Top news

With effect from 1 April, SEBI has set a maximum limit on the amount that mutual funds can invest in debt instruments with special features (such as being convertible to equity). The investment limit in such instruments will be 10% of the value of debt portfolio of a fund.

Net outflows from open ended equity mutual funds stood at Rs 4,534 crore in February 2021 compared to outflow of Rs 9,253 crore in the previous month. The industry AUM rose to Rs 31.6 lakh crore in February from Rs 30.5 lakh crore in December.

Edelweiss Mutual Fund and IDFC Mutual Fund have launched the NFOs - Edelweiss Nifty PSU Bond Plus Sdl Index 2026 Fund, IDFC Gilt 2027 Index Fund and IDFC Gilt 2028 Index Fund. The NFOs close on 16 March and 19 March respectively.

Easy Trip Planners IPO got oversubscribed by 159 times. The IPO was issued with the price band of Rs 186-187 per share.

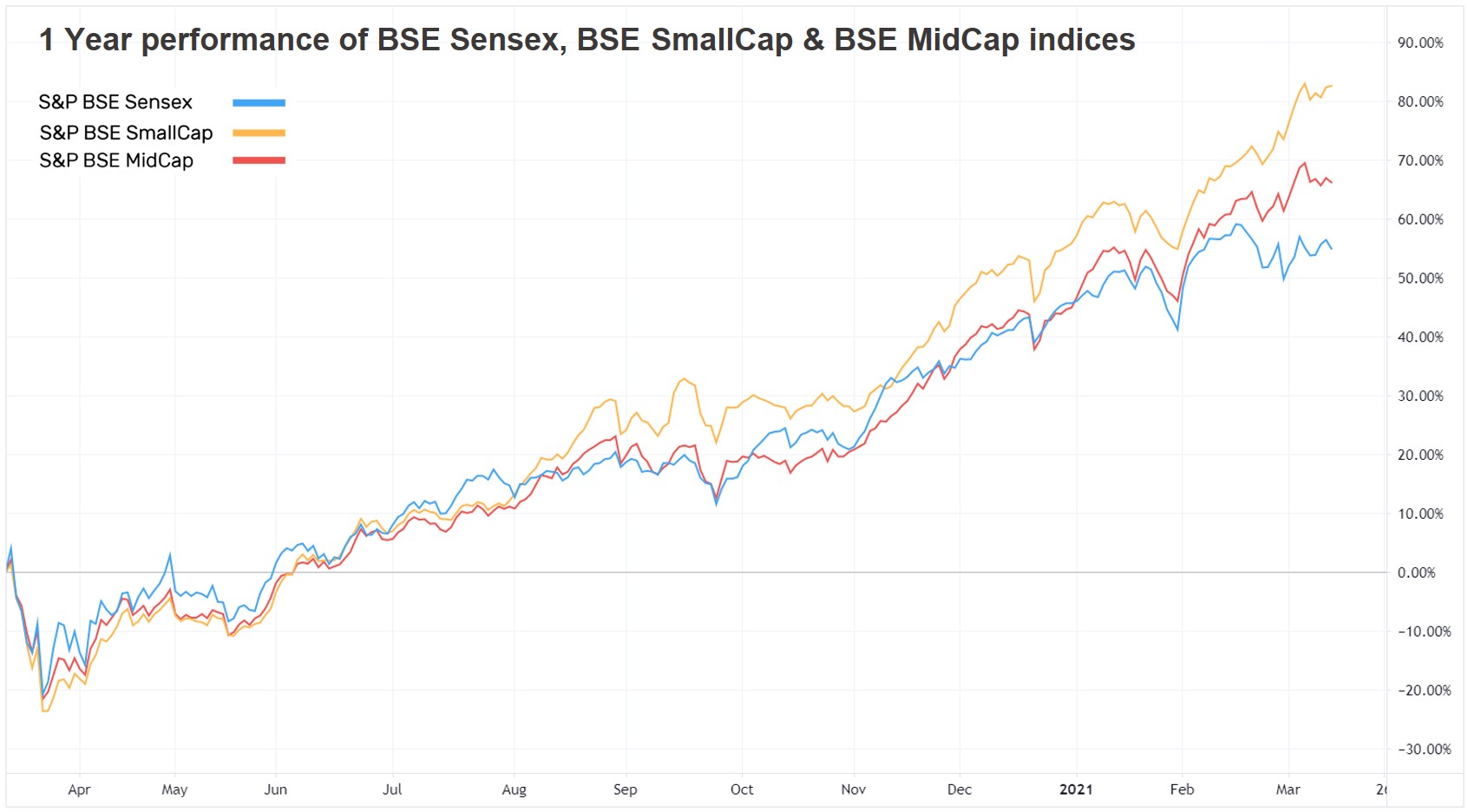

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | 0.6% | 56.6% | 13.0% | 40.9 | 4.3 |

