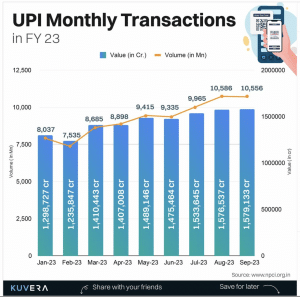

In a significant testament to India’s digital payments revolution, the Unified Payments Interface (UPI) achieved a remarkable milestone in August 2023. The National Payments Corporation of India (NPCI), the Reserve Bank’s non-profit agency, officially confirmed that UPI crossed the astounding mark of 10 billion monthly transactions. This announcement comes on the heels of a remarkable journey, with UPI’s monthly transaction count surging to an impressive 10.24 billion, amounting to a staggering net transaction value of ₹15.18 trillion.

This achievement signifies a remarkable growth trajectory for UPI, with transactions soaring by over 50% year-on-year. Just last year, in August 2022, the UPI network was celebrating 6.58 billion monthly transactions. The path to this milestone was swift; in July 2023, UPI was already on the cusp of 10 billion transactions, recording a remarkable 9.96 billion transactions. This followed a minor dip in June, reflecting the platform’s robust resilience and continued ascent.

The journey of UPI, which crossed the 1 billion monthly transaction mark for the first time in October 2019, highlights the rapid pace of adoption, with a fourfold increase in less than four years. This blog delves deeper into the significance of this achievement and explores the factors contributing to UPI’s meteoric rise in the digital payments landscape.

In the digital age, UPI (Unified Payments Interface) has revolutionised the way we make transactions. It’s fast, convenient, and secure when used correctly.

However, with increasing numbers of UPI payments, various types of frauds related to UPI payments are also on the rise. As per the Ministry of Finance’s report, there was a notable rise in fraudulent activities associated with UPI transactions in the fiscal year 2022-23. The data indicates an increase in reported fraud cases, exceeding 95,000, compared to the previous fiscal year, during which there were approximately 84,000 such incidents in 2021-22.

To help you navigate the world of UPI safely, here are ten crucial tips:

1. Download Official Apps

Always download UPI apps from trusted sources like Google Play Store or Apple App Store. Beware of counterfeit apps that can compromise your security.

2. Secure Your Mobile Device

Keep your phone’s operating system and UPI app updated to the latest versions to ensure the latest security features are in place.

3. Use a Secure Connection

Never perform UPI transactions using public Wi-Fi. Always use a secure, password-protected network to prevent eavesdropping.

4. Enable Two-Factor Authentication (2FA)

Activate 2FA for your UPI account, which usually involves receiving an OTP (One-Time Password) via SMS. This adds an extra layer of security.

5. Create Strong Passwords

Use a complex combination of letters, numbers, and symbols for your UPI PIN. Avoid using easily guessable information like birthdays or names.

6. Regularly Monitor Transactions

Keep a close eye on your transaction history. If you notice any suspicious activity, report it to your bank or UPI provider immediately.

7. Be Cautious with Sharing Information

Never share your UPI PIN, password, or any sensitive information via phone, email, or social media. Legitimate institutions will never ask for these details.

8. Verify Payee Details

Double-check the payee’s details, including the UPI ID or account number, before initiating a transaction. A small mistake can lead to fund transfers to the wrong recipient.

9. Use Secure Apps for Payments

Only make UPI payments through trusted apps. Beware of malicious links or QR codes that may lead to fraudulent apps or websites.

10. Logout After Transactions

Always log out of your UPI app after completing a transaction. This prevents unauthorized access if your phone is lost or stolen.

By following these ten tips, you can make the most of the convenience of UPI payments while ensuring the safety of your financial transactions. Remember, staying vigilant and cautious is the key to a secure UPI experience in today’s digital landscape.

Want to know more about the safeguarding yourselves from financial frauds? Start here; Most common credit card frauds in India and most common financial frauds in India.

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube: Investing with legends series

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.