Top news

Data released by the ministry of statistics shows that factory output in India is at an eight-month high. The index of industrial production, a measure of output at factories, mines and utilities, rose by 3.6% in October.

Tata Consultancy Services on Wednesday announced a share buyback plan amounting to Rs 16,000 crore, which will commence on December 18 and close on January 1, 2021.

With equity markets at an all time high, net outflows from equity mutual fund schemes stood at Rs 13,004 crore in November compared with Rs 3,991.01 crore in the previous month, as per data from Association of Mutual Funds in India (AMFI).

IDFC Mutual Fund has appointed Sachin Anandrao Relekar as the Senior Fund Manager (Equity) and key personnel of the AMC.

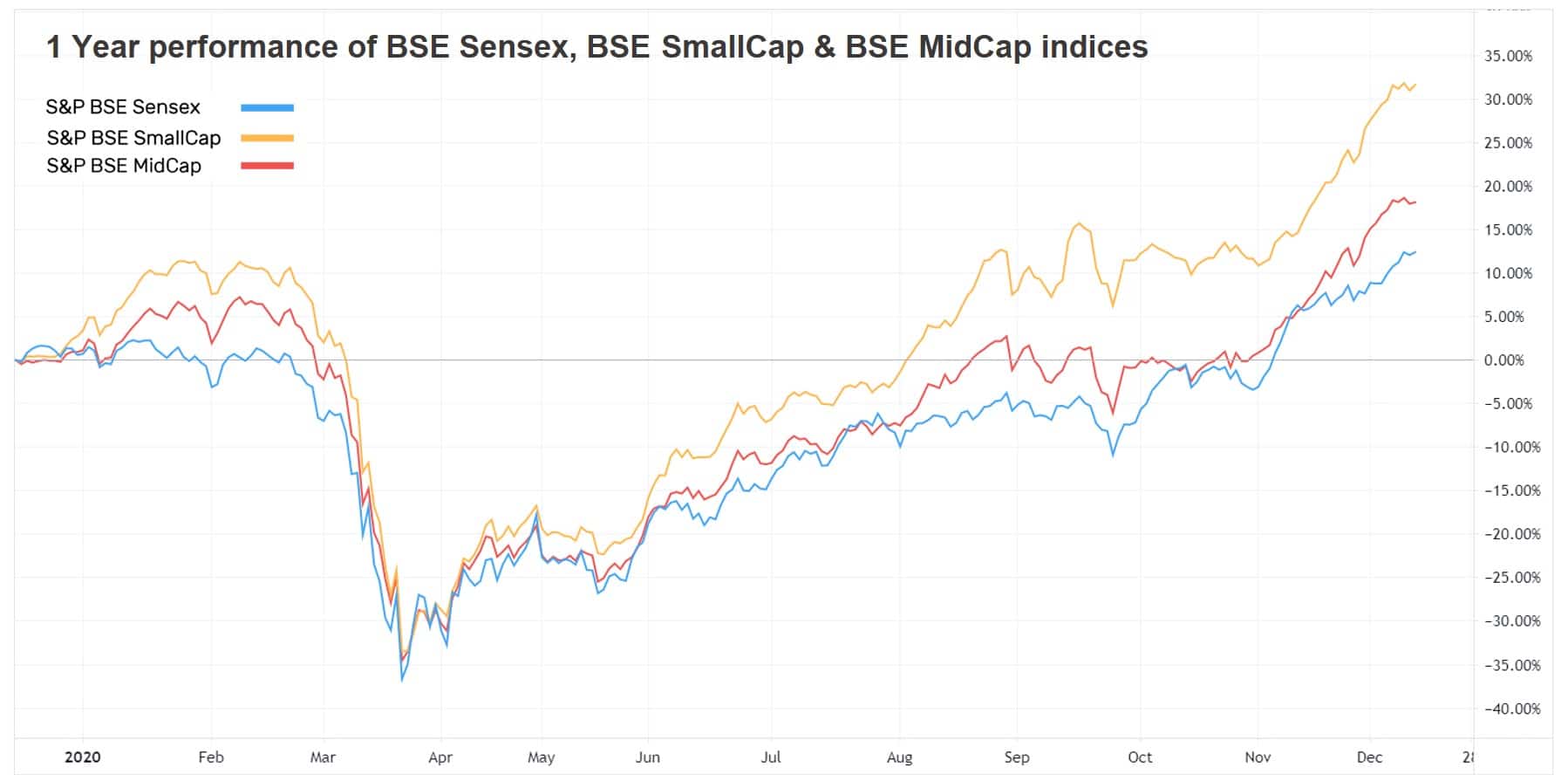

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 1.9% | 13.4% | 9.4% | 37.2 | 3.8 |

