Top news

Franklin Mutual Fund has announced the second payout to unitholders of the six wound-up schemes. Unitholders can check their payout status here.

Quant MF, HDFC MF and BNP Paribas MF have launched the NFOs for Quant Quantamental Fund, HDFC Asset Allocator FoF, and BNP Paribas Funds Aqua FoF.

Infosys has approved a buyback of upto 5.25 crore equity shares or 1.23% of the total paid-up capital. The buyback will be done at Rs 1,750 per Equity Share. The shares of Infosys closed at Rs 1,353.75 on April 16.

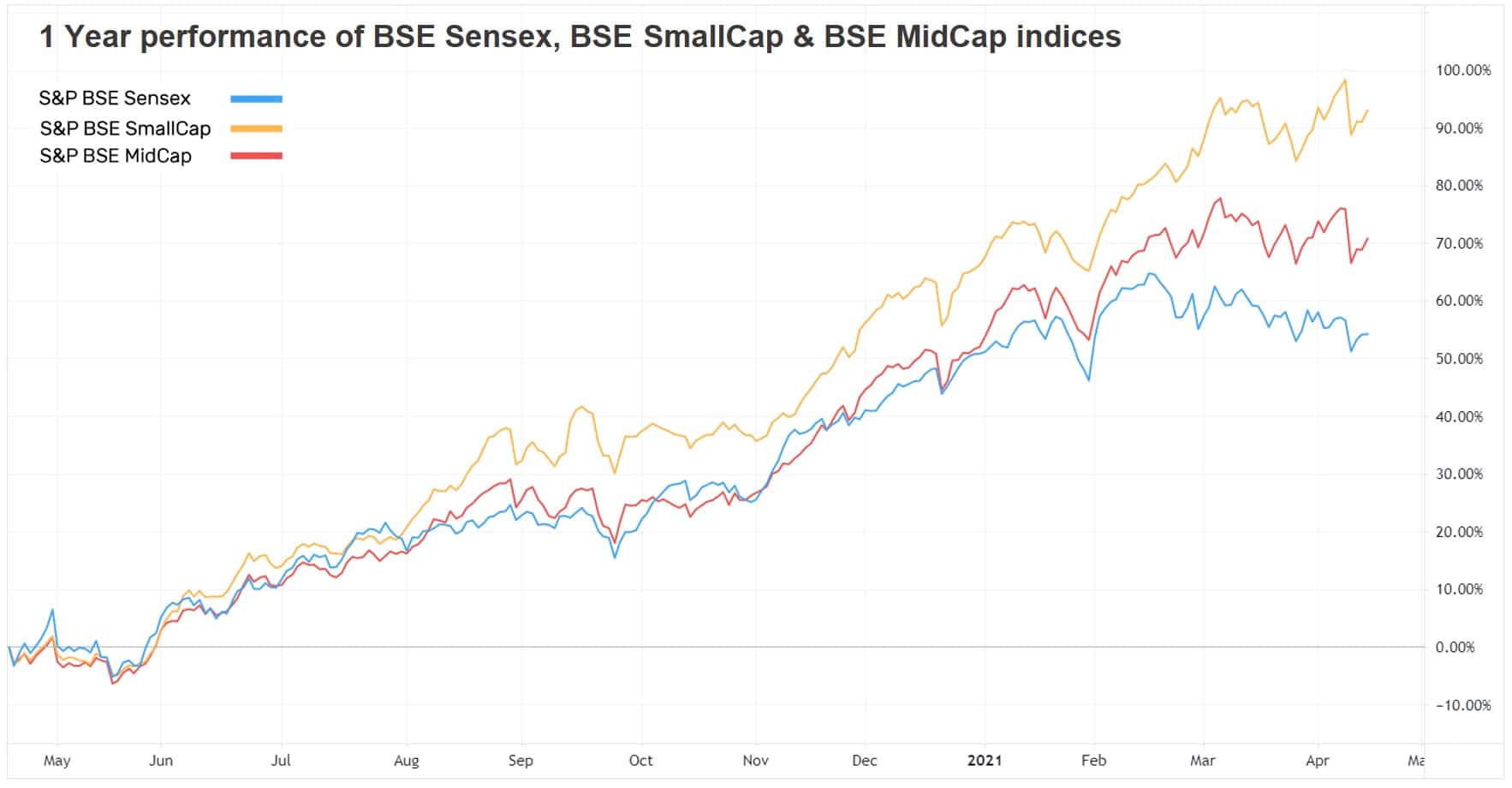

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -1.5% | 62.4% | 11.6% | 32.8 | 4.2 |

