Governments globally have woken up to the seriousness of the problem that COVID19 poses and have put in place adequate emergency responses. On our part, we should follow the best practices and ensure the spread is contained.

Please rely on authentic sources in dealing with this along with your family.

The first lesson for all of us is “please don’t be tone-deaf”. While crashing markets in bad times are a good opportunity to buy, as a community we must collectively wish and actively work towards making things better. So stay healthy, sit tight, and spread awareness where you can.

In hindsight, this week will be an example of not making investment decisions in the heat of the moment. If you got whipsawed by the price movement then consider it a learning lesson. We wrote about 5 practical hacks to help you survive a market crash. It is worth visiting them again.

1/ Stick to your asset allocation and rebalance if it gets off by 5%. We will send reminders when that happens. In a crash, you will sell your debt and add equity. It may appear counter-intuitive but it is not. You are buying more equity as it falls.

2/ Track your wealth and not just your portfolio. The average Mutual Fund account on Kuvera is worth Rs 10.6 lakhs. The average EPF account is Rs 10.4 lakhs and the average gold account is Rs 6.2 lakhs. At a wealth level, last months ~20% decline in Equity Mutual Funds is still only a 5% decline in average wealth as gold has rallied.

3/ Postpone all decisions by 2 days. Say you are itching to buy or sell or stop a SIP or increase your SIP. Write the decision down and revisit it in two days. You will make better decisions.

4/ Check your wealth once a week. Yes, that’s right. The more you check the more you will think you need to do something. Anything. Inaction is not our strength.

5/ If you have itchy hands, buy Rs 100 in any index fund. Always buy, always make it a trivial amount. It satisfies your urge to take action without making any difference to your long term outcomes.

Switch to Direct plans. Think about this, you will pay more in commissions in your investing life than what you lost in the markets last week.

And the commission once paid, is not coming back. It is not a mark to market loss.

So stop paying commissions and use this opportunity to switch to Direct.

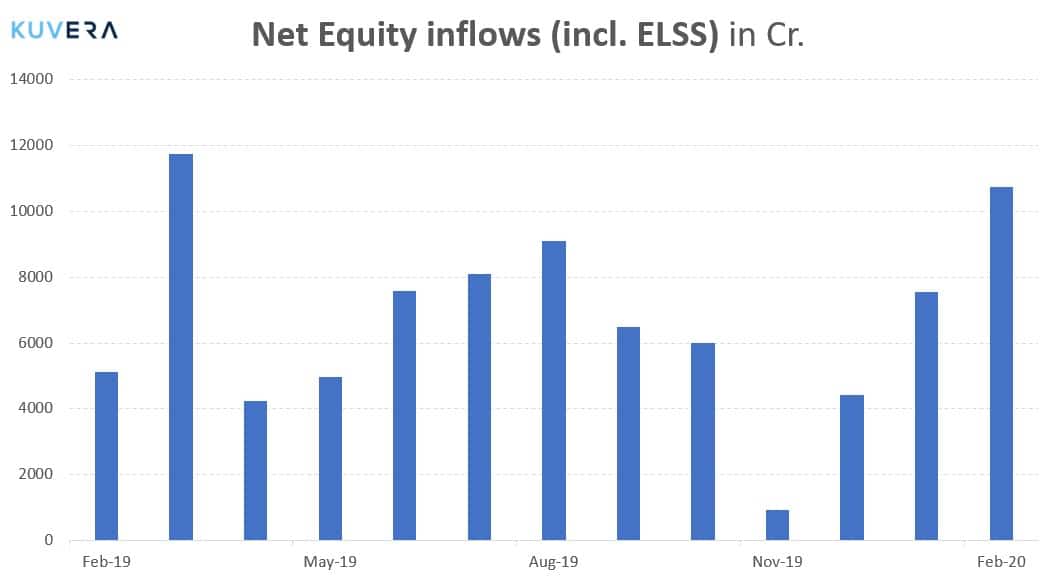

Inflows into equity mutual funds stood at an 11-month high in February. Mutual fund industry witnessed inflows of Rs 10,730 crore in equity schemes in February, up 42% from January where the inflows stood at Rs 7,548 crore. Inflows into large-cap, mid-cap, multi-cap and small-cap funds were in the range of Rs 1,400 -1,600 crore. Sectoral funds witnessed inflows of Rs 1,928 crores in February, as compared to just Rs 3.8 crores in January. The assets under management (AUM) of the mutual fund industry dropped by 2.3% to Rs 27.23 lakh crore in February from Rs 27.86 lakh crore in the previous month.

|

|

|

|

|

|

|

Movers & Shakers

1/ Franklin MF has marked down it’s exposure in debt securities of Reliance ADAG and Essel Group by 90%.

2/ IDFC Mutual Fund has appointed Piyush Anchliya as Chief Financial Officer and Swati Singh as Head – Human Resource.

3/ Taurus Mutual Fund has appointed Alok Singh as Fund Manager of Taurus Liquid Fund and Jinal Patel as Chief Financial Officer of the firm.

Quote of the week:

But the world is ever more interdependent. Stock markets and economies rise and fall together. Confidence is the key to prosperity. Insecurity spreads like contagion. So people crave stability and order.

: Tony Blair

Interested in how we think about the markets?

Read more: Zen And The Art Of Investing

Watch/hear on YouTube:

Start investing through a platform that brings goal planning and investing to your fingertips. Visit kuvera.in to discover Direct Plans and start investing today.

#MutualFundSahiHai, #KuveraSabseSahiHai!

Jyotsana

April 9, 2020 AT 08:02

Should we invest in lumpsum? If yes which ones should we prefer?

Gaurav Rastogi

April 9, 2020 AT 13:57

If you add your goals to Kuvera, we will advise on a risk-appropriate portfolio with scheme names as well.