Top news

RBI’s Monetary Policy Committee kept the repo rate & reverse repo rate unchanged at 4% and 3.35% respectively with an accommodative stance. The MPC kept the GDP growth projection unchanged at 10.5% for FY22.

SIP inflows hit an all-time high of Rs 9,182 crore in March 2021, a substantial rise of 22% from the previous month. Equty mutual funds also witnessed inflows of Rs 9,115 crore after outflows for eight straight months since July 2020.

SBI Mutual Fund became the first mutual fund house to cross Rs 5 lakh crore in average AUM. SBI AMC recorded a growth of 35% for the F.Y. 2020-21 reaching the AAUM of Rs 5.04 lakh crore from Rs 3.73 lakh crore last year.

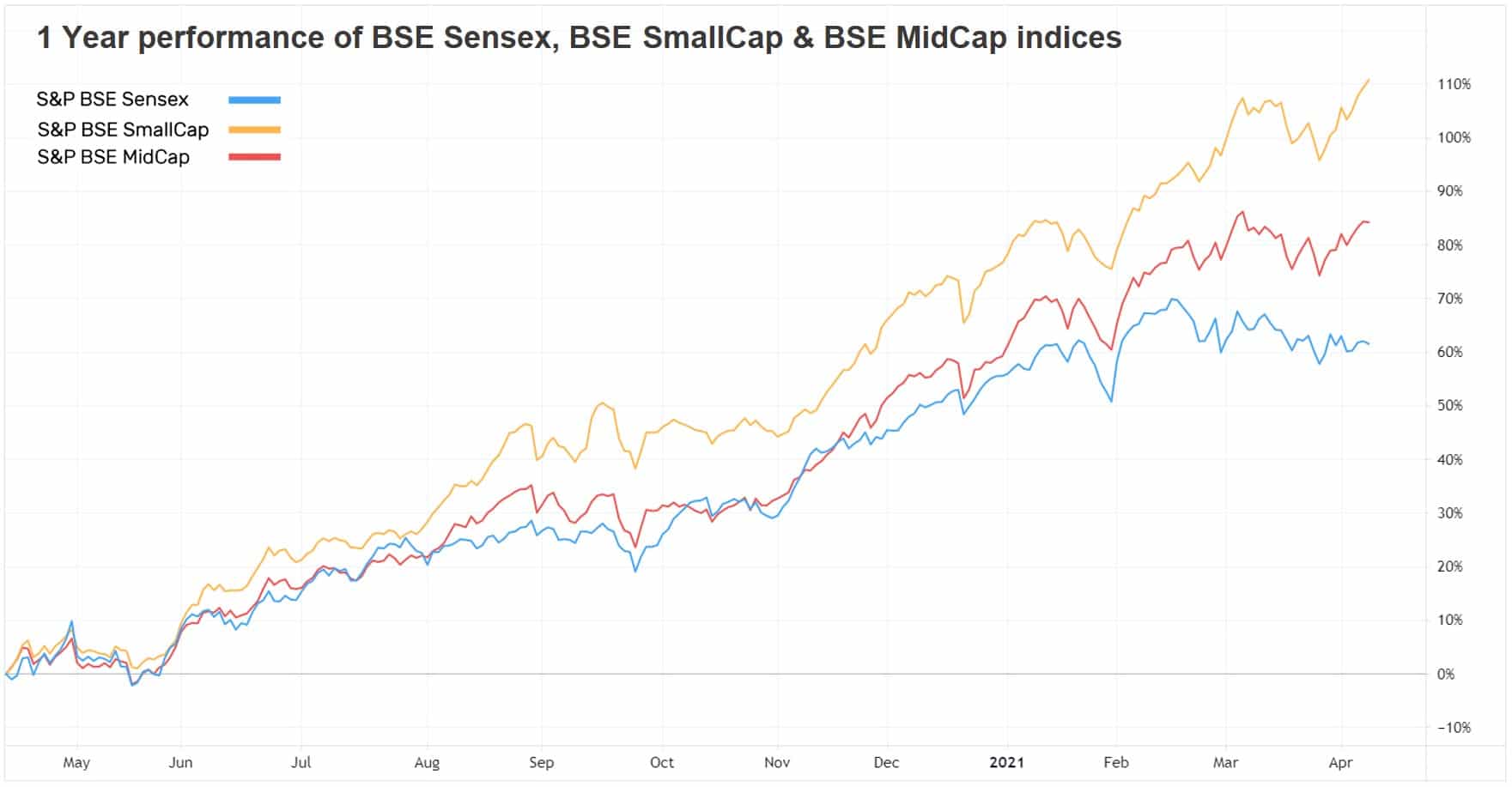

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -0.2% | 62.6% | 12.7% | 33.5 | 4.2 |