| NIFTY NEXT 50 | -2.0% | 49.0% | 4.8% | 43.1 | 4.6 |

| S&P BSE SENSEX | -1.5% | 59.4% | 12.5% | 34.0 | 3.3 |

| S&P BSE SmallCap | -2.7% | 99.1% | 5.2% | 79.0 | 2.9 |

| S&P BSE MidCap | -2.9% | 73.9% | 6.4% | 57.7 | 3.0 |

| NASDAQ 100 | 1.4% | 60.2% | 28.1% | 41.0 | 8.8 |

| S&P 500 | 1.4% | 49.4% | 16.1% | 32.8 | 4.6 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Mining | 4.2% | 87.7% | 21.8% |

| PGIM India Global Equity Opp... | 3.6% | 70.4% | 33.8% |

| Franklin India Feeder US Opp... | 3.5% | 54.9% | 28.7% |

| Nippon India US Equity Opp... | 3.4% | 57.9% | 27.9% |

| 3.2% | 18.3% | 19.5% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| PGIM India Long Term Equity | -0.7% | 65.1% | 11.7% |

| ABSL Tax Relief96 | -0.9% | 47.3% | 7.3% |

| Parag Parikh Tax Saver | -1.1% | 68.0% | NA |

| SBI Magnum Tax Gain Scheme | -1.1% | 61.9% | 9.30% |

| -1.4% | 61.2% | 11.40% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Adani Gas | 14.3% | 1072.5% | NA |

| Cadila Healthcare | 12.0% | 55.4% | 11.1% |

| Cipla | 11.5% | 58.4% | 13.2% |

| Procter & Gamble | 7.1% | 25.9% | 17.5% |

| 6.2% | 151.5% | 16.7% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | -4.1% | 121.4% | 29.8% |

| IPRU Technology | -4.0% | 140.2% | 29.50% |

| ABSL Digital India | -3.9% | 120.0% | 28.7% |

| IDFC Infrastructure | -3.8% | 80.7% | 1.1% |

| -3.8% | 55.4% | 9.3% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| RBL Bank | -14.0% | 114.4% | NA |

| DLF | -10.0% | 80.0% | 16.40% |

| Bandhan Bank | -9.1% | 72.5% | NA |

| Hindustan Zinc | -8.4% | 71.7% | 18.5% |

| -8.2% | 180.9% | 26.7% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | -0.9% | 73.3% | 20.4% |

| Axis Bluechip | -1.6% | 47.2% | 15.4% |

| Principal Emerging Bluechip | -1.9% | 67.5% | 10.6% |

| UTI Nifty Index | -1.5% | 63.9% | 12.6% |

| -1.0% | 105.8% | 21.6% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| L&T Emerging Businesses | -2.0% | 90.5% | 4.1% |

| Kotak Flexicap | -2.0% | 59.0% | 11.7% |

| Mirae Asset Midcap | -2.0% | 88.6% | NA |

| ABSL Flexi Cap | -1.7% | 64.0% | 10.4% |

| -3.0% | 70.1% | 8.6% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | -4.1% | 121.4% | 29.8% |

| IPRU Technology | -4.0% | 140.2% | 29.5% |

| Parag Parikh Flexi Cap | -0.9% | 73.3% | 20.4% |

| Mirae Asset Emerging Bluechip | -1.8% | 73.5% | 17.2% |

| 3.6% | 70.4% | 33.8% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -3.5% | 69.8% | 30.0% |

| Adani Green Energy | -5.0% | 489.6% | NA |

| Infosys | -6.1% | 111.6% | 19.8% |

| Tata Consultancy Services | -3.7% | 84.1% | 21.8% |

| HDFC Bank | -0.4% | 65.4% | 21.9% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 9.3% | 391.1% | 70.8% |

| Apple | 0.9% | 89.7% | 37.3% |

| Amazon.com | 0.8% | 43.0% | 40.3% |

| Microsoft Corporation | 1.9% | 45.9% | 36.2% |

| -2.0% | 70.9% | 22.8% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!