| NIFTY NEXT 50 | -1.3% | 52.7% | 6.9% | 39.1 | 4.7 |

| S&P BSE SENSEX | 0.8% | 54.8% | 14.4% | 35.4 | 3.4 |

| S&P BSE SmallCap | 1.3% | 82.4% | 6.8% | NA | 2.9 |

| S&P BSE MidCap | -0.1% | 66.0% | 8.5% | 58.1 | 3.0 |

| NASDAQ 100 | 2.1% | 77.9% | 22.0% | 37.8 | 8.1 |

| S&P 500 | 2.6% | 58.8% | 12.3% | 32.0 | 4.3 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Principal Global Opp... | 5.4% | 58.4% | 11.5% |

| ABSL Global Emerging... | 3.8% | 43.8% | 13.7% |

| ABSL Digital India | 3.6% | 102.8% | 28.4% |

| Tata Digital India | 3.5% | 101.5% | 29.7% |

| 3.5% | 16.5% | 16.7% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Baroda Elss 96 B | 1.3% | 54.7% | 9.3% |

| 1.1% | 60.4% | 19.4% | |

| BOI AXA Tax Advantage | 1.0% | 58.6% | 14.8% |

| Invesco India Tax | 0.9% | 52.1% | 14.7% |

| 0.9% | 57.1% | 11.7% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| IDBI Bank | 11.9% | 63.4% | -8.4% |

| Adani Gas | 7.2% | 516.8% | NA |

| Tech Mahindra | 3.7% | 41.7% | 19.1% |

| Vedanta | 3.7% | 140.3% | 27.5% |

| 3.6% | 35.6% | 15.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Emerging Markets | -9.6% | 24.4% | 9.2% |

| Edelweiss Greater China Equity | -7.8% | 61.7% | 23.1% |

| PGIM India Global Equity Opp... | -6.2% | 57.9% | 29.3% |

| -6.0% | 47.4% | 11.0% | |

| -4.0% | 43.1% | 12.3% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Bank of Baroda | -9.8% | 16.6% | -11.0% |

| Motherson Sumi Systems | -8.6% | 137.9% | 15.2% |

| Bharat Electronics | -8.3% | 103.4% | 7.2% |

| Gland Pharma | -7.6% | NA | NA |

| -7.5% | 44.0% | 16.0% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 2.0% | 62.9% | 18.5% |

| Motilal Oswal Nasdaq 100 FoF | 3.1% | 59.7% | NA |

| Axis Bluechip | 0.2% | 40.0% | 18.5% |

| UTI Nifty Index | 0.6% | 57.7% | 14.1% |

| -0.1% | 43.1% | 16.6% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Equity Saving Cumula... | 0.1% | 18.5% | 8.2% |

| IPRU Technology | 3.4% | 121.4% | 29.0% |

| IPRU Commodities | 0.0% | 119.1% | NA |

| HDFC Arbitrage Wholesale | 0.0% | 3.5% | 5.5% |

| 0.9% | 70.8% | 3.7% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | 3.5% | 101.5% | 29.7% |

| PGIM India Global Equity Opp... | -6.2% | 57.9% | 29.3% |

| Parag Parikh Flexi Cap | 2.0% | 62.9% | 18.5% |

| IPRU Technology | 3.4% | 121.4% | 29.0% |

| 0.2% | 40.0% | 18.5% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -1.7% | 87.2% | 33.9% |

| Adani Green Energy | -2.1% | 786.4% | NA |

| Infosys | 3.3% | 100.6% | 20.8% |

| Tata Consultancy Services | 0.3% | 56.4% | 22.4% |

| -0.1% | 39.4% | 25.1% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 16.0% | 535.1% | 75.6% |

| Apple | -0.3% | 74.1% | 36.5% |

| Amazon.com | 3.0% | 73.0% | 40.2% |

| GameStop Corp. | 92.0% | 5675.1% | 53.8% |

| 1.8% | 48.4% | 34.8% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!