Employees’ Provident Fund (EPF) aims to provide financial security to employees in the organized sector in India during their retirement, as well as in case of financial emergencies such as unemployment, illness, or disability. It also offers additional benefits such as pension and life insurance, making it an important part of an employee’s financial planning.

What is EPF?

The Employees’ Provident Fund (EPF) is a mandatory savings scheme for employees in the organized sector in India. It is administered by the Employees’ Provident Fund Organization (EPFO), a statutory body of the Government of India, and is governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

Under the EPF scheme, employers are required to contribute a certain percentage of an employee’s salary towards the employee’s provident fund account. Employees also have the option to contribute a portion of their salary towards the account. The funds in the account can be used by employees for their retirement, or in case of financial emergencies such as unemployment, illness, or disability.

In addition to the EPF, the EPFO also administers other schemes such as the Employees’ Pension Scheme, the Employees’ Deposit Linked Insurance Scheme, and the Employees’ Family Pension Scheme. These schemes provide additional benefits to employees and their families, such as pension and life insurance.

The EPF plays an important role in providing social security to employees in the organized sector in India, and helps them save for their retirement and cope with financial emergencies.

Who can open an EPF account?

An Employees’ Provident Fund (EPF) account can be opened by any employee who is part of the organized sector in India, as defined by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952. This includes employees who work for the central or state government, public sector undertakings, private companies, and other organizations that employ a certain number of workers.

To open an account, an employee needs to provide their personal and employment details, as well as their bank account information. The employee’s employer is responsible for registering the employee with the EPFO (Employees’ Provident Fund Organization) and making the necessary contributions to the employee’s EPF account.

In some cases, self-employed individuals may also be eligible to open an EPF account. This includes individuals who are engaged in businesses or professions that are registered with the EPFO, and who have at least 20 employees. Self-employed individuals can open an EPF account by submitting the necessary forms and documents to the EPFO.

Anyone who is part of the organized sector in India and meets the eligibility criteria can open an EPF account to save for their retirement and avail of other benefits provided by the EPFO.

How to open an EPF account

To open an Employees’ Provident Fund account, you will need to provide the following information:

- Your personal details, such as your name, date of birth, and address

- Your employment details, such as the name and address of your employer, and your salary information

- Your bank account details, including the name of the bank, the branch, the account number, and the IFSC code

- Your Aadhaar number or any other government-issued identification number

You can open an EPF account by visiting the EPFO website and filling out the online form, or by submitting a physical form to your employer. Your employer is responsible for registering you with the EPFO and depositing your contributions into your EPF account.

Once your EPF account is open, you can check your account balance and make transactions online through the EPFO portal. You can also download the EPFO app to access your account information and manage your EPF account on the go.

What is UAN?

UAN stands for Universal Account Number, and it is a unique 12-digit identification number assigned to every employee who has an Employees’ Provident Fund account. The UAN remains the same throughout an employee’s career, regardless of any changes in their employment or their EPF account.

The UAN is designed to make it easier for employees to access and manage their EPF accounts. With a UAN, employees can view their EPF balance, check their transaction history, download their passbook, and make online claims for advances or withdrawals from their EPF account.

To access the benefits of a UAN, employees need to activate their UAN by linking it to their personal and employment details, as well as their bank account. This can be done through the EPFO portal or the EPFO app.

In addition to making it easier for employees to manage their EPF accounts, the UAN also helps employers by simplifying the process of depositing contributions and maintaining records. Employers are required to provide their employees with their UAN, and to update the EPFO with any changes in the employee’s personal or employment details.

EPF on Kuvera

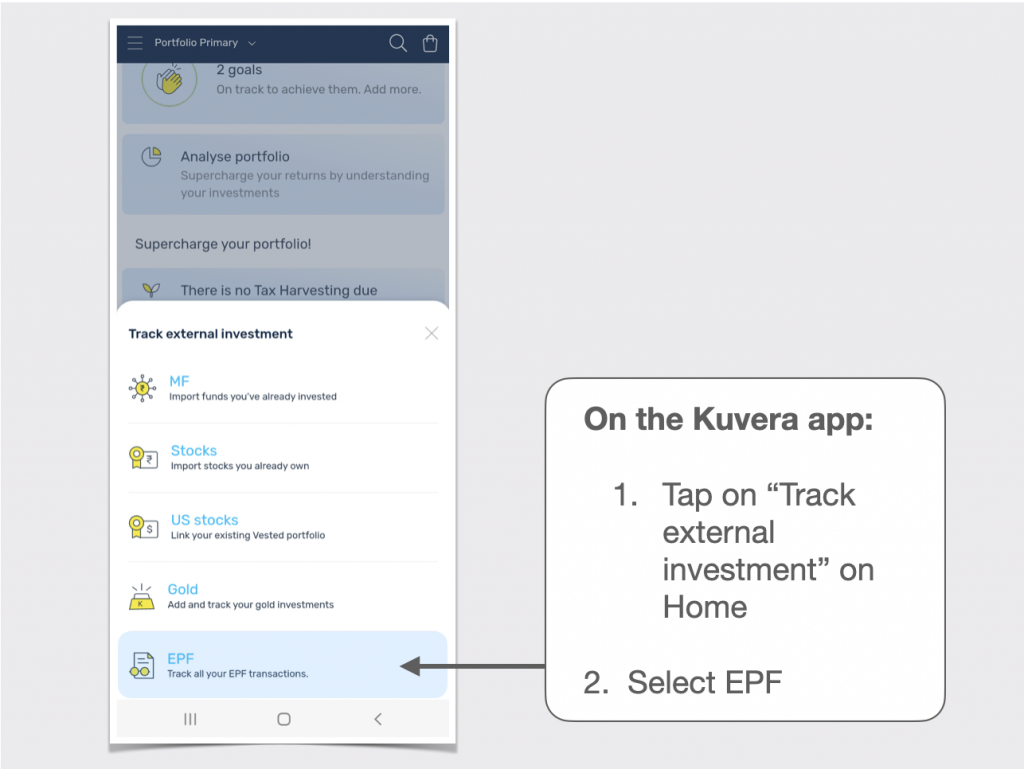

Kuvera simplifies your investment experience by bringing all your investments to one dashboard. In addition to importing external mutual funds and stock investments, you can also track your EPF balance on Kuvera.

How to track EPF on Kuvera?

To start tracking your EPF balance on Kuvera, you just need to log in with your UAN and password. After that, the balance will automatically get updated every month, so you can track it along with your other investments. Watch this video to know more about tracking your EPF account balance on Kuvera.

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabs

——————-

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Check out all our “Investor Education Originals” videos on Youtube and get smart about investing