Debit cards are an essential part of the Indian financial system. They have a staple form of transactions for most Indians. today we will understand all about debit cards, their types, the banks issuing them, and their growth over the years.

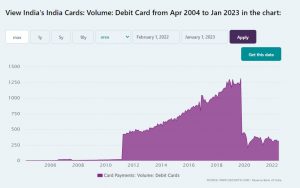

According to data released by the RBI, the volume of debit cards was reported at 226.531 Units mn in Feb 2023. This records a decrease from the previous 251.009 Unit mn for Jan 2023. It was at an all-time high of 1,314.043 Unit mn in Oct 2019 and a record low of 3.305 Unit mn in Apr 2004.

Types of debit cards

Let us look at the various types of debit cards available in the Indian market and their distinguishing features.

1) Visa card:

The Visa Debit card is a widely used financial tool that offers numerous features for convenient and secure transactions. With a Visa Debit card, users can make worldwide online and offline transactions.

The card allows for easy access to funds in the linked bank account, eliminating the need to carry cash. It also provides a secure way to make transactions with chip and PIN technology, reducing the risk of fraud. Additionally, the Visa Debit card offers the convenience of contactless payments, making transactions faster and more efficient. Users can also check their account balances, view transaction history, and manage their finances online or through mobile banking apps.

Some of its main features include:

- Worldwide acceptance

- Chip and PIN security

- Contactless payments

- Overdraft protection

- ATM access

- Zero liability protection

There are many different types of Visa cards available in the market, some of them include:

- Visa Classic debit card

- Visa Gold debit card

- Visa Platinum debit card

- Visa Infinite debit card

- Visa Signature debit card

2) RuPay card:

Rupay Debit card is a popular payment card issued in India that offers a variety of features for seamless and secure transactions. With Rupay Debit card, users can make purchases at numerous merchants across India, both online and offline.

The card provides easy access to funds from the linked bank account, eliminating the need for cash transactions. Rupay Debit cards also come with advanced security features, such as chip and PIN technology, to protect against fraud.

Additionally, Rupay Debit cards may offer rewards programs, cashback, and discounts on purchases, providing added benefits to cardholders. Rupay Debit cards are also accepted at thousands of ATMs in India, allowing users to withdraw cash whenever needed.

Various types of Rupay cards:

- RuPay PMJDY debit card

- RuPay Mudra debit card

- RuPay Platinum debit card

- RuPay PunGrain debit card

- RuPay Classic debit card

- RuPay Kisan debit card

3) MasterCard

Mastercard is a globally recognized and widely used payment system that enables individuals and businesses to make transactions in a secure, convenient, and efficient manner. As a leading provider of electronic payment solutions, Mastercard offers a range of products and services, including credit cards, debit cards, prepaid cards, and digital wallets, which are accepted at millions of locations worldwide.

Features of MasterCard

1. Global Acceptance: Mastercard and Visa are globally accepted payment systems, allowing users to make transactions at millions of locations worldwide RuPay, on the other hand, is a domestic payment system primarily used in India, with limited acceptance internationally.

2. Card Variants: Mastercard and Visa offer a wide range of card variants, including credit cards, debit cards, prepaid cards, and commercial cards, catering to diverse user needs. RuPay, on the other hand, primarily offers debit and prepaid cards, with limited credit card options.

3. Rewards and Benefits: Mastercard and Visa often provide various rewards programs, such as cashback, discounts, and loyalty points, offering added benefits to cardholders. RuPay also offers rewards programs, but they may be more focused on domestic usage and may have different offerings compared to Mastercard and Visa.

4. Cost and Fees: The fees associated with Mastercard, Visa, and RuPay cards may vary depending on the issuing bank and card variant. However, in general, RuPay cards are known for their lower transaction fees compared to Mastercard and Visa, making them a more cost-effective option for domestic usage.

5. Focus on Financial Inclusion: RuPay, as a domestic payment system in India, has a strong focus on financial inclusion and promoting digital payments among underserved populations. It offers benefits such as lower transaction costs and tailored solutions for rural areas, making it a preferred option for certain segments of the population.

6. Security Measures: Mastercard, Visa, and RuPay all prioritize security measures to protect cardholder information and prevent fraud. They use advanced encryption technologies, multi-factor authentication, and other security features to ensure secure transactions.

Types of MasterCard in India

- Standard Debit MasterCard

- World Debit Mastercard

- Platinum Debit Mastercard

- World Debit Mastercard

4) Maestro Card

Maestro is a brand of debit card issued by Mastercard, one of the world’s leading payment processing companies.

Maestro cards are widely accepted at point-of-sale (POS) terminals for in-person transactions, as well as for online and mobile purchases. They can also be used at ATMs (Automated Teller Machines) for cash withdrawals and balance inquiries. Maestro cards are typically linked to the cardholder’s bank account, and funds are deducted directly from the account when a purchase or withdrawal is made.

Features of Maestro card

- Issuer: Maestro cards are issued by Mastercard, while Mastercard, RuPay, and Visa cards are issued by their respective payment processing companies.

- Card Type: Maestro cards are primarily debit cards, linked to the cardholder’s checking or savings account, while Mastercard, RuPay, and Visa cards can be debit or credit cards, offering different payment options.

- Global Acceptance: Mastercard, RuPay, and Visa cards are generally accepted at millions of merchants worldwide, while Maestro cards are primarily accepted in Europe and other regions, with more limited acceptance in some countries

- Card Network: Maestro cards are part of the Mastercard network, while Mastercard, RuPay, and Visa cards are part of their respective payment networks.

5) Contactless card

Contactless cards, also known as contactless payment cards or tap-and-go cards, are payment cards that use near field communication (NFC) technology to enable quick and convenient transactions without the need for physical contact between the card and the payment terminal. Contactless cards have a small embedded chip and antenna that allow them to communicate wirelessly with contactless-enabled point-of-sale (POS) terminals or other compatible devices.

Top banks offering debit cards

Before we go ahead and talk about the top banks offering various types of debit cards, let’s take a look at the market share of the total debit cards of various banks in India.

1) SBI

As you can see in the above image SBI has the largest market share of debit cards in India. the State Bank of India (SBI) offers a wide range of cards to its customers, including debit cards, credit cards, and prepaid cards. Here are some of the different types of debit cards issued by SBI:

- Silver Debit card

- Pride card

- Platinum International Debit card

- Gold International Debit card

- Global international Debit card

2) Bank of Baroda

Bank of Baroda offers almost 15 different types of debit cards in India. With 8.54% of the total market share, it is the second-largest bank when it comes to debit cards in India. Here are some of the debit cards offered by them:

- Virtual debit card

- World VISA opulence debit card

- World Agniveer debit card

- World VISA sapphire debit card

- Rupay classic debit card

3) HDFC

HDFC Bank has the third largest market share in the total number of debit cards in India. HDFC offers a range of debit cards with various features, benefits, and transaction limits. Here are some of the different types of debit cards issued by HDFC Bank:

- Millennia Debit card

- EasyShop Platinum Debit card

- Times Points Debit card

- RuPay Premium Debit card

- EasyShop Gold Debit card

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube: Stocks vs. Mutual Funds

Start investing through a platform that brings goal planning and investing to your fingertips. Visit Kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

#MutualFundSahiHai #KuveraSabseSahiHai!