Top news

Sensex and Nifty made new all time highs this week as they breached the level of 50,000 and 14,700 for the first time.

IPOs of Indian Railway Finance Corporation (IRFC), Indigo Paints and Home First Finance Company went live this week. Indigo paints got oversubscribed by 117 times and IRFC got oversubscribed by 3.5 times. Home First Finance IPO is open for subscription till January 25.

Franklin Templeton’s unitholders unanimously voted in favour of winding up the six debt schemes. The next Supreme court hearing on this matter is scheduled for January 25, 2021.

Nippon Mutual Fund and SBI Mutual Fund have launched the NFO for Nippon India Asset Allocator Fof and SBI Retirement Benefit Aggressive Fund. The NFOs remain open for subscription until February 01 and February 03 respectively.

Index Returns

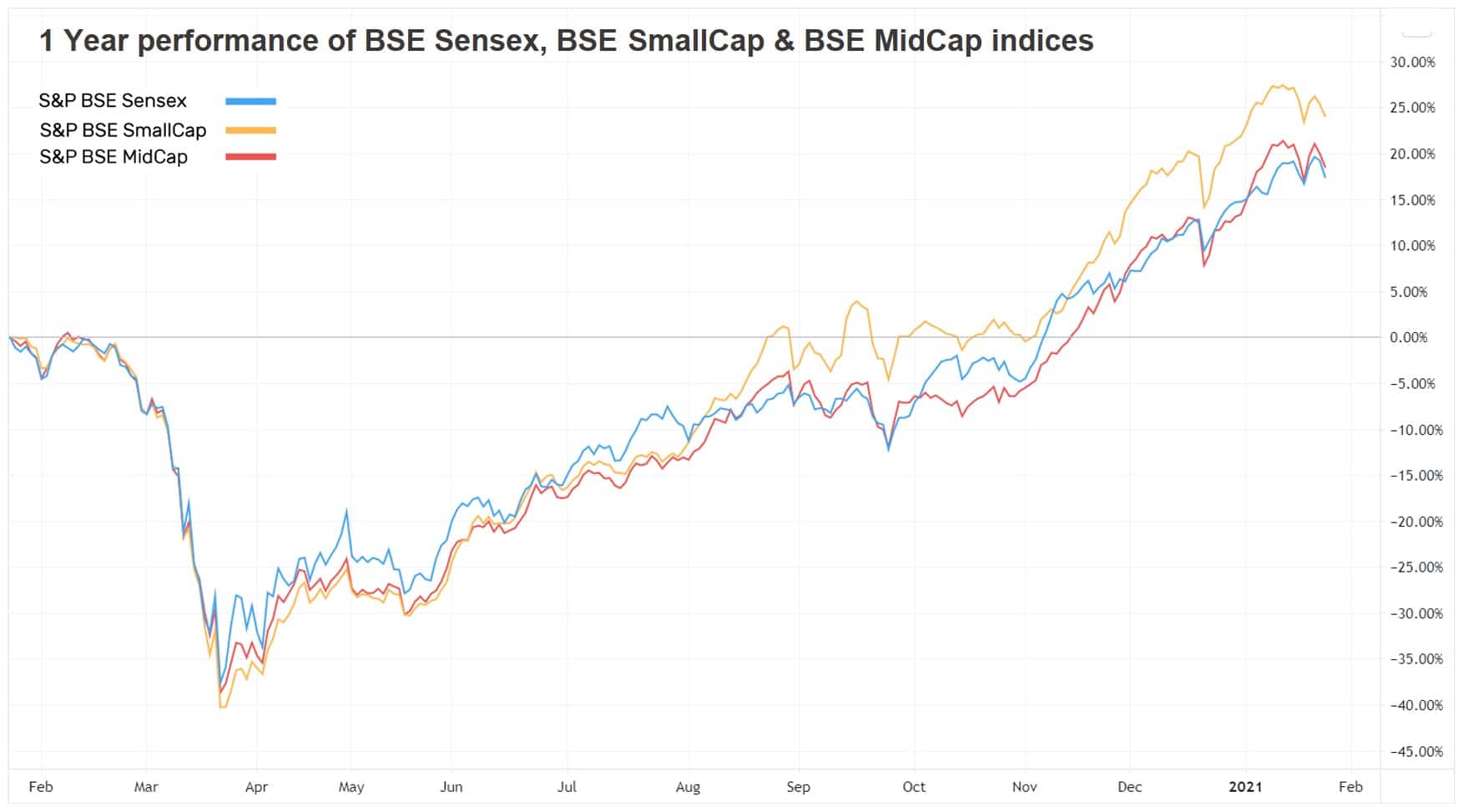

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.4% | 18.6% | 9.4% | 38.9 | 4.1 |

