Top news

Arbitrage fund inflows rise 33% in May as investors chase low risk, tax efficient options.

IPO of Oswal Pumps got over subscribed by 0.34 times.

BNP Baroda AMC, ICICI AMC & Groww AMC have launched the NFO for Baroda BNP Paribas Health & Wellness Growth Direct Plan, ICICI Prudential Nifty Top 15 Equal Weight Index Growth Direct Plan & Groww Nifty India Internet ETF FoF Growth Direct Plan.

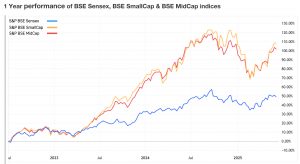

Index Returns

| Index | 1W | 1Y | 3Y | P/E | P/B |

|---|---|---|---|---|---|

| NIFTY 50 | -1.1% | 5.6% | 15.1% | 22.2 | 3.6 |

| NIFTY NEXT 50 | -1.5% | -5.5% | 21.2% | 21.7 | 4.1 |

| S&P BSE SENSEX | -1.3% | 5.6% | 8.9% | 22.7 | 4.2 |

| S&P BSE SMALLCAP | -0.1% | 5.3% | 21.8% | 33.1 | 3.8 |

| S&P BSE MIDCAP | -0.9% | 0.4% | 21.7% | 36.9 | 4.7 |

| NASDAQ 100 | -0.6% | 10.0% | 12.7% | 38.9 | 4.3 |

| S&P 500 | -0.4% | 10.0% | 10.4% | 28.5 | 5.1 |

Best Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| ICICI Prudential Nifty IT Index | 3.1% | 12.1% | NA |

| SBI Nifty IT Index Growth | 3.1% | NA | NA |

| Axis Nifty IT Index | 3.1% | 12.0% | NA |

| Bandhan Nifty IT Index | 3.1% | 12.2% | NA |

| Nippon India Nifty IT Index | 3.1% | 12.2% | NA |

| ELSS Tax Saving Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| NJ ELSS Tax Saver Scheme | 0.2% | 2.8% | NA |

| Quant ELSS Tax Saver | -0.4% | -6.6% | 20.9% |

| Parag Parikh ELSS Tax Saver | -0.5% | 14.6% | 22.6% |

| LIC MF ELSS Tax Saver | -0.6% | 10.1% | 20.5% |

| Bajaj Finserv ELSS Tax Saver | -0.7% | NA | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| Muthoot Finance | 13.3% | 46.1% | 21.6% |

| Oil India | 13.1% | 8.2% | 51.1% |

| Oracle Financial Services Software | 8.5% | 8.4% | 29.8% |

| Max Healthcare Institute | 8.4% | 41.6% | NA |

| AU Small Finance Bank | 6.7% | 15.2% | 26.5% |

Worst Performers

| Mutual Funds | 1W | 1Y | 3Y |

|---|---|---|---|

| Tata Nifty Capital Markets Index | -4.3% | NA | NA |

| Motilal Oswal Nifty Capital Market Index | -4.3% | NA | NA |

| Groww Nifty India Railways PSU Index | 3.7% | NA | NA |

| Tata Nifty India Tourism Index | -3.4% | NA | NA |

| Kotak Nifty India Tourism Index | 3.4% | NA | NA |

| Stocks (Market cap > Rs 50k Cr) | 1W | 1Y | 5Y |

|---|---|---|---|

| United Spirits | -9.8% | 12.6% | 18.7% |

| Indian Overseas Bank | -7.9% | -44.7% | 29.6% |

| Mazagon Dock Shipbuilders | -6.7% | 100.0% | NA |

| IDBI Bank | -6.2% | 8.6% | 24.5% |

| Rail Vikas Nigam | -5.3% | 3.8% | 86.0% |

Bought and Sold

| Most Bought MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Parag Parikh Flexi Cap | 2.1% | 14.4% | 23.9% |

| Motilal Oswal Midcap | -0.9% | 11.9% | 36.7% |

| UTI Nifty 50 Index | 0.6% | 7.6% | 16.4% |

| Bandhan Small Cap | 1.3% | 19.1% | 35.7% |

| Kotak Equity Arbitrage | 0.2% | 7.7% | 7.7% |

| Most sold MF | 1W | 1Y | 3Y |

|---|---|---|---|

| Quant PSU | 1.4% | -8.2% | NA |

| Quant Flexi Cap | 0.2% | -5.2% | 23.6% |

| Quant Active | 0.2% | -8.5% | 18.5% |

| SBI Banking & Financial Services | -0.6% | 18.3% | 25.3% |

| Nippon India Arbitrage | 0.2% | 7.6% | 7.5% |

Most Watchlisted

Mutual Fund Watchlist | 1W | 1Y | 3Y |

|---|---|---|---|

| Axis Nifty 50 Index Growth Direct Plan | -1.1% | 6.7% | 17.2% |

| Axis Small Cap Growth Direct Plan | -0.2% | 9.3% | 25.4% |

| -1.5% | -5.04% | 22.5% | |

| Motilal Oswal Midcap Growth Direct Plan | -0.9% | 11.9% | 36.7% |

| Parag Parikh Flexi Cap Growth Direct Plan | 0.93% | 12.8% | 23.6% |

Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Suzlon Energy | -3.1% | 28.7% | 73.4% |

| Reliance Power | 14.5% | 144.1% | 93.4% |

| ITC Ltd | -1.2% | 10.7% | 19.8% |

| Bharat Electronics | 0.2% | 35.7% | 75.1% |

| Tata Power Company | 0.9% | -11.7% | 57.0% |

US Stocks Watchlist | 1W | 1Y | 5Y |

|---|---|---|---|

| Palantir Technologies | 7.6% | 482.9% | NA |

| Netflix | -2.4% | 81.1% | 23.7% |

| Mercadolibre, Inc. | -4.5% | 49.9% | 21.5% |

| NVIDIA Corporation | 0.18% | 7.7% | 73.8% |

| Microsoft Corporation | 1.0% | 7.3% | 20.3% |

Data Source: NSE, BSE & Kuvera.in

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and Fixed Deposits and start investing today.

Disclaimer: Mutual Fund investments are subject to market risks. Read all scheme related documents carefully.

Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Investment in the securities is subject to market risks. Read all the related documents carefully before investing.

The securities quoted are for illustration only and are not recommendatory.

This market update was initially published by Livemint.

#MutualFundSahiHai, #KuveraSabseSahiHai!