Top news

Foreign Portfolio Investors (FPIs) have invested Rs 2.77 lakh crore into equities in the financial year 2020-21 till now, up from Rs 6,153 crore in the previous financial year.

Delhi high court has restrained Future Retail from completing the deal to sell its business to Reliance Retail for Rs 24,713 crore.

Aditya Birla Sun Life Mutual Fund has launched the NFOs for two Index Funds - Aditya Birla Sun Life Nifty Midcap 150 Index Fund and Aditya Birla Sun Life Nifty Smallcap 50 Index Fund. The NFOs close on March 26.

5 IPOs went live this week. Nazara Technologies and Laxmi organic got oversubscribed by 175.5 times and 106.8 times respectively. Craftsman Automation, Kalyan jewellers and Suryoday Small Finance Bank were subscribed by 3.8 times, 2.6 times and 2.4 times respectively.

Index Returns

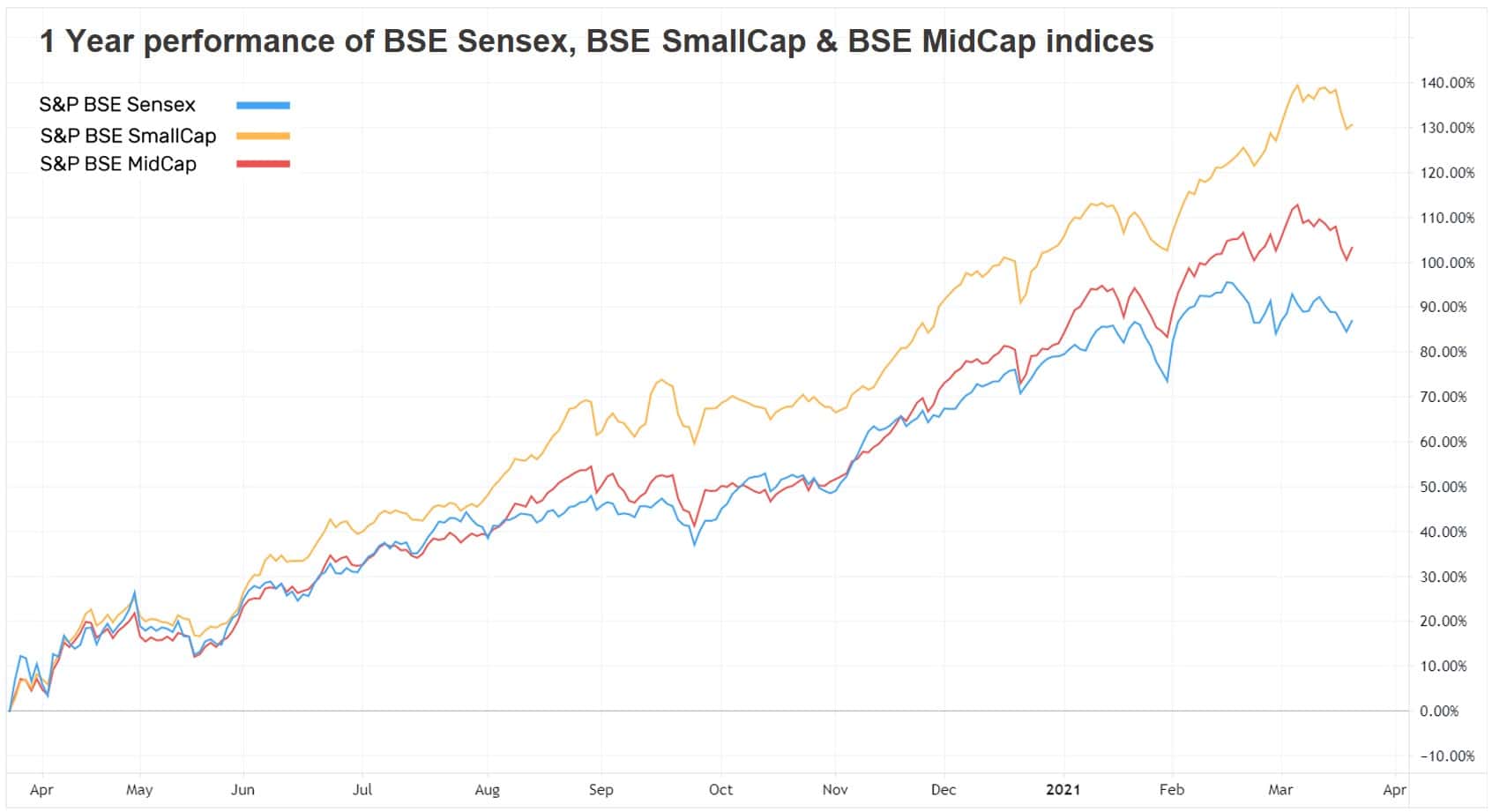

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -1.9% | 78.2% | 13.5% | 40.16 | 4.18 |