| NIFTY NEXT 50 | -1.3% | 16.5% | 2.0% | 42.3 | 4.5 |

| S&P BSE SENSEX | -0.3% | 18.8% | 10.9% | 33.8 | 3.3 |

| S&P BSE SmallCap | -1.4% | 25.8% | -2.1% | NA | 2.5 |

| S&P BSE MidCap | -0.8% | 20.6% | 1.6% | 69.1 | 2.8 |

| NASDAQ 100 | 4.4% | 40.9% | 23.8% | 41.2 | 8.9 |

| S&P 500 | 1.5% | 13.8% | 10.5% | 30.8 | 4.2 |

We recently published “State of Personal Finance Report 2020-21”. Check how investor’s behaved and the lessons we all learned in a pandemic year. Download a detailed version of the report here

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Edelweiss Greater China Equity | 6.6% | 76.9% | 28.0% |

| PGIM India Emerging Markets | 4.8% | 35.5% | 13.1% |

| 3.2% | 41.1% | 14.5% | |

| ABSL Global Emerging... | 3.2% | 28.3% | 11.4% |

| 3.0% | 34.7% | 14.8% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Mahindra Mutual Kar Bachat... | 0.1% | 20.3% | 5.6% |

| ABSL Tax Relief96 | 0.0% | 17.4% | 6.3% |

| Invesco India Tax | -0.2% | 22.6% | 9.9% |

| Axis Long Term Equity | -0.2% | 21.8% | 12.4% |

| -0.3% | 10.5% | 6.0% |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Motors | 18.1% | 51.2% | -3.1% |

| Tata Motors Ltd Class A | 16.3% | 44.4% | -15.1% |

| Bajaj Auto | 14.5% | 32.2% | 13.9% |

| Havells India | 11.9% | 81.9% | 30.9% |

| 11.3% | -1.9% | 17.3% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| HSBC Brazil | -5.8% | -22.2% | -1.8% |

| SBI PSU | -4.4% | -8.3% | -8.6% |

| IPRU Infrastructure | -3.9% | 5.2% | -1.8% |

| IPRU Thematic Advantage | -3.7% | 24.6% | 10.0% |

| -3.5% | 22.6% | 3.9% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Tata Steel | -17.9% | 263.6% | NA |

| Bandhan Bank | -15.8% | -34.1% | NA |

| Biocon | -15.6% | 33.7% | 37.6% |

| Oil & Natural Gas Corp | -11.6% | -24.4% | -3.6% |

| -10.3% | 106.1% | NA |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh LTE | 1.0% | 33.1% | 15.3% |

| Axis Bluechip | -0.3% | 22.2% | 16.10% |

| UTI Nifty Index | -0.4% | 19.4% | 10.5% |

| Axis Mid Cap | -0.6% | 26.9% | 15.0% |

| -1.3% | 17.2% | NA |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| IDFC Arbitrage | 0.1% | 4.4% | 6.1% |

| HDFC Small Cap | -0.4% | 18.3% | 1.5% |

| HDFC Balance Advantage | -2.4% | 11.5% | 4.5% |

| Tata Arbitrage | 0.1% | 5.5% | NA |

| -0.8% | 13.7% | -1.6% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | -0.1% | 60.2% | 28.4% |

| PGIM India Global Equity Opp... | 2.0% | 70.4% | 33.5% |

| Axis Bluechip | -0.3% | 22.2% | 16.1% |

| IPRU Technology | -0.6% | 71.2% | 27.9% |

| 1.0% | 33.1% | 15.3% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | 4.5% | 34.9% | 33.1% |

| Adani Green Energy | 8.3% | 418.0% | NA |

| Infosys | -2.2% | 75.9% | 20.3% |

| Tata Consultancy Services | 1.6% | 52.1% | 24.9% |

| -1.7% | 16.0% | 23.3% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 2.5% | 640.2% | 83.7% |

| Apple | 9.4% | 74.2% | 40.5% |

| NIO | 10.1% | 1166.9% | NA |

| Amazon | 6.1% | 74.7% | 40.7% |

| 6.3% | 35.5% | 34.0% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!