| NIFTY NEXT 50 | 1.6% | 15.6% | 2.0% | 40.5 | 4.4 |

| S&P BSE SENSEX | 2.3% | 14.0% | 11.3% | 33.0 | 3.1 |

| S&P BSE SmallCap | 1.4% | 33.3% | -1.3% | NA | 2.4 |

| S&P BSE MidCap | 0.8% | 19.9% | 0.8% | 63.0 | 2.6 |

| NASDAQ 100 | -1.2% | 47.0% | 24.6% | 38.3 | 8.4 |

| S&P 500 | -1.0% | 16.5% | 11.2% | 28.6 | 4.0 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| ICICI Prudential FMCG | 5.4% | 11.5% | 8.6% |

| IPRU Bharat 22 FoF | 3.4% | -5.4% | NA |

| Indiabulls Blue Chip | 2.7% | 10.5% | 8.3% |

| HDFC Balance Advantage | 2.7% | 10.4% | 4.6% |

| 2.7% | 15.1% | 6.7% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Indiabulls Tax Saving | 2.5% | 12.2% | NA |

| PGIM India Long Term Equity | 2.2% | 18.1% | 7.7% |

| Quant Tax | 2.1% | 45.9% | 13.8% |

| IPRU Long Term Equity | 1.9% | 14.3% | 8.2% |

| 1.8% | 3.6% | -6.2% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Yes Bank | 25.6% | -61.6% | -26.8% |

| Vedanta | 15.9% | 4.0% | 21.3% |

| Punjab National Bank | 13.1% | -32.1% | -19.9% |

| Bandhan Bank | 12.5% | -18.7% | NA |

| 11.6% | 17.2% | 24.9% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| -2.1% | 3.3% | 1.7% | |

| Sundaram Global Advantage | -1.0% | 21.6% | 10.4% |

| Nippon India Japan Equity | -0.9% | NA | NA |

| -0.9% | 13.9% | 6.2% | |

| -0.8% | 29.4% | 18.6% |

| Stocks (BSE 200) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Green Energy | -9.1% | 719.8% | NA |

| Ambuja Cements | -5.8% | 25.7% | 7.7% |

| Shree Cement | -4.8% | 17.7% | 17.7% |

| Tata Motors | -3.2% | 12.0% | -13.9% |

| -3.1% | 16.2% | 10.2% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 0.5% | 33.2% | 15.2% |

| Mirae Asset Emerging Bluechip | 1.1% | 23.9% | 11.4% |

| Axis Bluechip | 1.9% | 17.8% | 15.4% |

| ABSL Index | 1.9% | 13.9% | 9.8% |

| 1.9% | 14.1% | 10.4% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Motilal Oswal Multicap 35 | 1.5% | 10.9% | 3.7% |

| ABSL Frontline Equity | 1.5% | 13.4% | 6.6% |

| L&T Emerging Businesses | 1.1% | 16.6% | -1.4% |

| Kotak Equity Arbitrage | 0.2% | 4.8% | 6.1% |

| 2.1% | 7.2% | 5.0% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Global Equity Opp... | 0.7% | 70.6% | 31.3% |

| Tata Digital India | 1.5% | 47.1% | 27.7% |

| Parag Parikh LTE | 0.5% | 33.2% | 15.2% |

| IPRU Technology | 1.6% | 62.4% | 27.3% |

| 1.9% | 17.8% | 15.4% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 2.1% | 29.6% | 34.0% |

| Adani Green Energy | -9.1% | 719.8% | NA |

| Tata Consultancy Services | 2.8% | 38.3% | 20.0% |

| Infosys | 3.2% | 62.8% | 19.0% |

| HDFC Bank | 0.4% | 10.6% | 21.9% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Apple | -1.8% | 80.8% | 30.0% |

| Tesla | -1.3% | 765.5% | 69.7% |

| Amazon | -1.8% | 78.3% | 37.2% |

| Microsoft | -1.0% | 40.6% | 31.6% |

| -3.7% | 35.3% | 21.8% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

SADIKA parveen

December 17, 2020 AT 05:49

Good luck