| NIFTY NEXT 50 | -2.1% | 68.2% | 6.5% | 38.25 | 4.54 |

| S&P BSE SENSEX | -1.8% | 76.0% | 14.9% | 34.7 | 3.4 |

| S&P BSE SmallCap | -3.5% | 110.3% | 6.0% | NA | 2.8 |

| S&P BSE MidCap | -2.6% | 87.2% | 7.9% | 56.6 | 2.9 |

| NASDAQ 100 | -0.5% | 76.3% | 23.3% | 37.6 | 8.1 |

| S&P 500 | -0.8% | 62.2% | 13.0% | 31.7 | 4.3 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Brazil | 6.5% | 38.7% | -5.8% |

| PGIM India Emerging Markets | 4.0% | 66.0% | 10.6% |

| DSP World Gold | 3.3% | 46.8% | 18.6% |

| PGIM India Global Equity Opp... | 2.7% | 103.1% | 31.0% |

| 2.3% | 58.7% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Tax Saver | 1.2% | 76.6% | NA |

| Quant Tax | 0.2% | 145.4% | 22.6% |

| UTI Long Term Equity | -2.0% | 75.0% | 13.6% |

| Indiabulls Tax Saving | -2.0% | 63.2% | 7.5% |

| -2.1% | 78.6% | 13.8% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| General Insurance Corporation | 9.2% | 90.8% | NA |

| ITC | 8.1% | 48.1% | 3.6% |

| Power Grid Corp Of India | 7.1% | 60.1% | 14.4% |

| JSW Steel | 6.4% | 168.9% | 30.2% |

| 4.7% | 300.3% | 86.7% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Sundaram Infrastructure Adv... | -4.8% | 77.7% | 4.8% |

| Franklin India Prima | -4.2% | 74.5% | 10.3% |

| IPRU Pharma Healthcare & ... | -4.2% | 84.8% | NA |

| ABSL Tax Relief96 | -4.1% | 59.6% | 9.2% |

| -4.1% | 64.1% | 11.3% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Bank of India | -13.3% | 85.5% | -7.1% |

| IPRU Life Insurance Co | -11.2% | 42.9% | NA |

| Coal India | -9.5% | -5.9% | -6.7% |

| Hero MotoCorp | -8.7% | 85.7% | 5.0% |

| -8.5% | 105.1% | 22.6% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 0.7% | 84.8% | 19.4% |

| Axis Bluechip | -2.2% | 56.1% | 18.40% |

| UTI Nifty Index | -1.9% | 79.9% | 14.5% |

| Kotak Balanced Advantage | -0.5% | 47.4% | NA |

| -2.2% | 74.4% | 14.6% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| IPRU Regular Gold Saving | 1.4% | 12.8% | 13.2% |

| -3.6% | NA | NA | |

| ABSL Arbitrage | 0.1% | 4.1% | 5.90% |

| SBI Equity Saving | -1.0% | 36.3% | 9.4% |

| -2.9% | 94.7% | 6.9% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | -0.9% | 131.6% | 30.4% |

| PGIM India Global Equity Opp... | 2.7% | 103.1% | 31.0% |

| IPRU Technology | -0.8% | 159.3% | 30.0% |

| Parag Parikh Flexi Cap | 0.7% | 84.8% | 19.4% |

| -2.4% | 88.2% | 19.0% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -4.6% | 116.9% | 32.9% |

| Adani Green Energy | 0.5% | 821.1% | NA |

| Infosys | -1.7% | 151.4% | 19.3% |

| Tata Consultancy Services | -0.3% | 85.5% | 21.8% |

| -3.8% | 70.4% | 24.3% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | -5.6% | 665.9% | 69.7% |

| Apple | -0.9% | 109.7% | 35.3% |

| Amazon.com | -0.5% | 66.6% | 41.0% |

| Microsoft Corporation | -2.3% | 68.4% | 33.9% |

| 8.1% | 93.9% | 21.1% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!