| NIFTY NEXT 50 | 1.9% | 54.3% | 5.7% | 44.0 | 4.7 |

| S&P BSE SENSEX | -0.9% | 59.0% | 13.7% | 34.3 | 3.3 |

| S&P BSE SmallCap | 2.5% | 109.5% | 6.4% | 80.3 | 2.9 |

| S&P BSE MidCap | 1.2% | 82.3% | 7.7% | 58.7 | 3.1 |

| NASDAQ 100 | 3.9% | 67.9% | 28.8% | 40.5 | 8.7 |

| S&P 500 | 2.7% | 47.9% | 16.5% | 33.5 | 4.5 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| DSP World Gold | 8.1% | 31.6% | 19.4% |

| DSP World Mining | 5.9% | 92.7% | 21.2% |

| Nippon India Pharma | 5.6% | 57.2% | 25.7% |

| ABSL Global Emerging... | 5.5% | 47.4% | 15.8% |

| 5.3% | -5.5% | 14.2% |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant Tax | 4.6% | 122.3% | 24.2% |

| BOI AXA Tax Advantage | 2.0% | 68.5% | 13.4% |

| IDFC Tax Advantage | 1.9% | 96.2% | 11.3% |

| Parag Parikh Tax Saver | 1.5% | 66.9% | NA |

| 1.5% | 69.3% | NA |

| Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| JSW Steel | 22.0% | 301.3% | 37.8% |

| Cadila Healthcare | 16.5% | 47.0% | 10.5% |

| Info Edge (India) | 12.3% | 112.7% | 43.5% |

| Adani Ports & SEZ | 11.9% | 228.6% | 30.6% |

| 11.1% | 384.7% | 43.9% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| -3.7% | 54.7% | 9.7% | |

| -3.4% | 57.4% | NA | |

| ABSL Banking & Finan... | -3.4% | 68.6% | 6.6% |

| -3.1% | 53.2% | 11.6% | |

| -3.1% | 63.2% | 2.9% |

Stocks (Top 200 by market cap) | 1W | 1Y | 5Y |

|---|---|---|---|

| Bajaj Finance | -7.5% | 108.9% | 47.1% |

| IndusInd Bank | -7.0% | 131.7% | 0.4% |

| Axis Bank | -6.3% | 70.8% | 10.0% |

| Honeywell Automation India | -6.2% | 61.2% | 38.1% |

| -4.9% | 86.9% | -11.2% |

Bought and Sold

| Bought on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 3.2% | 76.6% | 21.1% |

| UTI Nifty Index | -0.2% | 64.1% | 13.7% |

| Axis Bluechip | 0.1% | 46.3% | 16.6% |

| Kotak Flexicap | 0.2% | 62.4% | 12.7% |

| 0.3% | 78.6% | 18.2% |

| Sold on kuvera.in | 1W | 1Y | 3Y |

|---|---|---|---|

| ABSL Midcap | 1.6% | 77.7% | 5.6% |

| HDFC Equity Saving | -0.1% | 28.9% | 8.3% |

| Franklin India Flexi Cap | -0.5% | 74.7% | 11.3% |

| Franklin India Prima | 0.8% | 78.1% | 9.9% |

| -0.6% | 70.4% | 12.1% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Digital India | 5.3% | 127.3% | 33.4% |

| IPRU Technology | 4.4% | 147.6% | 32.5% |

| Parag Parikh Flexi Cap | 3.2% | 76.6% | 21.1% |

| Mirae Asset Emerging Bluechip | 0.3% | 78.6% | 18.2% |

| 5.1% | 76.9% | 32.7% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Reliance Industries | -1.9% | 67.9% | 31.3% |

| Adani Green Energy | -1.4% | 586.4% | NA |

| Infosys | 4.0% | 128.1% | 21.3% |

| Tata Consultancy Services | 4.9% | 94.8% | 23.7% |

| -4.4% | 59.9% | 22.3% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Tesla | 2.3% | 490.8% | 68.4% |

| Apple | 8.1% | 98.5% | 37.4% |

| Microsoft Corporation | 5.6% | 54.9% | 36.3% |

| Amazon.com | 6.7% | 65.0% | 41.5% |

| 4.6% | 78.3% | 23.1% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Lakshman S

April 17, 2021 AT 17:09

I want to know whether it’s legal to invest in US stocks through your platform. I am sure payment would be in equivalent INR.