and Pyramid Technoplast got oversubscribed by 97.11 times and 18.29 times, respectively.

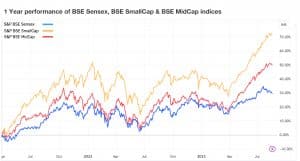

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.2% | 10.0% | 18.9% | 22.0 | 4.4 |

| NIFTY NEXT 50 | 0.9% | 3.0% | 16.6% | 24.9 | 4.4 |

| S&P BSE SENSEX | -0.1% | 10.4% | 18.7% | 23.7 | 3.5 |

| S&P BSE SmallCap | 1.1% | 16.1% | 34.4% | 29.5 | 3.0 |

| S&P BSE MidCap | 1.5% | 22.8% | 26.9% | 24.2 | 3.2 |

| NASDAQ 100 | 2.3% | 11.9% | 8.7% | 26.2 | 4.2 |

| S&P 500 | 0.8% | 8.6% | 8.7% | 25.2 | 4.2 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Mirae Asset NYSE FANG+ ETF FoF | 4.9% | 46.7% | NA |

| Edelweiss US Technology Equity FoF | 4.4% | 22.4% | 8.0% |

| HDFC Defence | 4.2% | NA | NA |

| DSP World Gold | 3.6% | 17.6% | -9.2% |

| Motilal Oswal Nifty Microcap 250 Index | 3.2% | NA | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal Long Term Equity | 1.7% | 22.4% | 25.0% |

| Axis Long Term Equity | 1.4% | 3.8% | 14.5% |

| Mahindra Manulife ELSS | 1.1% | 16.4% | 26.1% |

| JM Tax Gain | 1.1% | 20.5% | 25.2% |

| WOC Tax Saver | 1.0% | NA | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Power | 13.4% | -16.7% | 58.9% |

| Tata Communications | 7.1% | 55.5% | 30.0% |

| Adani Transmission | 6.4% | -76.4% | 39.5% |

| Cholamandalam Investment and Finance Co | 6.0% | 35.5% | 30.2% |

| Siemens | 5.9% | 31.0% | 30.0% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| ICICI Prudential Nifty Pharma Index | -1.6% | NA | NA |

| Tata India Pharma & HealthCare | -1.3% | 24.8% | 16.7% |

| UTI Healthcare | -1.2% | 24.0% | 14.1% |

| ITI Pharma and Healthcare | -1.2% | 21.8% | NA |

| ICICI Prudential US Bluechip Equity | -1.1% | 15.6% | 14.9% |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Macrotech Developers | -8.6% | 20.3% | NA |

| Union Bank of India | -5.3% | 121.3% | 2.1% |

| PI Industries | -5.0% | 7.5% | 37.0% |

| Sbi Cards And Payment Services | -3.4% | -11.0% | NA |

| Tech Mahindra | -3.4% | 11.1% | 13.8% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Small Cap | 0.9% | 38.4% | 46.9% |

| Parag Parikh Flexi Cap | 0.6% | 18.3% | 23.2% |

| HDFC Balanced Advantage | 0.5% | 21.4% | 26.0% |

| ICICI Prudential Nifty Bank Index | 0.9% | 13.9% | NA |

| UTI Nifty 50 Index | -0.2% | 10.9% | 20.1% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Bluechip | 0.4% | 4.6% | 14.5% |

| Quant Manufacturing | 1.0% | NA | NA |

| Motilal Oswal Flexi Cap | 2.4% | 13.0% | 13.8% |

| Axis Mid Cap | 1.7% | 13.8% | 23.7% |

| Axis Focused 25 | 1.1% | 0.0% | 12.5% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal Midcap | 2.4% | 25.7% | 35.9% |

| Axis Small Cap | 1.9% | 22.6% | 33.5% |

| IPRU Bluechip | 0.7% | 16.4% | 23.3% |

| IPRU Value Discovery | 0.7% | 23.2% | 29.2% |

| Bandhan Sterling Value | 0.8% | 23.4% | 36.0% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Motors | -1.4% | 30.6% | 19.1% |

| IDFC First Bank | 2.9% | 87.5% | 14.3% |

| ITC | 0.5% | 41.2% | 10.0% |

| Tata Steel | 0.7% | 9.7% | 18.2% |

| Union Bank Of India | -5.3% | 121.3% | 1.8% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Provention Bio | 2.2% | 396.6% | 49.2% |

| NVIDIA Corporation | 6.3% | 183.0% | 46.8% |

| Netflix | 2.8% | 86.3% | 3.0% |

| Microsoft Corporation | 2.1% | 20.5% | 25.7% |

| Alphabet | 1.9% | 17.7% | 16.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!