In 2022, the landscape of global savings rates offered a revealing look at economic behaviors worldwide. With an average rate of 23.91% across 85 countries, based on data from the World Bank, we get a clear picture of how different nations prioritize saving.

Let’s delve into the top 10 countries with the highest savings rates, along with India’s noteworthy position.

Analyzing Global Gross Savings Percentage

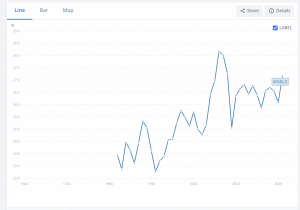

Interestingly, the global gross savings percentage peaked in 2006 at 28%. This was a period characterized by robust global economic growth, driven by high commodity prices, increasing trade, and expansive financial conditions.

Economies worldwide were experiencing a surge in wealth, leading to higher savings rates. The high savings rate in 2006 can also be attributed to significant economic growth in emerging markets, which contributed to a global accumulation of savings. However, this peak was followed by a gradual decline, influenced by the global financial crisis of 2008 and subsequent economic adjustments.

The Leaders in Savings

- Norway (50.92%): Tops the list with its exceptional savings rate, highlighting a strong economy and prudent financial management.

- Singapore (43.22%): Known for its robust economic policies and a culture emphasizing saving and investment.

- Azerbaijan (42.47%): High savings influenced by its oil reserves and focus on economic security.

- Algeria (42.43%): Reflects a savings culture shaped by its oil wealth.

- Saudi Arabia (41%): Another oil-rich nation with a high rate of savings.

- Denmark (37.68%): Shows a balanced approach to savings, reflecting a stable and well-functioning economy.

- Uzbekistan (37.5%): High savings rate indicative of its growing economy and development policies.

- Ireland (37.47%): Demonstrates a strong saving culture, coupled with rapid economic growth.

- Indonesia (37.03%): Its savings rate highlights the country’s economic resilience and growth strategy.

- Belize (35.97%): A smaller economy with a significant focus on saving as a percent of GDP.

India’s Position

India at 29.84% ranks 19th on the list of countries with the highest savings percentages.

India’s Gross Savings Rate was stable at 30.2% in March 2022, mirroring the previous year’s figure. This consistency is remarkable, with an average of 30.2% since 1951. The all-time high was in March 2008 at 30.2%, and the lowest was 7.9% in 1954. These figures reflect India’s balanced approach to domestic investment and consumer saving, amidst an expanding economy, with a GDP growth of 6.1% YoY in March 2023, nominal GDP of 873,666.0 USD mn, and GDP per capita of 2,452.2 USD.

Understanding the Dynamics

These savings rates are not just numbers; they represent the economic strategies, cultural values, and policy effectiveness of each nation. High savings rates often indicate robust economies and investment potential, while cultural and governmental factors significantly influence these percentages.

Wealth for your financial goals from just ₹500 per month. Start SIP now.

Decoding the Implications

- Economic Stability: High savings rates often indicate potential for investment and future growth, while lower rates might point to increased consumer spending or economic strain.

- Cultural Influences: These rates are significantly shaped by cultural attitudes towards saving and consumption.

- Governmental Role: National policies and economic structures play a crucial role in influencing these rates.

Conclusion

The 2022 data on savings as a percentage of GDP provides valuable insights into the financial priorities and economic health of nations. From Norway’s leading position to India’s stable and growing economy, these figures narrate stories of financial prudence and strategic economic planning.

Data source: World Bank

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Check out all our videos on YouTube and get smart about investing